WE HAVE A WIDE RANGE OF AGES & STAGES ON DECK SO LETS TAWK BOUT

RISK TOLERANCE

* The Long Game

Recognize that investing is often about long-term growth rather than short-term gains. The market can be volatile, and understanding that ups and downs are part of the journey can help you remain patient.

How much RISK can you take⁉️

When it comes to investing, risk and return may come hand-in-hand. If unwilling to take risks, one should not expect returns.

However, it could be dangerous when some only has their eye on the CAGR, ROI & returns while neglecting the risks.

So, how does one balance risk and return⁉️ This depends on how much risk you can take.

Risk tolerance varies from person to person. This is often related to 4 main factors.

• The first factor is age.

A youngin in his prime and a retired senior generally have different levels of risk tolerance.

Young people usually (think they) have a longer timeline to recover from their losses.

Therefore, they may be more risk-tolerant.

However, many elderly people live off pensions or savings, and may not have other sources of income, which can make them relatively less risk-tolerant.

A commonly cited rule of thumb makes it easier to approach the relationship between age and potentially high-risk assets, such as stocks.

According to this principle, the percentage of stocks people may consider holding is equal to 100 minus their age.

For example, a 30-year-old investor may consider allocating 70% of their idle funds to stocks, while according to this rule, that percentage for an investor aged 70 should be within 30% (this number can be more based on the person’s individual goals and risk tolerance. If their risk tolerance is high and they want to retire soon they can allocate 50-80%+ into the market and other assets with a solid history & CAGR).

However, this formula can be flexible. You can adjust it according to your situation. But, all else being equal, the principle is the older you are, the lower the proportion of your portfolio that you MAY want to consider investing in high-risk assets.

• The second factor is financial status.

For example, if someone is well-off and has no debt and he is also single, then there is a lot less financial burden on his hands. But if he is married with kids, then living expenses are high, and he might struggle to make ends meet.

There is an essential difference between his risk tolerance level in these two situations.

The former is in good financial condition. A slight loss will not affect life. Therefore, the risk tolerance is relatively strong.

The latter's financial situation is already unstable. Losing money on an investment might result in a huge burden on life.

Therefore, the risk tolerance is less.

• The third factor is individual risk appetite.

Everyone has different perspectives on risks.

Some people are conservative even when they are young and well-off. They simply do not want to take any risks, thus they are not the best candidates for high-risk investments.

Some people are more radical. Losing money will not rattle their mindsets. Thus they are willing to take high risks to gain possible high returns.

• The fourth factor is the level of investment knowledge.

The essence of risk is uncertainty. Before investing, you will not know the profits or losses it brings.

If you have done your homework in asset analysis with the right investment mindset, you may become more capable of controlling the investment risks perceived by others as huge uncertainty.

Conversely, you'll be walking a thin line if you choose to invest in financial assets that you don't know much about, especially those involving high risk.

To sum up, the investment risk that you can take depends on your age, financial situation, risk appetite, and investment knowledge. Before investing, we must know our situation, and not act on impulse.

* Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Billionaire

Extra Credit:

* ETFs, Longs, Shorts 👈🏽 in that order. ETFs and Longs is the retirement and Generational Wealth. NO funny stuff in the ETFs and the Longs. Shorts is for fun and Free Cash Flow… but can occasionally also hit 2x to 10x plus, if it doesn’t go to 0. Hail Mary.

* Only invest LONG TERM in stuff that’s outperforming the market. S&P 500 📈 does 7-10% a year, my ETFs gotta yield or earn the same or MORE on an annual basis, to be worth my time.

* IF you have extremely LOW RISK tolerance consider a CD or money market.

* ONLY deal with shorts if you have the means and risk tolerance. Otherwise stick to LONG TERM STOCKS, ETFs & REAL ESTATE FOR CASH.

Let’s all

Stop 🛑 focusing on a quick buck. Hold, and go long.

Collect Assets at a Discount. DCA either way. Be patient. We Build Wealth.

The compound annual growth rate (CAGR) is the mean annual growth rate of an investment over a period longer than one year.

It's one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time.

= 10 to 100% CAGR or more for All of Our Assets:

Ex:

What does 10% CAGR mean?

CAGR tells you the average rate at which an investment has grown over a specified period.

10% CAGR means the 10% interest you earn every year is first added to your principal investment. And then, on the total amount, you again get 10% return.

