Q3 P/L Challenge - my take!

My investment journey started in June with a mindset of 'yoohoo, let's go shopping, that can't be hard!'. So I filled my portfolio with 70% large caps & solid companie and 30% promising companies and thought I could sit back and relax, waiting for dividends from the 70% and capital gains from the 30%.

Somewhere in July, I went 'oopsy daisy, somethings not right, there is smoke in the kitchen!'. I realised many stocks I bought were over-valued and underperforming, leading to the first portfolio shrinkage. So, I dragged my lazy a** to dig deeper into it and ended up understanding the do or die matter of applying fundamental analysis as part of the due diligence.

In Aug, I was still deep in the FA rabbit hole, bumping around, pulling my hair, and adjusting my portfolio - pruning off the bad apples and adding better ones. This is when I discovered ETFs and started to dig another rabbit hole, compare them, eventually added them to my portfolio.

In Sept, it was another 'uh-oh, here we go again!'. There was still shrinkage but unrelated to the USD devaluation (although that was a big factor for Aug & Sept). So again, it's still my own doing (when is this gonna end? all I want is to chill and see my money working for me, as the cliche goes), and this is when I discovered Technical Analysis. To my ultimate horror, I have committed so many sins I might as well throw in the towel. 90% of my entries were timed wrongly, even though they are the companies I wanted. So I dragged myself up again from the lazy chair to study TA, all the while crying over all my spilled milk.

Around the same time, I also learned about option trading because I saw the trigger words from the education materials - passive income.

So, how did my portfolio actually performed since I started my investment journey in June 24?

