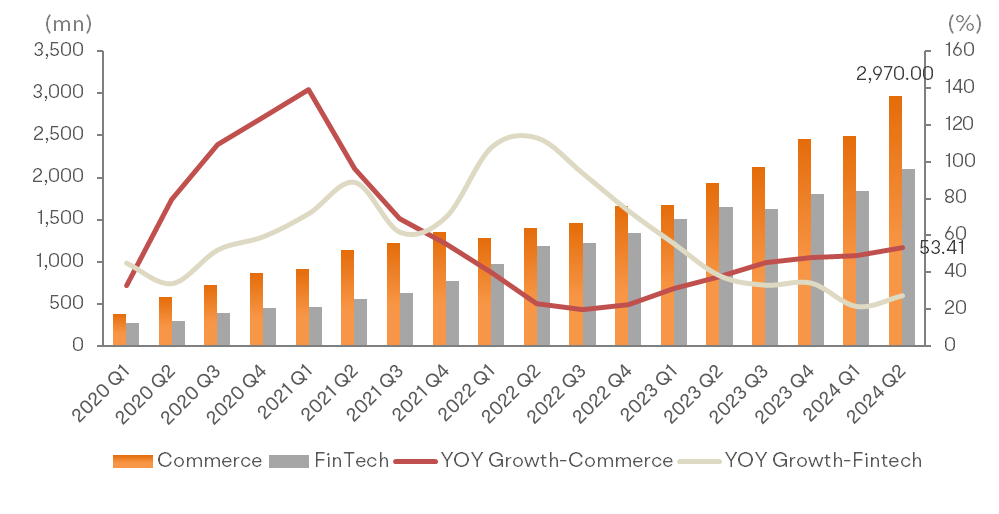

Coupang's Product Commerce division, which includes its primary South Korean e-commerce and logistics operations, generates around 88% of the company's net revenue. The remaining revenue stems from Developing Offerings, which features Farfetch, Taiwan e-commerce, Coupang Eats, streaming services, and fintech. This segment is grappling with mounting losses.

Yee HueiKoh : P

74423696 : Wonder, amazing.