Traditional Investing

Buy & Hold

Big Boy Blue Chip

Long Term

#CoachDonnie

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes discussed here

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

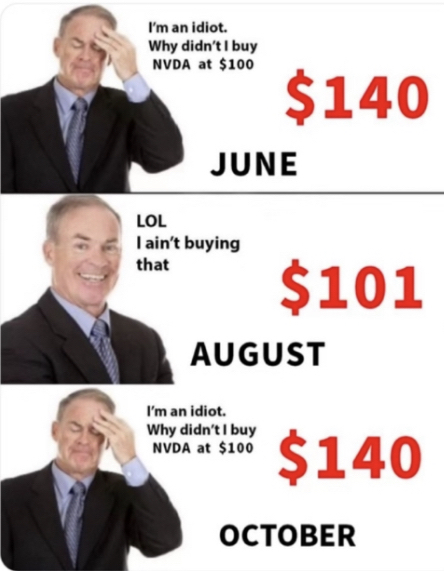

Manolani808 : I wish

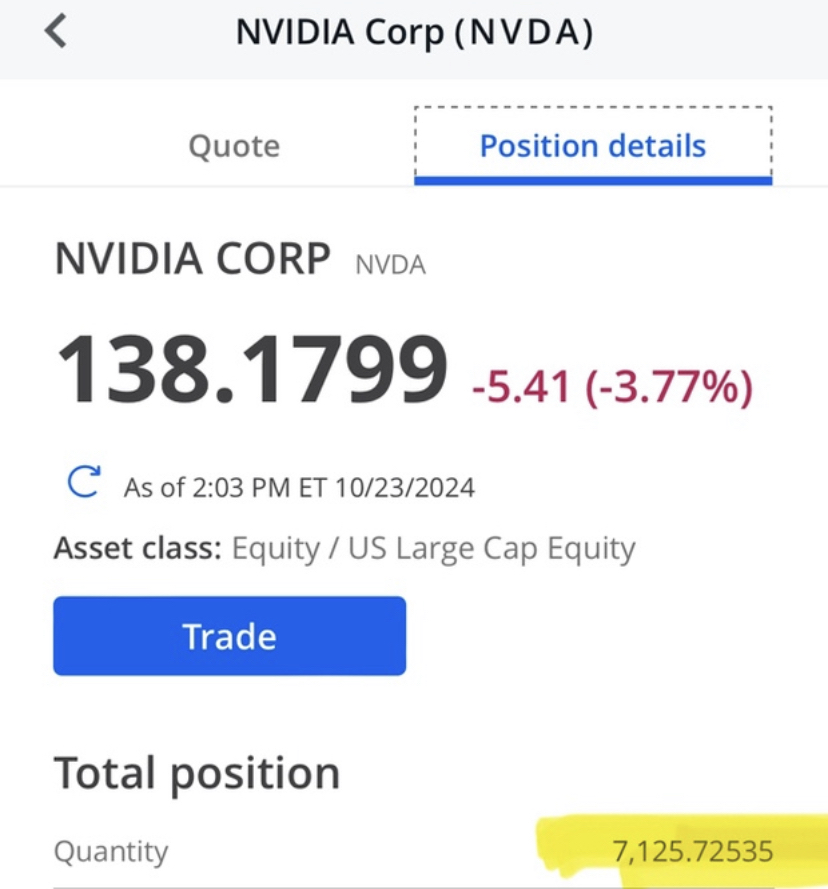

Coach Donnie OP Manolani808 : It’ll go and shock everybody

and shock everybody

Or go down spook a lot of people out then go back up like crazy

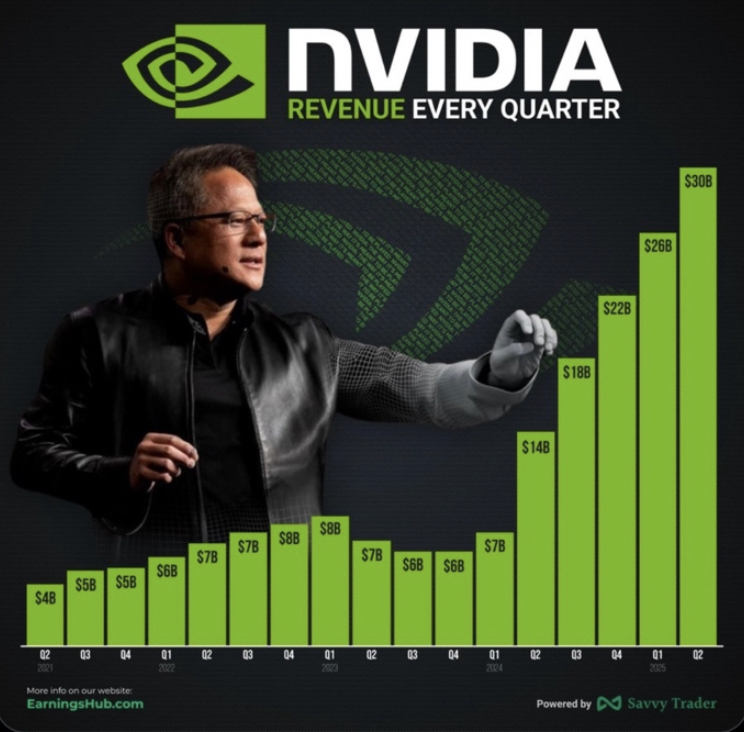

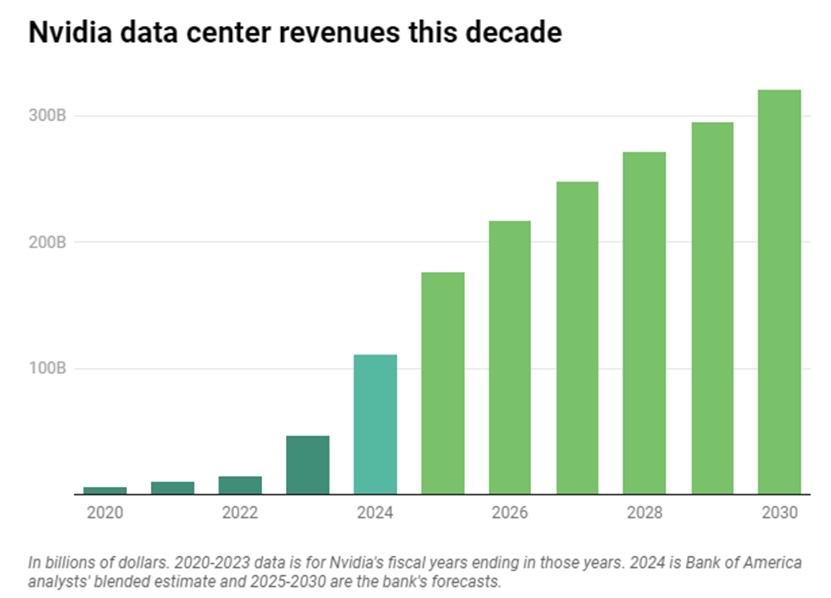

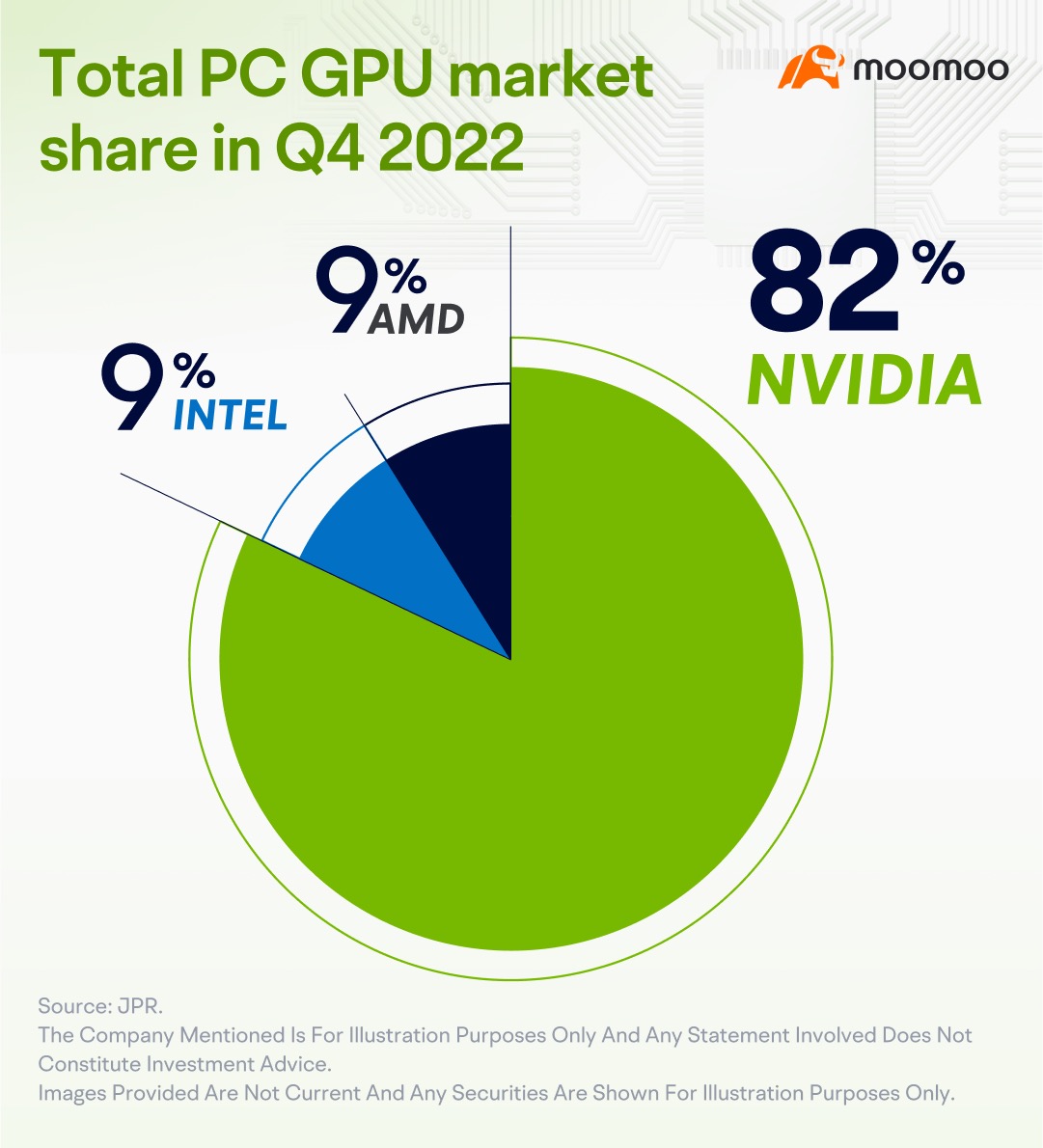

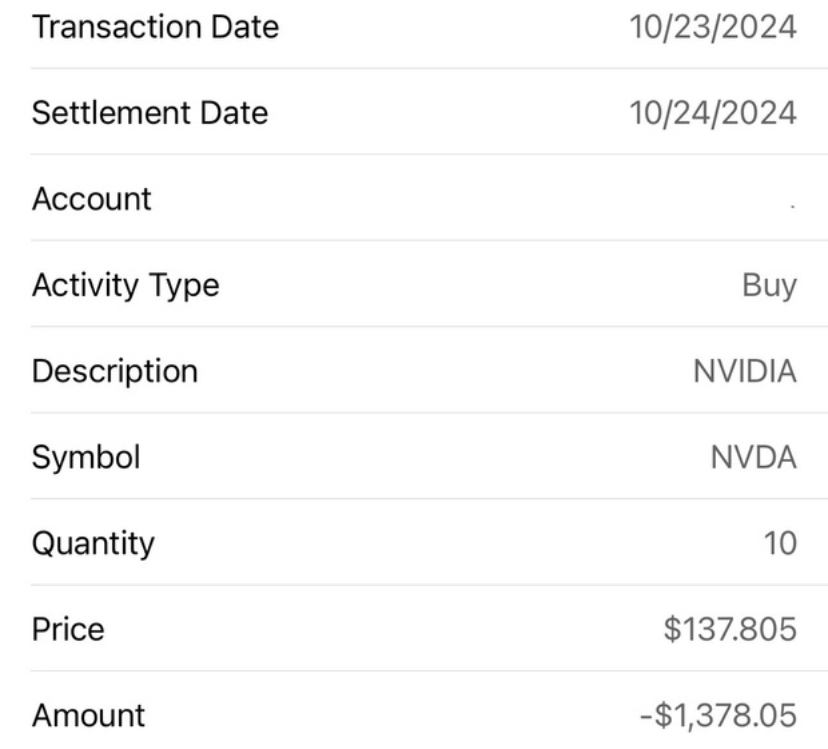

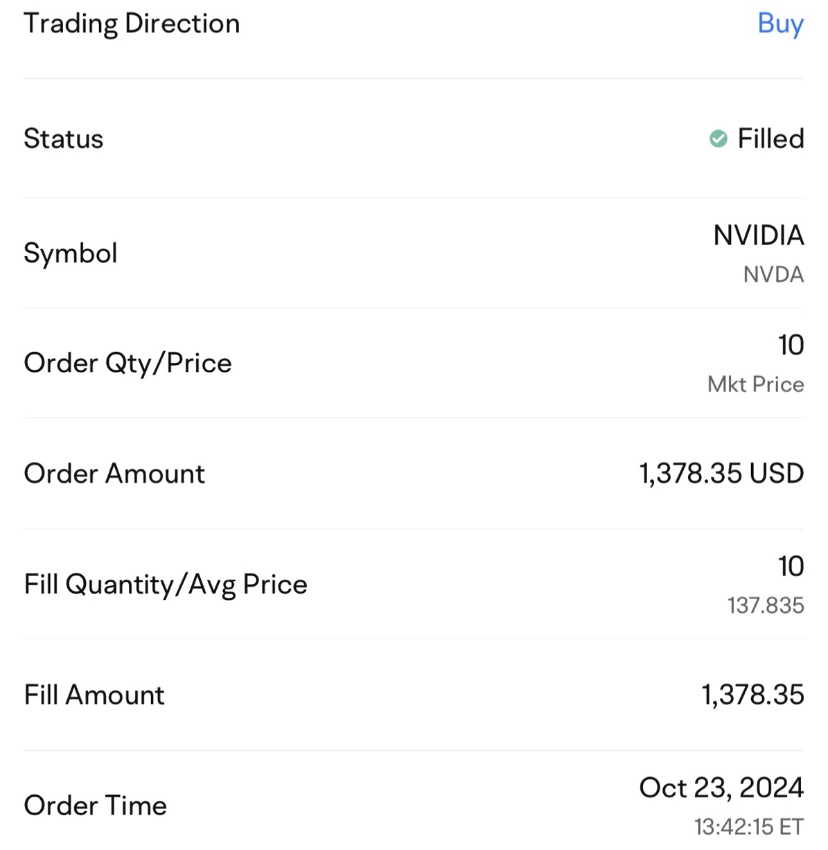

Coach Donnie OP : $NVIDIA (NVDA.US)$ Dan Ives

- YouTube

Coach Donnie OP : How much risk can you take?

When it comes to investing, risk and return may come hand-in-hand. If unwilling to take risks, one should not expect returns.

However, it could be dangerous when some only have their eye on the returns and neglect the risks.

So, how to balance risk and return? This depends on how much risk you can take.

Risk tolerance varies from person to person. This is mainly related to 4 factors.

The first factor is age.

A young man in his prime and a retired senior generally have different levels of risk tolerance.

Young people usually have a longer timeline to recover from their losses.

Therefore, they may be more risk-tolerant.

However, many elderly people live off pensions or savings, and may not have other sources of income, which can make them relatively less risk-tolerant.

A commonly cited rule of thumb makes it easier to approach the relationship between age and high-risk assets, such as stocks.

According to this principle, the percentage of stocks people may consider holding is equal to 100 minus their age.

