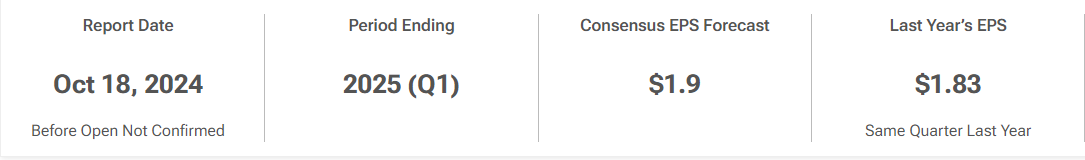

At an investor conference on 05 Sep, PG CFO has indicated that the consumer products company's first quarter, which ended 30 Sep, would "not look materially different" from the prior quarter. In its fourth quarter ended 30 June, sales were flat and organic sales rose 2%. Organic sales do not count the impacts of foreign exchange, acquisitions and divestitures.