Rate Cut Expectations Bolstered for September; Tech Giants Lead US Stocks to More Records

The $S&P 500 Index (.SPX.US)$ climbed Wednesday to a fresh record, breaking above 5,600 for the first time, as a sharp rise in semiconductor stocks led the market higher. The $Nasdaq Composite Index (.IXIC.US)$ advanced 1.18%, also hitting an all-time high and ending at 18,647.45.

The primary forces lifting the S&P and the Nasdaq remain the well-known tech "Magnificent Seven." The stocks of the "Mag 7" have risen for seven consecutive days, with gains on 10 out of the past 11 days, including Tesla, which has increased for 11 days straight.

Source: Bloomberg

The key catalyst behind the market rally

Powell's "dovish" remarks set the stage for a rate cut

The US central bank will not want to wait for inflation to cool to its two percent target before considering a rate cut, Federal Reserve Chair Jerome Powell told lawmakers on Wednesday.

"You don't want to wait until inflation gets all the way down to 2%," he said. "If you waited that long you probably waited too long because inflation will be moving downward and would go well below 2%, which we don't want."

His comments on his second day of testimony before Congress largely mirrored those made on Tuesday, when he also acknowledged the cooling labor market and noted that "we now face two-sided risks" in the economy.

“Powell took a relatively cautious approach,” said Karl Schamotta, chief market strategist at Corpay in Toronto. “But there were enough dovish hints within his narrative to help risk appetite improve in markets.”

“The idea that the labor market is no longer generating the inflation pressure that the U.S. economy was struggling with, is helping to reduce the likelihood of further rate hikes and also put a September rate cut more firmly on the table,” Schamotta said.

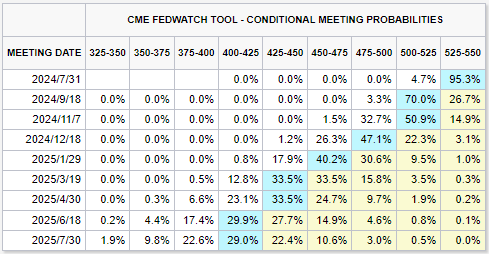

Traders now have around 73% odds for a rate cut by September, with a second cut also seen likely by December, according to the CME Group’s FedWatch Tool.

Source: CME FedWatch

Tech Stocks Holding Up Hope for Earnings Growth

Bank of America Merrill Lynch stated that large tech companies ( $Microsoft (MSFT.US)$ , $Amazon (AMZN.US)$ , $Alphabet-C (GOOG.US)$ , $Meta Platforms (META.US)$) confirmed their view in the last quarter that 2024 will be the first year of a multi-year AI investment cycle.

During the first quarter earnings season, the consensus expectation for the 2024 capital expenditures of the four companies increased by $18 billion to around $200 billion, a year-on-year growth of 34%.

AI investment is now forming a potential virtuous cycle. Semiconductors are the most obvious beneficiaries, as the increase in power usage and physical construction of data centers brought by AI should also lead to increased demand for electrification, construction, utilities, commodities, etc., ultimately creating more job opportunities.

Additionally, tech stocks are carrying the hopes for earnings growth. The current optimistic forecast in the market is an 11% year-over-year EPS growth in the second half of the year. However, excluding the "Magnificent Seven," the consensus expectation for sales growth is only 1%.

Although the expected 14% EPS growth in the fourth quarter looks high, over 60% of the growth comes from the "Mag 7," according to Bank of America.

Dive in >

Source: MarketWatch, Yahoo Finance, Bank of America

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102367479 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)