Potential Upside From AMD To Continue Due to Upbeat PC-Chip Trends

The Federal Reserve kicked off an easing cycle with a 50 basis-point interest rate cut to keep US economic growth on track.

$NVIDIA (NVDA.US)$ and $Advanced Micro Devices (AMD.US)$ led the tech stock rally Thursday following the Federal Reserve’s sizable 50 basis point interest rate cut. Nvidia stock jumped more than 5%, while its rival Advanced Micro Devices saw shares rise as much as 7% in afternoon trading, before edging down slightly to close the day.

The rising stock prices illustrate that investors are comprehending Fed Chair Jerome Powell’s message that the US economy is “in good shape.” The tech-heavy NASDAQ led the stock market’s upward trajectory. The index rose 2.5%, while the S&P 500 rose 1.7% and the DJIA climbed 1.3%.

AMD Continue To Benefit From PC-Chip Upbeat Trends

AMD in late June posted second quarter profits up nearly 20% from the prior year. The company will report third quarter results in late October. AMD shares could continue to benefit from upbeat PC-chip trends and more realistic AI-revenue expectations

AMD shares have been on nice rally up rising 28% off their March lows. The drivers of this recent rally, with AMD shares (AMD) up 7% this week alone, there seems to be enthusiasm about $Taiwan Semiconductor (TSM.US)$ upbeat results and what they say about the health of the chip sector.

There is also encouraging indicators in the personal-computer market as well as "manageable" expectations for AMD when it comes to artificial-intelligence chips. AMD's PC central-processing units saw sequential growth in the second quarter, and that the company is benefiting from overall industry growth thanks to execution-related delays from a chip designed by Meteor Lake PC - a rival of Intel Corp. (INTC)

PC growth should pick-up into 2025 helped by an aging installed base and improved corporate demand. AI PCs could be a second-half driver if Microsoft Corp. (MSFT) can fix problems with the Recall AI feature on its Copilot+ PCs.

AMD AI Strategy Boost With AI Lab, LLM Developer Silo AI

US chip-maker AMD is acquiring Finnish startup Silo AI to further advance its AI plans after buying a handful of other AI firms last year.

Silo AI is a private AI lab with four offices in Europe and over 300 employees, including 125 AI scientists with PhDs in their respective fields, according to the company's website. The startup is working on various areas within artificial intelligence, including "computer vision," large language models (LLMs), and machine learning. Silo CEO and co-founder Peter Sarlin will remain at the company and report to AMD SVP Vamsi Boppana.

Boppana tells Reuters the Silo acquisition helps AMD unlock "a significant amount of business moving forward." Silo has already developed LLMs using AMD's tech and will continue to build new AI models and AI products for businesses post-acquisition.

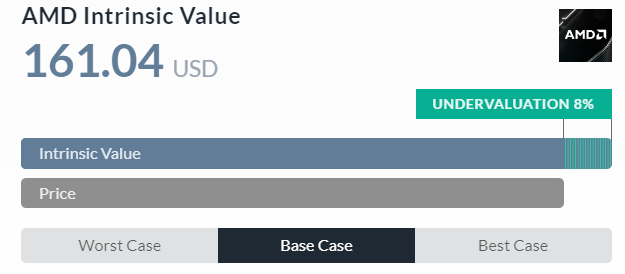

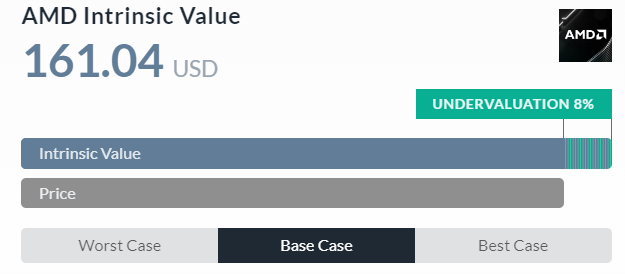

AMD Intrinsic Value Undervalued 8%

The intrinsic value of AMD stock under the base case scenario is $161.04.

Compared to the current market price of $148.29, AMD is undervalued by 8%, but Thursday (19 Sep), AMD close $156.74, we could be seeing AMD going beyond $160 soon.

The Intrinsic value is calculated as the average of DCF and Relative values where DCF value is at $93.19 and the Relative Value is at $228.89.

Technical Analysis - MACD and MTF (Multi Timeframe)

If we were to look at the MACD, AMD is exhibiting a nice upside trend, but MTF is showing that we might see some slight correction in the short term, but I think it will not be too long for AMD to go beyond $160.

AMD long term and short term MA from MTF is closing up, and AMD is trading above both, we might see a correction soon as long term MA is above short term MA.

SuperTrend Price Target Suggest Key Resistance Level $160

If we looked at AMD from supertrend, AMD need to break the $160 in order to see a nice rally from AMD. There is also a support level of $137 which we need to be aware.

Summary

As we are seeing semiconductor stocks benefitting from the rate cut, but their stock price did not raise too much, there is still some hesitation for these stocks.

So I am watching AMD to see if the optimism has bolstered tech stocks like Nvidia and Advanced Micro Devices, will continue.

Appreciate if you could share your thoughts in the comment section whether you think AMD would continue to enjoy significant jumps and hence help to power up market enthusiasm.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

STD0313 : For me, AMD exists in the same realm as PLTR. I would like to feel safe investing in them, but their PE ratios are so extreme that I am constantly waiting for them to plummet based on some short sellers' published theory. I don't see why at over 150x earnings, either can be considered a solid investment. So I watch as they continue to climb. Just my 2 cents. Great break down though, thank you for your analysis.