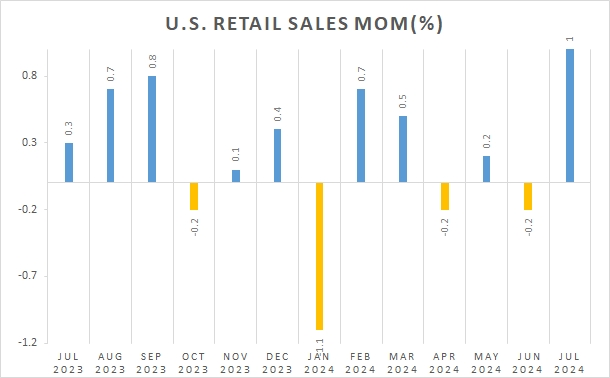

Taking a broad view, the U.S. economy, driven by both the services and manufacturing sectors, has demonstrated resilient growth. The services sector is booming like oil on a roaring fire, while the manufacturing sector, despite facing high interest rates and inventory adjustments, is mainly impacted on the production side. Durable goods consumption, particularly in the automotive market, remains robust. Overall, the U.S. economy is trending towards a "soft landing."