Rate Cut Expectations Rekindled, Pushing the Market to New Highs. What Other Catalysts Could Trigger a Rate Cut?

Last week, U.S. Treasuries ended on a strong note, with the benchmark 10-year Treasury yield falling by about 20 basis points over the week, approaching its lowest level since the end of June. Meanwhile, the U.S. S&P 500 Index also scored its 34th record closing high of the year on last Friday.

Recent frequent geopolitical disturbances have heightened the sentiment for "Trump trades" following the first U.S. presidential debate, leading to a divergence in the performance of major asset classes. After the release of the June non-farm payroll data, the main focus of "rate cut trades" once again overtook "Trump trades," with close attention being paid to the July FOMC meeting for guidance on the possibility of a rate cut in September.

■ Nonfarm payrolls fell in June, with the unemployment rate rising to 4.1%.

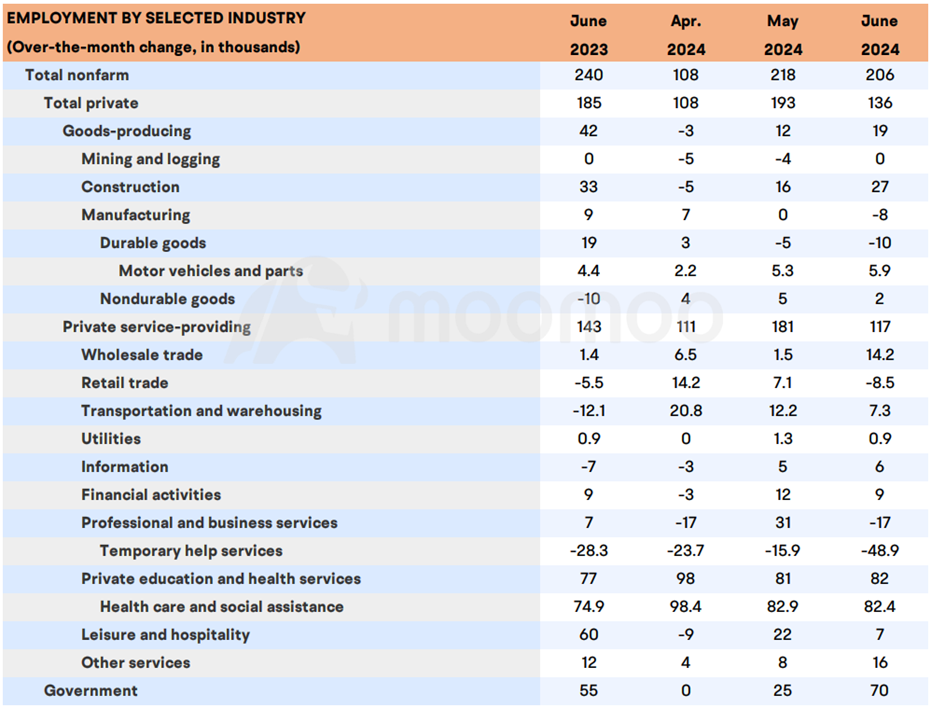

The US job market saw an addition of 206,000 positions in June, narrowly missing the revised figure of 218,000 for May. The May numbers experienced a significant downward revision from an initial estimate of 272,000, while the count for April was also adjusted downwards by 57,000 to 108,000.

Government jobs rose by 70,000; health care added 49,000 positions; and social assistance contributed 34,000 jobs. On the flip side, there were job losses in retail trade with a decrease of 8500 jobs, manufacturing dropped by 8,000 jobs, and the professional and business services sector shed 17,000 jobs.

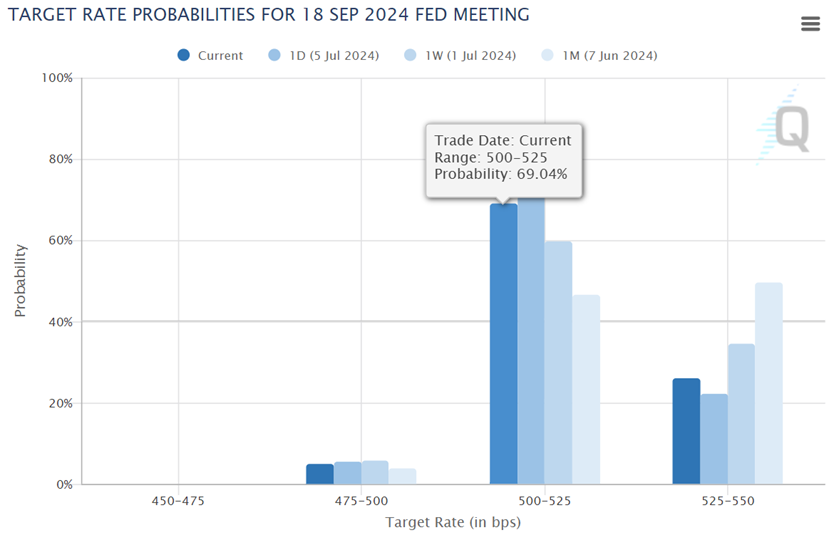

Employment in the private sector is losing steam, indicating a weakening economy, which has caused the probability of an interest rate cut in September to increase from 59.77% at the beginning of the month to 69.04%.

■ What upcoming events could trigger further trades betting on a rate cut?

This week, Federal Reserve Chairman Jerome Powell's semiannual congressional testimony and the highly anticipated U.S. June CPI data may continue to be catalysts for the "rate cut trade."

Fed Chair Powell's Testimony

Federal Reserve Chair Jerome Powell is scheduled to deliver his semiannual report on monetary policy to the Senate Banking Committee on July 9, followed by an appearance before the House Financial Services Committee on July 10. During these sessions, it is anticipated that Republican committee members will challenge him regarding the economic consequences of the inflation experienced over the last four years. Conversely, Democratic members are predicted to advocate for reductions in interest rates to avert a climb in unemployment figures.

Bloomberg analyst Niraj Shah expected Powell likely to strike a dovish tone. He is likely to present a cautious stance, recognizing the strides made in controlling inflation. Furthermore, Powell is expected to raise concerns about the unsustainable fiscal path of the US and stress the critical importance of maintaining the Federal Reserve's autonomy from political pressures, while refraining from making detailed statements on fiscal policies related to taxes and expenditures.

US June CPI report

The upcoming release of June's headline Consumer Price Index (CPI) on July 11 is anticipated to show a modest increase of 0.1%. This slight uptick is largely attributed to a notable seasonally adjusted decrease in gasoline prices. Meanwhile, the monthly core CPI, which excludes volatile food and energy prices, is expected to rise by 0.2%, influenced by softening prices in the used car market and recreational sectors. On an annual basis, the headline CPI is predicted to ease to 3.0% from the 3.3% recorded in May, while the core CPI is projected to hold steady at 3.4%.

This projection for the core CPI suggests a corresponding monthly increase of between 0.1% and 0.2% for the June core PCE price index, which is the Federal Reserve's preferred measure of inflation. The forthcoming data could represent the second consecutive month where the core PCE aligns with the Federal Reserve's inflation target of 2%. Should the inflation report for the following two months, leading up to the September FOMC meeting, continue to reflect this trend, market participants are anticipating that Federal Reserve officials may be poised to implement a rate cut at that time.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

EVELIOBESAS : good.

PAUL BIN ANTHONY : very helpful thanks

102377918 : well