For example, a 30-year-old investor may consider allocating 70% of their idle funds to stocks, while according to this rule, that percentage for an investor aged 70 should be within 30%.

However, this formula can be flexible. You can adjust it according to your situation. But, all else being equal, the principle is the older you are, the lower the proportion of your portfolio that you might want to consider investing in high-risk assets.

Coach Donnie OP : The second factor is financial status.

For example, if someone is well-off and has no debt and he is also single, then there is a lot less financial burden on his hands. But if he is married with kids, then living expenses are high, and he might struggle to make ends meet.

There is an essential difference between his risk tolerance level in these two situations.

The former is in good financial condition. A slight loss will not affect life. Therefore, the risk tolerance is relatively strong.

The latter's financial situation is already unstable. Losing money on an investment might result in a huge burden on life.

Therefore, the risk tolerance is very weak.

The third factor is individual risk appetite.

Everyone has different perspectives on risks.

Some people are conservative even when they are young and well-off. They simply do not want to take any risks, thus they are not the best candidates for high-risk investments.

Some people are more radical. Losing money will not rattle their mindsets. Thus they are willing to take high risks to gain possible high returns.

The fourth factor is the level of investment knowledge.

The essence of risk is uncertainty. Before investing, you will not know the profits or losses it brings.

If you have done your homework in asset analysis with the right investment mindset, you may become more capable of controlling the investment risks perceived by others as huge uncertainty.

Conversely, you'll be walking a thin line if you choose to invest in financial assets that you don't know much about, especially those involving high risk.

To sum up, the investment risk that you can take depends on your age, financial situation, risk appetite, and investment knowledge. Before investing, we must know our situation, and not act on impulse.

Coach Donnie OP : You may have heard

Time in The Market Beats Timin The Market.

In the market, "time" can refer to several important concepts:

1. Time Horizon: This is the period over which an investor intends to hold an investment before needing to access the funds. Time horizons can vary widely, from short-term (days to months) to medium-term (a few years) to long-term (typically five years or more). The time horizon influences investment strategy, risk tolerance, and asset allocation.

2. Time Value of Money (TVM): This principle states that a sum of money has greater value now than it will in the future due to its potential earning capacity. In investment terms, this concept underpins the importance of earning returns over time, often calculated using present value and future value formulas.

3. Market Timing: Refers to the strategy of making buy or sell decisions based on predictions of future market price movements. Market timing can be risky and is often criticized for being difficult to execute consistently.

4. Investment Duration: In fixed-income investments, duration measures how sensitive the price of a bond is to changes in interest rates. It considers the timing of all cash flows, including interest payments and the return of principal.

5. Compounding Time: The effect of compounding returns over time is crucial in investing. The longer the investment period, the more pronounced the effects of compounding can be, as returns generate additional returns.

Understanding these various aspects of time is essential for investors as they shape decisions, strategies, and expectations for returns in the investment market.

Time in The Market Beats Timin The Market.

#CoachDonnie

Coach Donnie OP : * Short-Term Trading: Day traders often make decisions based on minutes or hours, focusing on short-term price movements.

* Swing Trading: Traders may hold positions for several days or weeks, capitalizing on expected price swings.

* Long-Term Investing: Investors often look at timeframes of months or years, focusing on a company's fundamentals rather than short-term market fluctuations.

Coach Donnie OP : ATTITUDE OF GRATITUDE Brings More to You…

Brings More to You…

There are those who want a swimming pool in their home, while those who have it barely use it.

Those who have lost a loved one miss them deeply, while others who hold them close often complain about them.

Who doesn't have a partner longs for it, but who has it, sometimes doesn't value it.

He who is hungry would give everything for a plate of food, while he who has plenty complains about the taste.

The one who doesn't have a car dreams it, while the one who has it always looks for a better one.

The key is to be grateful, to stop looking at what we have and to understand that, somewhere, someone would give everything for what you already have and don’t appreciate it.

