[Preview] September US employment statistics scheduled to be released tomorrow night - Will US stocks face volatile markets?

This article uses auto-translation in some parts.

The US non-farm payrolls for September are scheduled to be announced at 9:30 pm Japan time on Friday, the 4th.Morgan Stanley sees this data as positive for US stocks, while Bank of America believes this data willbring significant volatility to the S&P500 index.And is warning.

![[Preview] September US employment statistics scheduled to be released tomorrow night - Will US stocks face volatile markets?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20241003/d69c877a053d18da2fe179d9df9a28a7.png/big?area=105&is_public=true)

In the market, the U.S. Septembernonfarm payroll employment is expected to recover slightly from 0.142 million in the previous month.It is expected to maintain a 4.2% unemployment rate.The increase in nonfarm payroll employment and the decrease in the unemployment rate in September are positive factors for U.S. stocks in the fourth quarter―Morgan Stanley.。

And is warning.

Mr. Tong believes that the best scenario for US stocks is for the September unemployment rate to fall below 4.1% and for the number of non-farm payrolls to exceed 0.15 million. In this scenario, as investors are willing to take on more risks, the market may experience sustained rotation, with the possibility of funds flowing into cyclical stocks. Mr. Tong also believes that if future rate cuts are implemented, small-cap stocks, industrial stocks, consumer discretionaries, and a-reit etfs would also benefit.

On the other hand, according to Mr. Tong, the worst-case scenario would be for the unemployment rate to rise to 4.3% and for the number of non-farm payrolls to fall below 0.1 million. In this case, the market is expected to strengthen risk aversion moves, with defensive stocks expected to perform well.

Furthermore, Mr. Tong believes that if employment statistics remain at August levels, there will be no significant change in market psychology, with large and high-quality stocks likely to outperform overall.

An analyst at bank of america corp believes that employment statistics are important as a factor of market fluctuations ahead of the US presidential election.

Based on stock index options pricing, the S&P500 index is expected to show volatility of over 1% on October 4th.

The US Labor Department's Job Openings and Labor Turnover Survey (JOLTS) announced on the 1st showed an increase of 0.329 million job openings to 8.04 million in August. The market expectation was 7.66 million. After decreasing for two consecutive months, it unexpectedly increased.

![[Preview] September US employment statistics scheduled to be released tomorrow night - Will US stocks face volatile markets?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20241003/782dfbd435b0581b0c9f948cbc500f55.jpg/big?area=105&is_public=true)

On the other hand, automatic data processing for corporate payroll services (Automatic Data Processing (ADP)) has announced theSeptember's US employment reportAccording toNon-farm payroll employmentThe semiconductor manufacturing equipment related to technologies like lasers is strong, with a psychological improvement due to the recovery of NVIDIA's stock in the U.S.An increase of 0.143 million people、Exceeding the market expectations of an increase of 0.124 million peopleThe growth expanded more than expected since August and reached the highest level since June.Contrary to other indicators showing a cooling labor market.US PCE Price Index revised downward to 2.8% increase for the April-June quarterObservations of immediate interest rate cuts are fading.。

![[Preview] September US employment statistics scheduled to be released tomorrow night - Will US stocks face volatile markets?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20241003/cc22a858b16514f162dfe6ce310d1277.jpg/big?area=105&is_public=true)

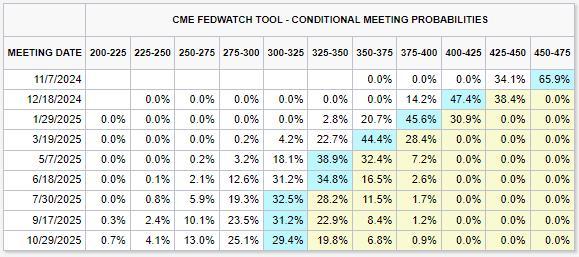

According to CME Group's FedWatch tool, the market...In November, there is a 65.9% chance that the FRB will implement a 25bp rate cut, and a 34.1% chance of implementing a 50bp rate cut.Regarding the timing of additional rate hikes, there are hardly any predictions for June, and July and October are both at 33%.

Some analysts believe that if the non-farm payroll employment number cools more than expected, market bets on a 50bp rate cut by the FRB may increase. On the other hand, if the non-farm payroll employment number stabilizes, a strong dollar due to a decrease in the unemployment rate may dampen market expectations for a significant rate cut by the FRB.

- moomoo News Zeber

Source: moomoo, Bloomberg

This article uses auto-translation in some parts.

Source: moomoo, Bloomberg

This article uses auto-translation in some parts.

![[Preview] September US employment statistics scheduled to be released tomorrow night - Will US stocks face volatile markets?](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240425/c3f0aeae25cc4bf947fff7f33d0f6a3a.png/big?area=105&is_public=true)

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment