[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.

This article uses auto-translation in some parts.

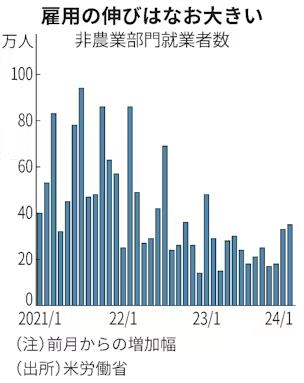

The number of non-farm payroll employees in the US in February...Scheduled to be announced on Friday (8th) at 10:30 PM Japan time.In the market, it is expected that the number of non-farm payroll employees in the US in February will increase by 0.198 million, with an unemployment rate of 3.7%.will increase by 0.198 million people, with an unemployment rate of 3.7%.Being done.

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/b6f3f83f6f864ba592ac081e8bcb2b17.png/big?area=105&is_public=true)

According to the ADP employment statistics announced on Wednesday this week, the number of private sector employees in the U.S. increased by 0.14 million in February. The growth expanded from 0.111 million increase in January but fell below expectations.

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/901d54e78da7401da18be2259b1bb7f8.jpg?area=105&is_public=true)

In addition, the U.S. Department of Labor's Job Openings and Labor Turnover Survey (JOLTS) announced on Thursday also showed a decrease in seasonally adjusted non-farm job vacancies from the previous month, with a decrease of 0.02 million 6000 to 8.86 million 3000, falling below the market forecast of 9 million.

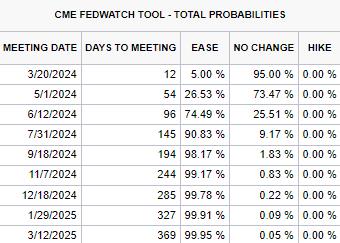

Federal Reserve Chairman Powell testified before the House of Representatives this week, stating that he believes the policy interest rate has already reached its peak and that it would be appropriate to start lowering interest rates at some point during the year.

The U.S. Department of Labor's employment statistics for the previous period (January), announced on the 2nd of the previous month, showed an increase of 0.35 million 3000 employees in the non-farm sector compared to the previous month. The growth exceeded the market expectation of approximately 0.18 million people.

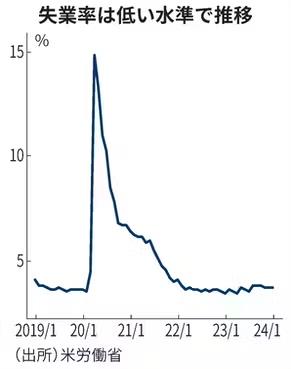

The unemployment rate has fallen below 4% for two consecutive years. The labor market has remained strong.

The corporate payroll calculation service provided by Automatic Data Processing (Automatic Data Processing (ADP)announced this WednesdayFebruary's National Employment ReportAccording toNon-farm payroll employmentThe semiconductor manufacturing equipment related to technologies like lasers is strong, with a psychological improvement due to the recovery of NVIDIA's stock in the U.S.An increase of 0.14 million people、Market expectations for an increase of 0.149 million people.In the previous periodRevised upward from 0.107 million to 0.111 million people.There are no signs of a slowdown in the labor market, as growth has expanded from the previous month and the previous month's data has also been revised upward.

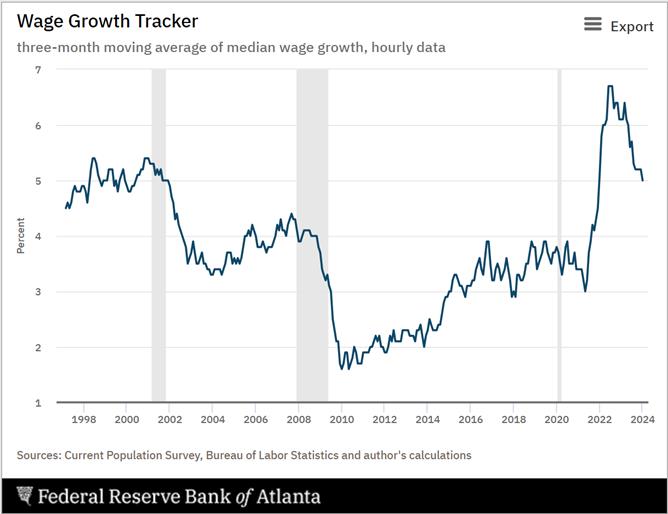

ADP's chief economist, Nela Richardson, pointed out in the announcement that "employment growth continues to be solid. Although the wage growth rate is declining, it still surpasses the inflation rate."

Job creation was widespread, led by entertainment, hospitality, construction, trade, and transportation. Job creation expanded regardless of region or company size.

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/01e7db470b78413294891a8cb96819a2.jpg?area=105&is_public=true)

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/28ff481a5f294651ae8eb5a83f524caa.jpg?area=105&is_public=true)

The Bureau of Labor Statistics' Job Openings and Labor Turnover Survey (JOLTS) for January, released on Thursday, showed that the seasonally adjusted number of job openings in the non-farm sector decreased by 0.026 million to 8.863 million, falling below the market forecast of 9 million.

According to the Nikkei, there were approximately 1.45 job openings per unemployed person in January. The number of job openings per unemployed person increased compared to the previous month.

While there is still a possibility that the year-on-year growth rate of wages for non-farm sector employees will exceed 4%, the monthly wage growth rate is likely to have decreased from 0.6% in the previous month to 0.2% due to the impact of weather in January. According to the Atlanta Fed's Wage Tracker, the moving average of wage growth rate over the past 3 months has decreased to 5.0%.

Chairman Powell stated last October that a 3.5% wage increase is appropriate to achieve the 2% inflation target.

If the data this time matches the expectations of economists, concerns about the reacceleration of the labor market are likely to recede. This is reassuring for the FRB, as it will gain confidence that economic growth is slowing in line with the return to the inflation target pace. However, as long as growth remains resilient, the timing of the first rate cut is likely to depend on actual inflation data.

After the 2008 Lehman shock, the US unemployment rate remained relatively high for a long time. The US unemployment rate fell below 6% in 2014. The current situation is completely different from back then. Due to the recovery of domestic investment in the US, aggressive fiscal policies, and the continued strength of the real estate market, there are few signs of a significant increase in the US unemployment rate.

According to CME Group's FedWatch tool, traders of FF rate futures temporarily had a 74.49% probability of an interest rate cut by June.74.49%by September.The probability of interest rate cut being implemented is 98.17%.I expected it.

- moomoo News Zeber

Source: Bloomberg, Reuters, Nikkei newspaper, CME FedWatch, ADP® National Employment Report, Kabutan, NHK, THE HILL, moomoo

This article uses auto-translation in some parts.

Source: Bloomberg, Reuters, Nikkei newspaper, CME FedWatch, ADP® National Employment Report, Kabutan, NHK, THE HILL, moomoo

This article uses auto-translation in some parts.

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/1709863587974-d20c6602fd.png?area=105&is_public=true/bigmoo)

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment