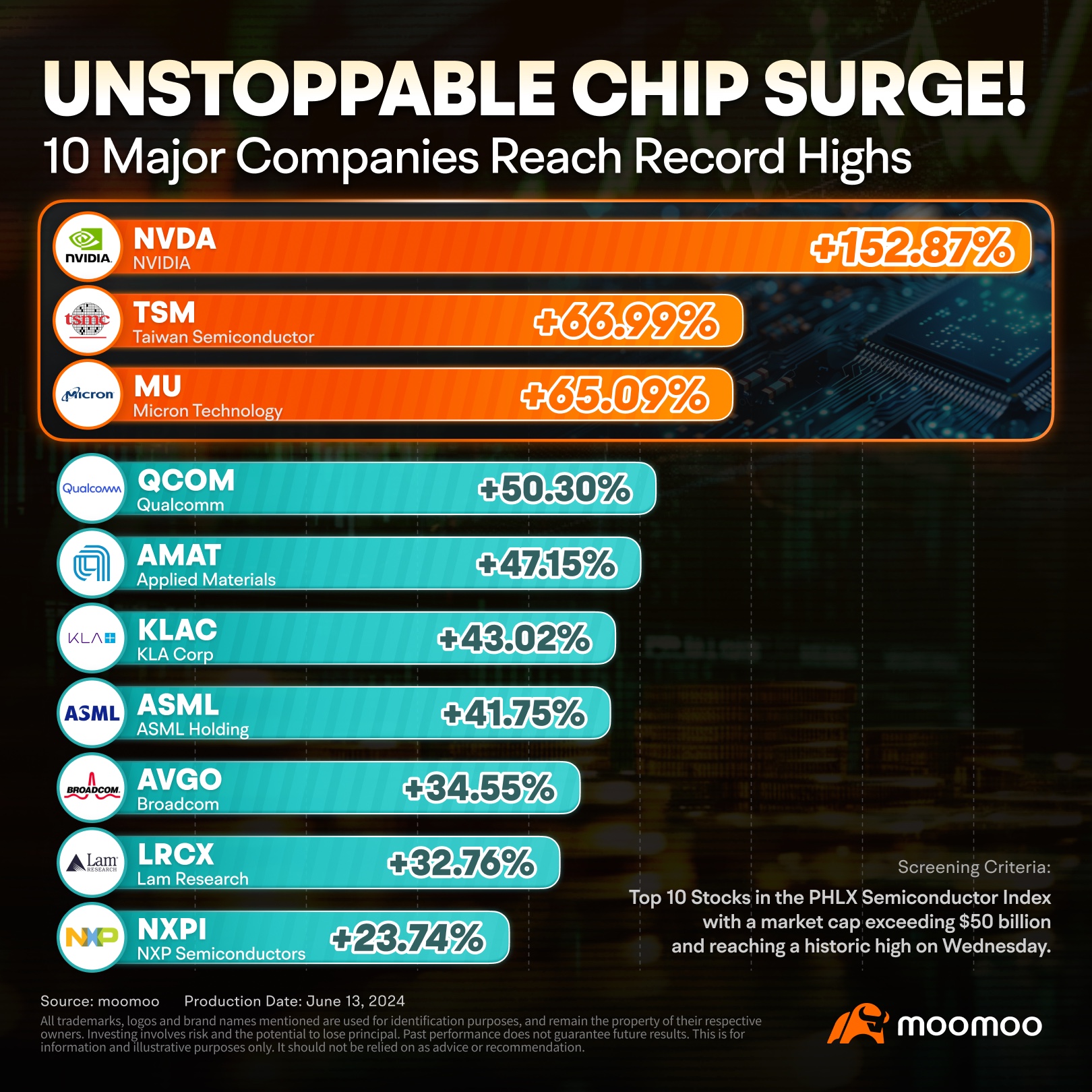

NVDA

NVIDIA

-- 108.380 TSLA

Tesla

-- 259.160 PLTR

Palantir

-- 84.400 AMZN

Amazon

-- 190.260 AAPL

Apple

-- 222.130

"I got the impression that the Fed will pivot quickly once the job market shows rapid deterioration; I don't think the market has factored in that risk."

10baggerbamm : a key point that no one is discussing that should be brought out front and center is... if you believe what chairman Powell has said yesterday and in the past then you must factor in what he said several months ago. and that was the FED is prepared to take action data dependent in between a Fed meeting the Fed can and may lower interest rates in between meetings so they don't have to wait till July they don't have to wait till September they don't have to wait till December they can do it in between a meeting and imagine the shock in the market if chairman Powell is going to speak momentarily what's he going to say and he says we've decided quarter point cut it would be a ballistic missile launch in the following sectors. real estate regional Banks utilities. of course tech stocks will continue rallying but on the margin the ones with the greatest gains are the regional Banks (DPST) are specific real estate investment trust (DRN) and utilities (UTSL) THESE ARE LEVERAGED ETFS THEY ARE HIGHLY VOLATILE WHEN SECTORS ARE GOING UP YOU'RE RINGING THE CASH REGISTER WHEN THE UNDERLYING STOCKS FALL YOU ARE GETTING HAMMERED AND WILL EXPERIENCE PAIN LIKE YOU'VE NEVER FELT BEFORE SO BEFORE YOU RUN OUT AND BUY THEM DO YOUR HOMEWORK ASK QUESTIONS AND LEARN. These are some of leveraged ETFs that I buy that I trade that I position myself in in anticipation of movements within sectors.

Morteza safarii : ۲۰۲۴

搞经济 抄底 加仓 : Naa.. FED will just make up another story

muhamad Hazairudin s : Muhamad Hazairudin Shadan

muhamad Hazairudin s 10baggerbamm : Muhamad Hazairudin Shadan