Precise Bearish View! Bridgewater's Flagship Fund Expects Bearishness on US Stocks and Bonds in Late July

$Bridgewater Bancshares (BWB.US)$ According to media reports citing a report released to investors by Bridgewater online on July 25th, the flagship fund Pure Alpha of Bridgewater is taking a "moderate" bearish view on US stocks in late July, as the momentum of US tech stocks was waning and they were positioned near short-term tops. Additionally, Bridgewater also holds a moderate bearish view on US bonds.

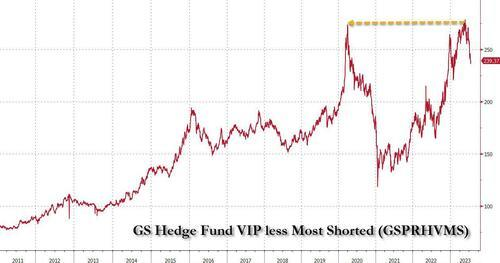

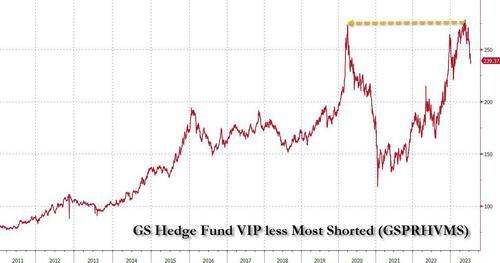

Benefiting from the unexpectedly resilient US economy and a decrease in inflation this year, US stocks have surged, with the S&P 500 Index surging over 20% at one point during the year and the Nasdaq 100 surging over 45%. The strong rally in the first half of July forced many hedge funds to abandon their short positions.

Benefiting from the unexpectedly resilient US economy and a decrease in inflation this year, US stocks have surged, with the S&P 500 Index surging over 20% at one point during the year and the Nasdaq 100 surging over 45%. The strong rally in the first half of July forced many hedge funds to abandon their short positions.

Based on the current situation, Bridgewater's assessment of US stocks and bonds has been quite accurate. The Nasdaq 100 has fallen about 6% from its intra-year high on July 19th, and the S&P 500 Index has dropped about 4% from its intra-year high on July 27th. The 10-year benchmark US bond yield has been consistently rising, reaching around 4.27%, the highest level since October of last year.

Bridgewater's views on various asset categories are as follows:

Bridgewater's views on various asset categories are as follows:

- Among the 28 assets analyzed by Bridgewater's flagship fund, 15 assets are taken with a bearish stance, including the US dollar, metals, and global stocks.

- Bridgewater maintains a neutral stance on five categories, including emerging market currencies, Eurozone stocks, and energy.

- A moderate optimistic view is held for inflation-linked bonds and the Mexican peso.

- The most bullish positions are on the Singapore dollar and the Euro.

- Bridgewater maintains a neutral stance on five categories, including emerging market currencies, Eurozone stocks, and energy.

- A moderate optimistic view is held for inflation-linked bonds and the Mexican peso.

- The most bullish positions are on the Singapore dollar and the Euro.

The latest 13F report reveals that Bridgewater increased its holdings in $PDD Holdings (PDD.US)$ and Chinese ETFs in the second quarter of this year, with heavy positions in US stocks and emerging market ETFs, while completely divesting from $Netflix (NFLX.US)$ and gold ETFs. $Gold (LIST2110.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment