Rate-Cut Expectations Dashed Again: How Will the Stock Market React? Wall Street's Views Vary

The series of economic data released this week all point to a robust economy and resilient labor market. Additionally, the recent hawkish comments from Federal Reserve officials have led to a continued downward revision of market expectations for interest rate cuts this year. After Tuesday's stronger-than-expected US job openings and factory goods orders, all three major US stock indices fell by over 1% intraday, with both the $Dow Jones Industrial Average (.DJI.US)$ and the $S&P 500 Index (.SPX.US)$ hitting their largest daily declines in four weeks. However, the timing, magnitude, and impact of any potential interest rate cuts by the Federal Reserve this year continue to be hotly debated on Wall Street.

The extremely optimistic expectations for interest rate cuts pushed a wide range of assets, such as US stocks, US bonds, gold, and Bitcoin, to surge significantly in the fourth quarter of last year. At that time, the most optimistic prediction was that the Fed would cut rates by around 150 bp in 2024, which was twice the prediction shown in the Fed's dot plot. However, since the beginning of this year, expectations for rate cuts in 2024 have been constantly revised, and the focus of the debate on Wall Street has shifted to whether the cut will be 75 or 50 basis points.

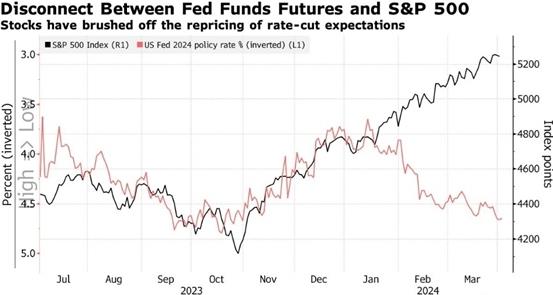

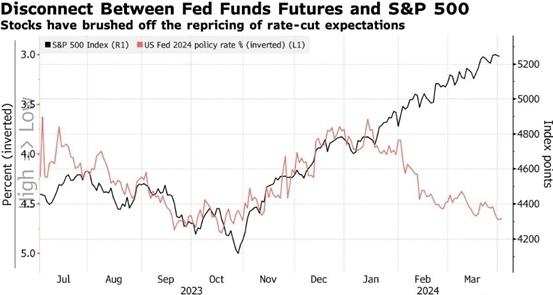

In the first week of the year, as people became uneasy about the timing of the Fed's shift to an accommodative monetary policy, the market got off to a bad start. After that, confidence in the prospect of rate cuts continued to wane, with the earliest possible timing for a rate cut being repeatedly postponed. However, the latest positive progress in AI seems to have overshadowed the impact of monetary policy expectations to some extent, and large tech stocks continue to lead the U.S. stock market higher, exacerbating the disconnect between the stock market and rate cut expectations.

Before the Fed's March FOMC meeting on March 20th, the market was still worried about whether the latest dot plot would lower the number of expected rate cuts from three to two, but the Fed maintained its prediction of three rate cuts in 2024 while raising economic growth and inflation expectations. This seemed to imply that the threshold for rate cuts had been lowered, which was also interpreted by the market as dovish, and traders began to significantly increase the probability of a rate cut in June. No one could have predicted that this situation would only last for just over a week, as recent strong economic data and frequent hawkish statements from Fed officials once again challenged rate cut expectations. The "good news is bad news" mantra continued to play out on Wall Street.

Robust Economic and Employment Data Erode Case for Interest Rate Cut Amid Stagnant Inflation Cooling.

Economic growth and labor market remain strong: The US March ISM manufacturing data released on Monday rose significantly by 2.5 percentage points from February to 50.3, unexpectedly returning to the expansion zone. Following this, the Job Openings and Labor Turnover Survey (JOLTS) released on Tuesday showed that the number of job vacancies in February increased slightly from 8.748 million in January to 8.756 million, indicating a tight labor market. The monthly factory orders for February, also released on the same day, increased by 1.4%, surpassing market expectations of 1%. All indicators demonstrate that the economic fundamentals remain robust.

Concerns over rising inflation: After the strong data in January, the February CPI YoY increase of 3.2% exceeded the expected 3.1%, and the core CPI YoY increase of 3.8% also exceeded the expected 3.7%, exceeding expectations for the second consecutive month. Subsequently, the PPI data also showed an acceleration of inflation, indicating that the last mile of combating inflation is not easy. Although the cooling of core PCE eased the Federal Reserve's worries, it is not enough to shake the Fed's cautious attitude towards interest rate cuts. Especially against the increasingly complex geopolitical situation, the risk of conflict intensifying and causing a rapid rise in oil prices will further push up inflation expectations.

Bank of America pointed out in its research on Tuesday that considering the favorable YoY basic effect of core PCE before May, but unfavorable for six out of the last seven months of this year, if the Fed has no reason to cut interest rates in June, it will be even more difficult to justify a rate cut later this year. Currently, investors are becoming more cautious about rate cuts, with expectations of only about 65 basis points this year, even lower than the median forecast of 75 basis points from the Fed's dot plot.

Some analysts are concerned that the market may face pressure due to fewer rate cuts.The US stock market appears to have disregarded the sustained weakening of interest rate expectations, as it continues to surge in Q1 despite setbacks to expectations of loose monetary policy. This divergence between the stock market and the diminishing rate cut outlook is worrisome, according to Morgan Stanley strategist Mislav Matejka. The team further highlights that investors are assuming economic growth will save the market, yet earnings forecasts for 2024 have yet to be revised upwards.

Some others do not view fewer rate cuts as bad news for the market. Andrew Slimmon, a managing director at Morgan Stanley Investment Management, believes that fewer rate cuts would be a positive sign for both the economy and the stock market. According to Slimmon, "a patient Fed validates that the economy is strong", which is better for equities."

Steve Eisman, the inspiration behind the movie "The Big Short," even sees the Fed's premature rate cuts this year as a threat to the stock market bubble. Eisman further emphasizes that historical lessons have shown that there is nothing worse than the Fed cutting rates first and then having to raise them when necessary.

Source: Bloomberg, Financial Times

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

NøüñgŚèñg : I had a meal.

Shootingstar : 1 trillion usd is printed. More can and will be printed. This inflation is going to be a norm who are to challenge the feds when they say this is normal and fed rates are to be lowered? The so called economist who keep getting it wrong for the past 5 years?

Peter YCS : America has done its evil deeds, and karma will surely come...

CY90 : cut or not cut. must drop all

RDK79 : Also, I saw this today: Atlanta Fed President Bostic sees only one rate cut this year, occurring in the fourth quarter.

Makes sense sorta:

- election year so extra effort for decent economy.

- unemployment remains record lows.

- inflation is fine albeit not where ‘they want it’ but it’s rarely there anyway.

- stock market performance is decent, typical ups and downs, trying to influence / drive fed rates (never works).

- deficit / debt remakes insane, which can drive rates, but politicians don’t care anymore, just make it a headline thing, just like southern boarder control.

- folks finally realizing after 2 years there’s recession, real or threat.