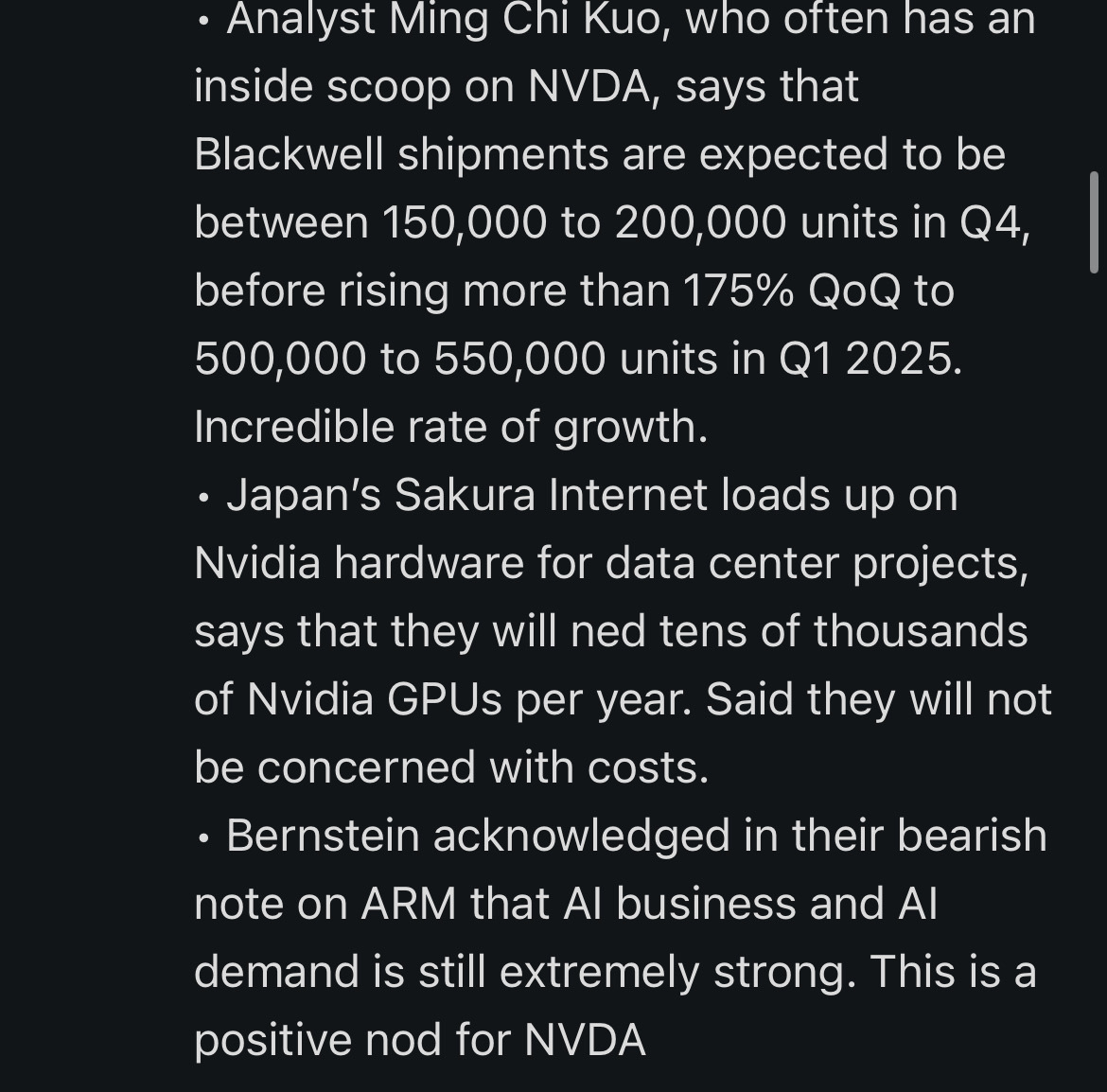

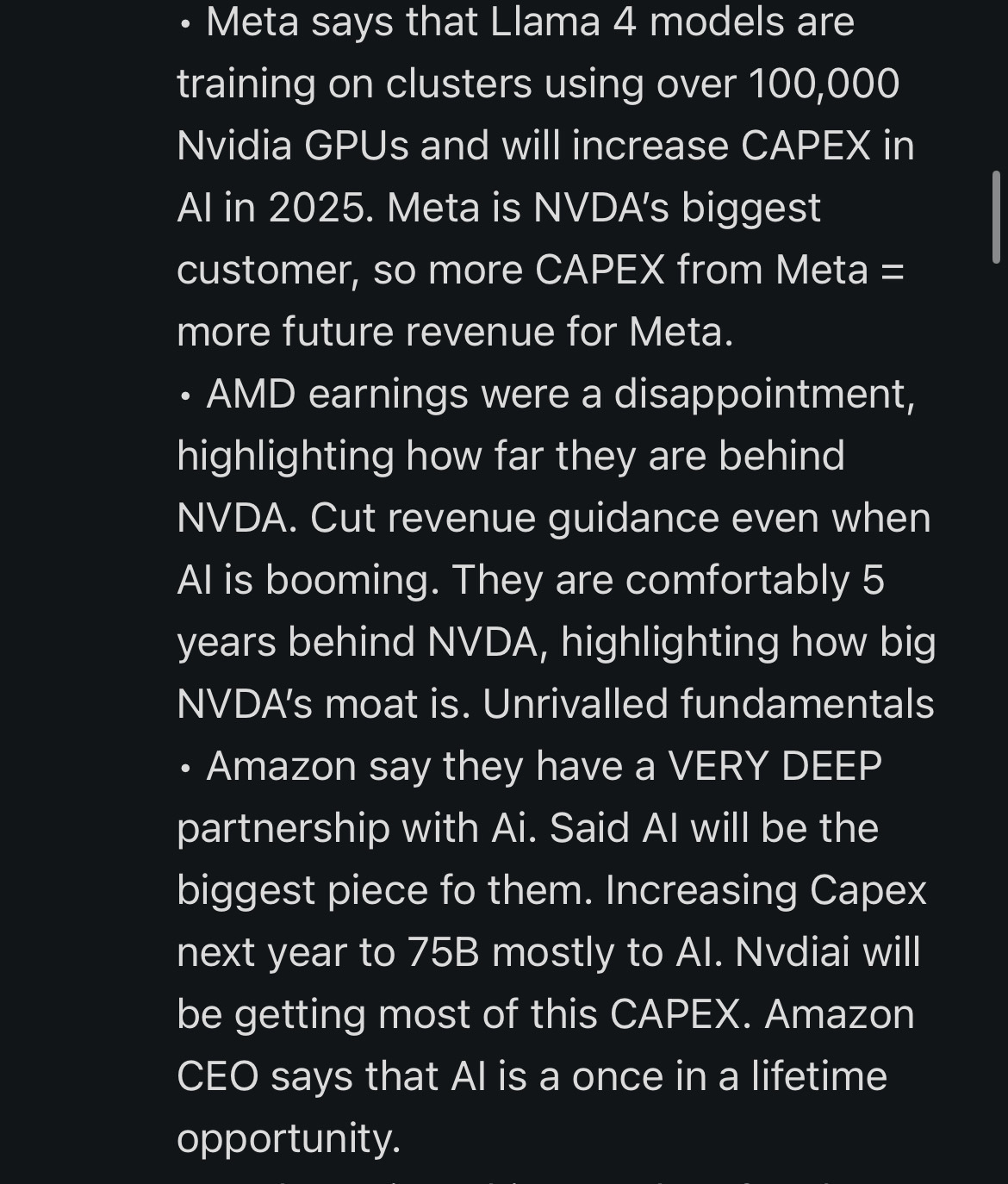

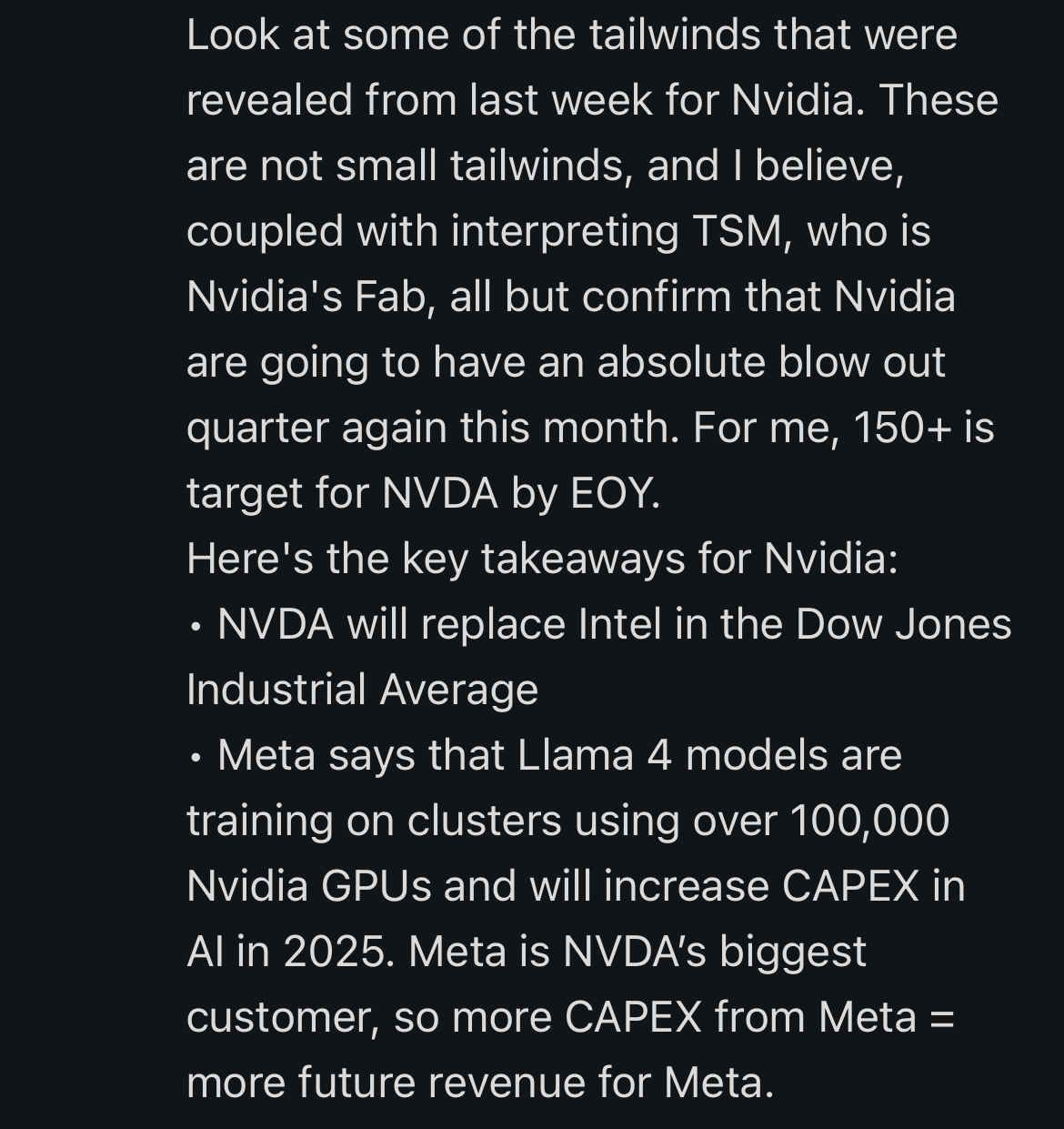

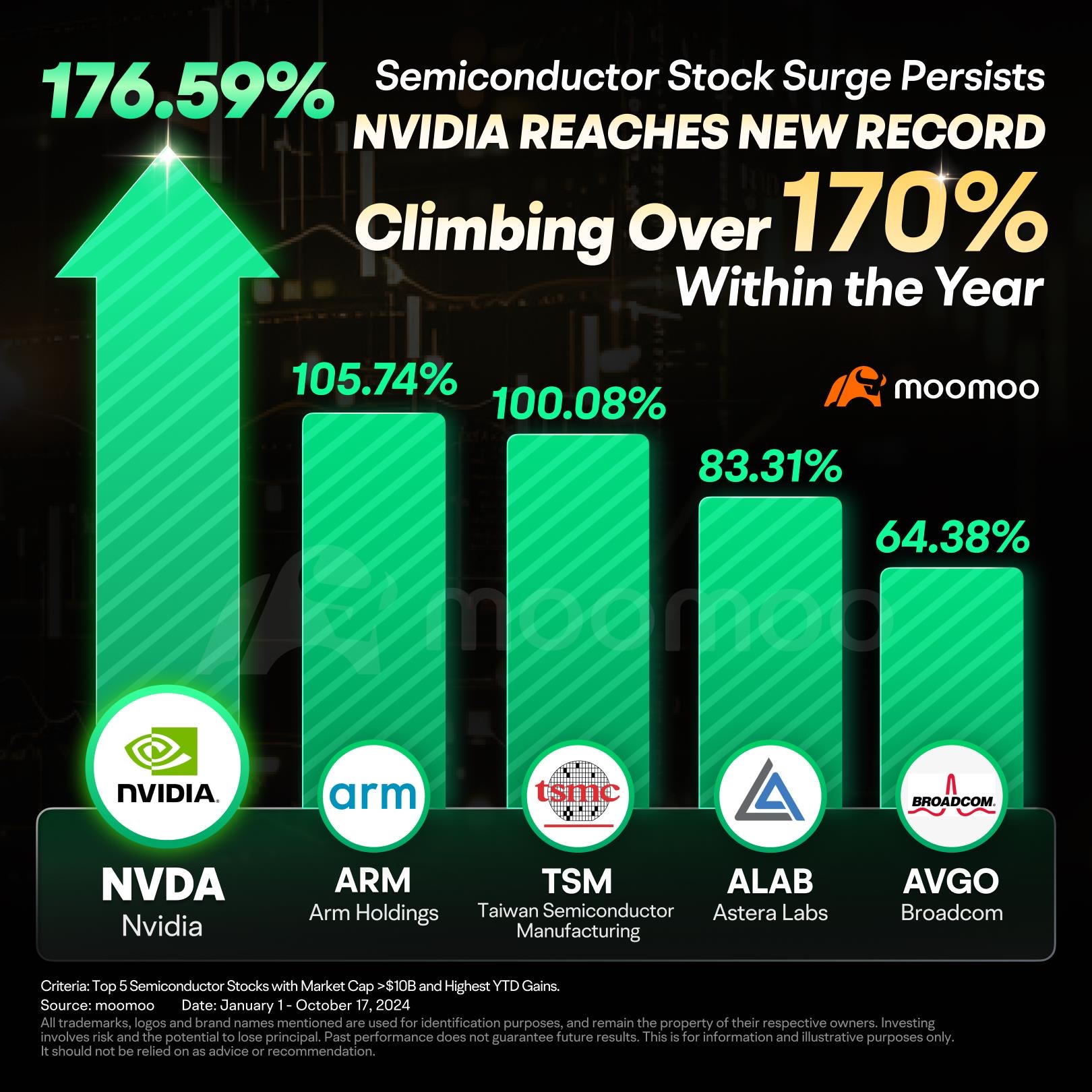

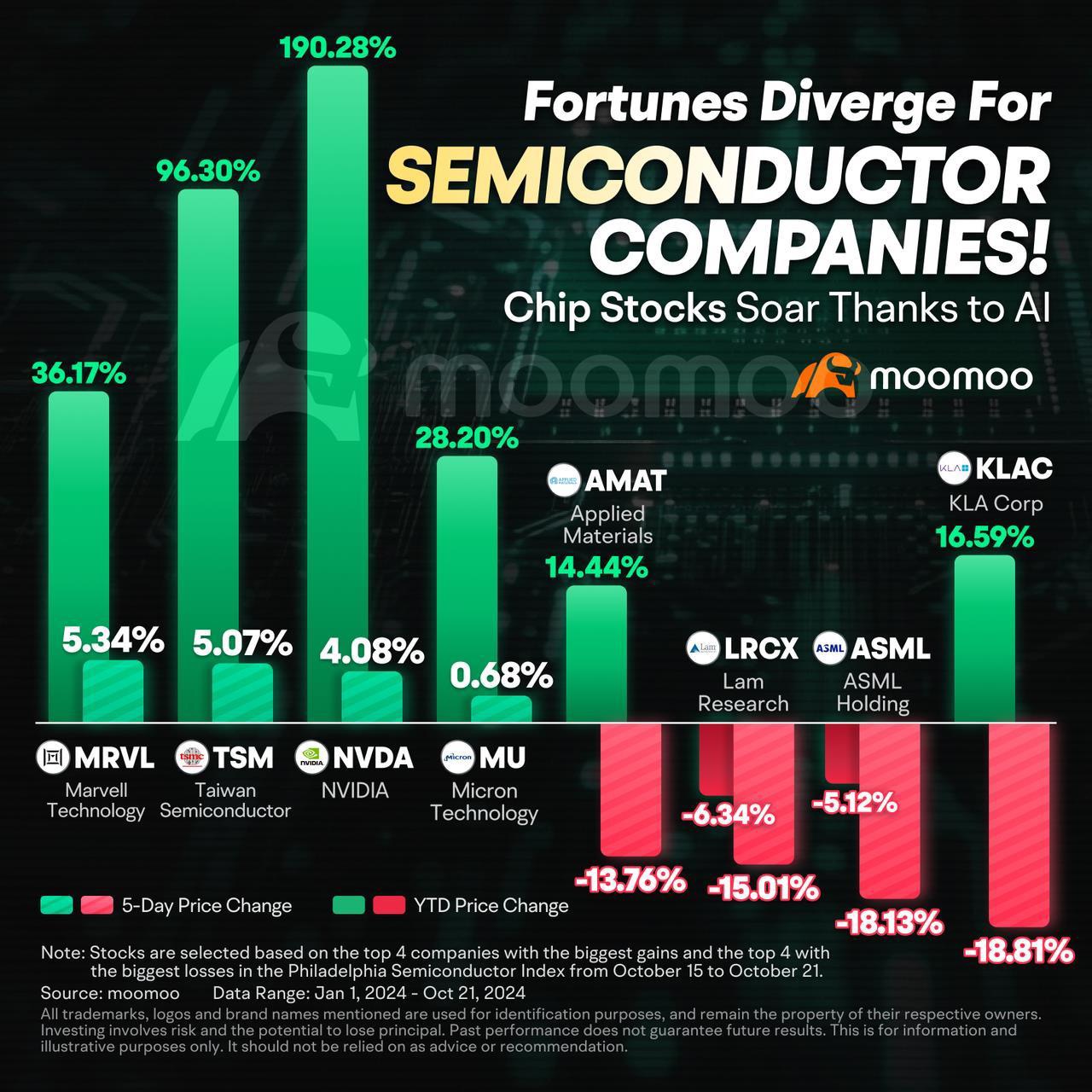

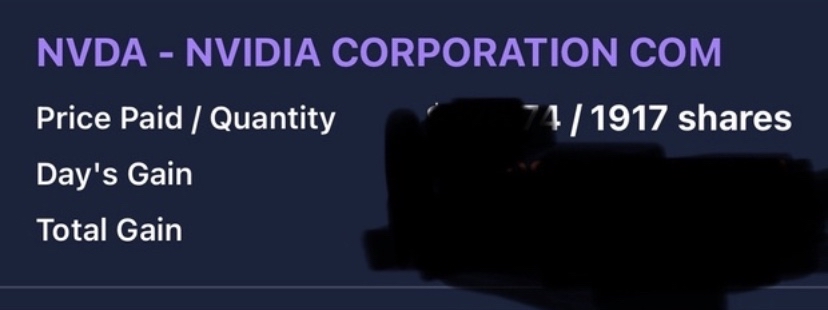