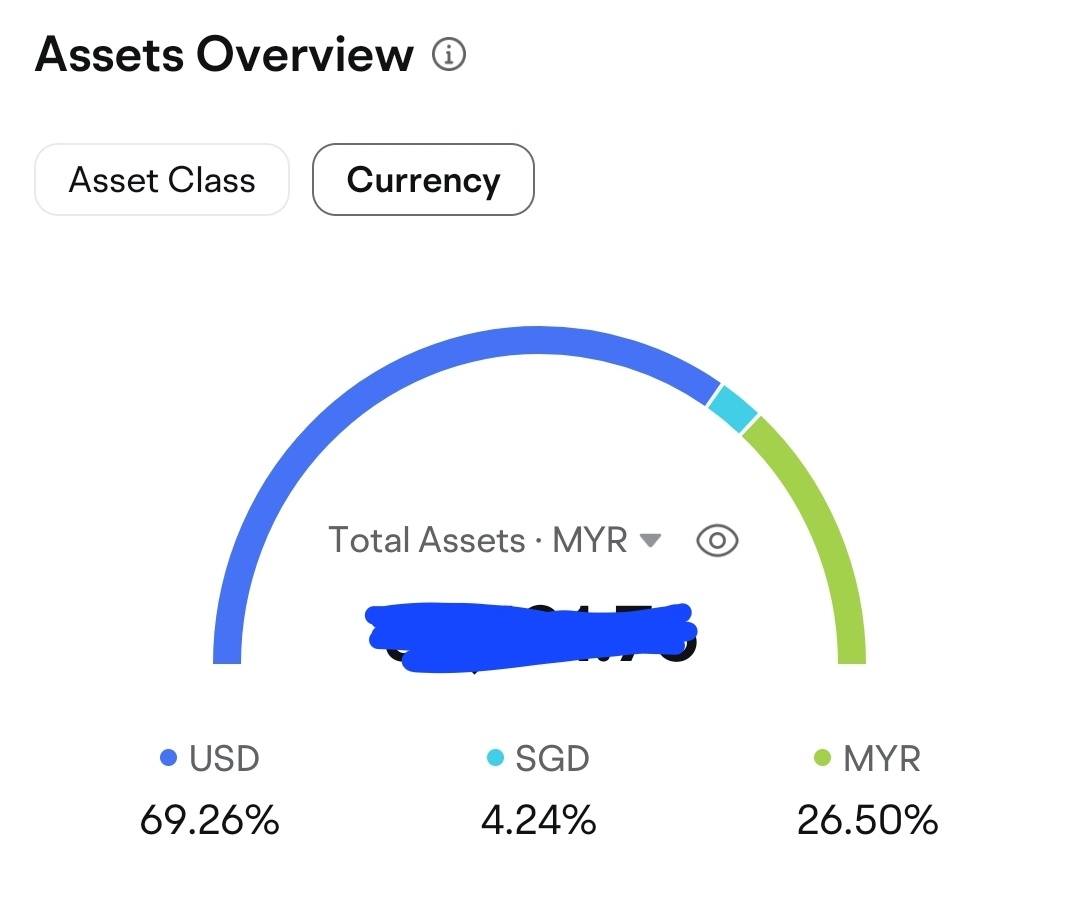

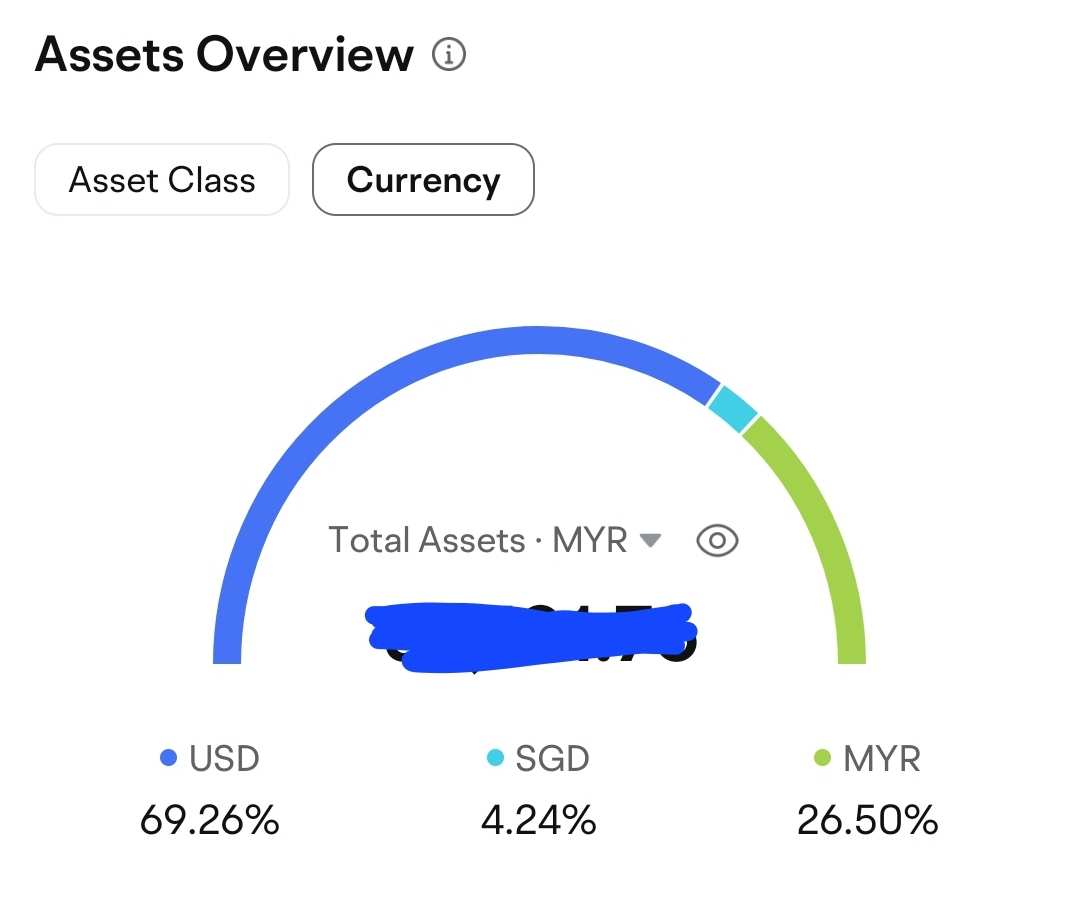

In view of 70% of my portfolio value is linked to USD assets, so as someone who has to buy USD with MYR invest, the past 3 months has been a blood bath. But if I switch to a USD view, it's actually a happy green, justifying the effort I have put in so far.

ETF has become a big part of my portfolio and Options just got started.

After internalising (beating myself up) and externalising (whining to others) my crash and burn, ups and downs...what's my strategy going forward?

For the Malaysian market - simple, easy and play safe!

✴️ Buy and keep good stocks that have good fundamentals, are not overvalued/ overpriced, and pays dividend.

For the US market - learn, sharpen my skills and take risks!

1️⃣ Buy some for dividends

2️⃣ Buy some for option trading

3️⃣ Buy some for price-trading.

If someone can be so kind to help me encapsulate this into a one sentence strategy, that will be great. I know some people are good at that...

------------------------

The by-product of investing is that it made me more attuned to global affairs, macroenomics, and stock market psychology. So, that's an UNEXPECTED GAIN right there!

------------------------

5 do-s and 5 don't-s:

Do #1️⃣ - enter and exit at a price supported by TA.

Do #2️⃣ - read up the analysts rating and make good use of fundamental analysis to make sure you choose the right company (it's not like grocery shopping like how I treated it in para 1)

Do #3️⃣ - do your daily tasks and other 'assignments' (like this one here) to earn points so you can leverage them to lower your future asset acquisition cost or just to increase the fun factor of your journey.

Do #4️⃣ - dedicate time to keep learning. No pain, no gain is the name of most games.

Do #5️⃣ - build a small community of like-minded people outside of the app bubble to exchange thoughts and ideas. Currently, I have 2 friends who also happen to be Moomoo users. We chat regularly about investment.

------------------------

Don't #1️⃣ - invest more than what you can afford to lose. Don't borrow from others / institutions to invest because we will never know what happens tomorrow. Don't burden yourself and others.

Don't #2️⃣ - be reckless with money, it will come back and bite you. If you are too impatient, you will crash in a matter of time. Conversely, you can also say that if you are too lackadaisical, you will miss out on a lot of opportunities. So it depends on your personality. Mine happens to be the earlier, so that came to my mind first.

Don't #3️⃣ - keep bringing up the stock market in conversation with others like a religion or a direct selling business. It's very annoying to most people. Do your own thing quietly and not be a manic over-sharer.

Don't #4️⃣ - let market ups and downs affect your health, emotions, and personal growth. Learn to set boundaries and live a balanced life.

Don't #5️⃣ - impose your matket take on others too eagerly. Are you going to take responsibility if others lose money because of your advice? I thought so. Know and respect boundaries.

------------------------

Wow, I truly feel like I'm in Uni again and trying hard to do my assignment well. I miss those carefree days, so I enjoy reliving that experience now.

Finally, if you have read this far, may Q4 bring new growth in all areas to our lives!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

bangmoomo : awesome sharing. keep it up