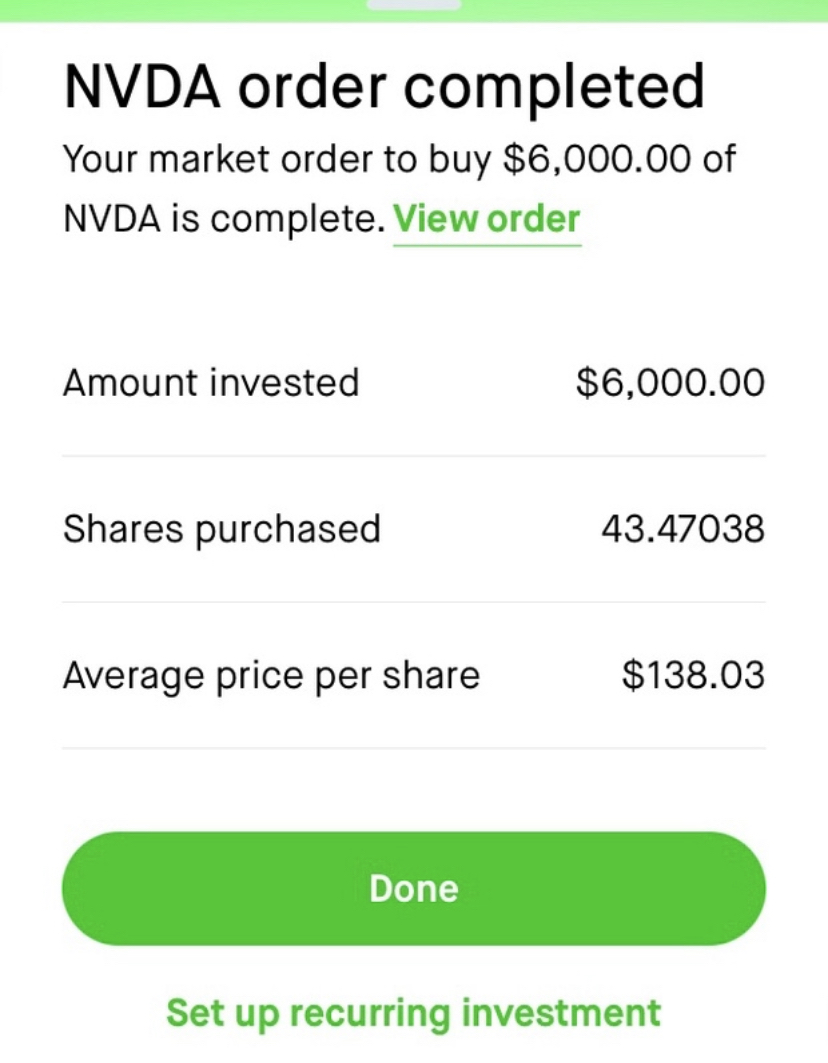

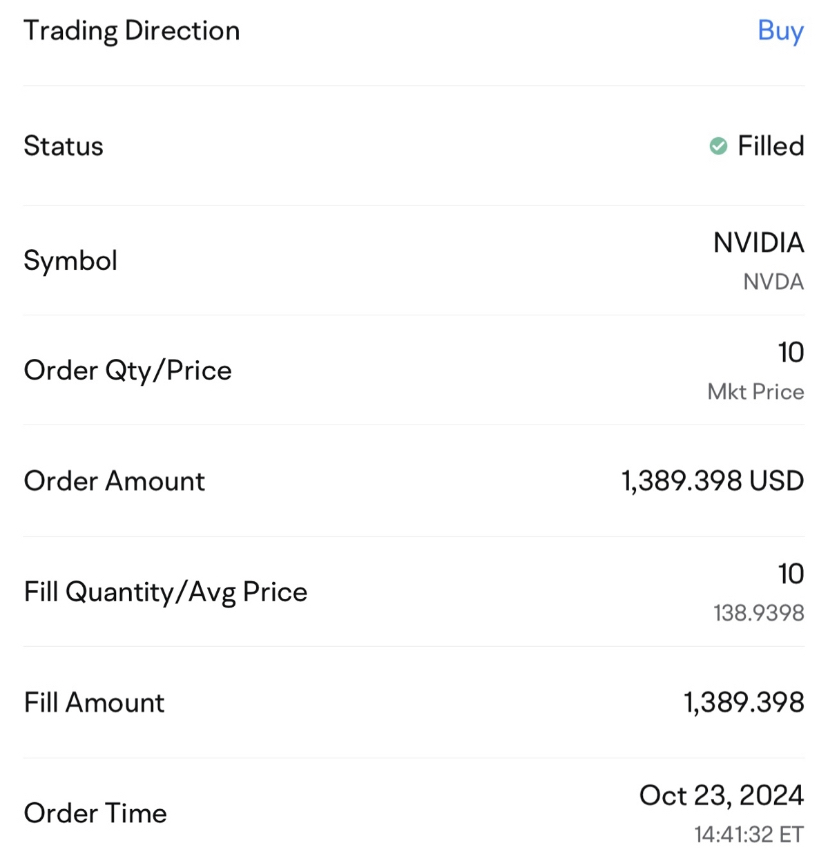

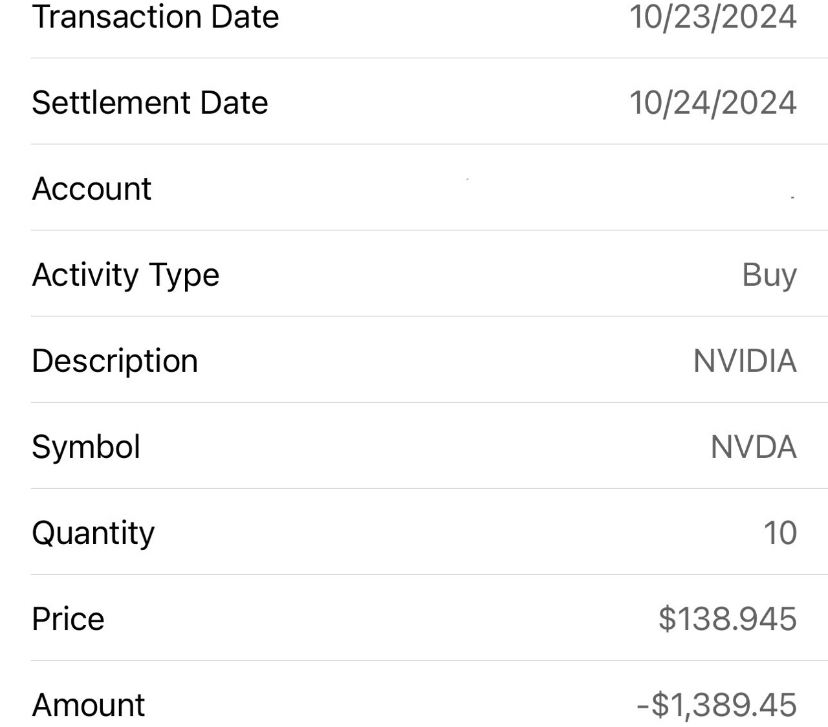

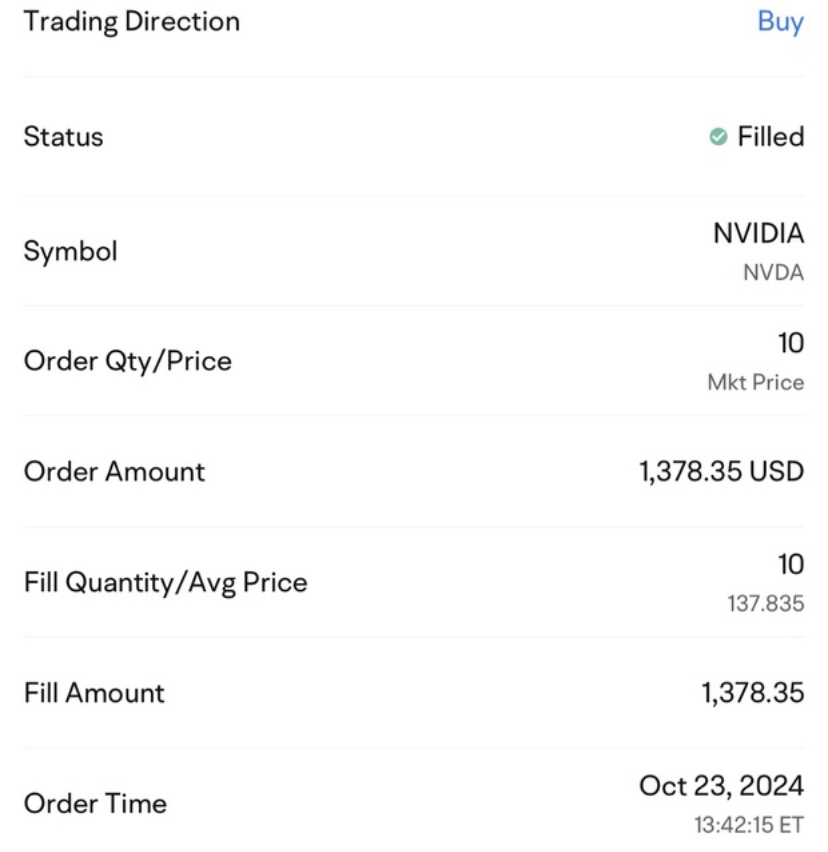

Coach Donnie OP : NVDA ROI CAGR 2024 SO FAR Should You Buy Nvidia Before or After the Blackwell Launch?

Coach Donnie OP : Hope everyone is having a Wealthy Weekend & enjoying Shabbat

are like a Parachute

are like a Parachute

reservoir

reservoir

my friend

my friend

Remember

The MIND and the HEART

They work BEST

When Open…

Finances is a Tool to be used

Not a pool to be viewed

Be a River

Not a dam

Let anything and everything that’s truly good

Flow through you

Not just to you

Be like water

#CoachDonnie #BruceLee

View more comments...