NVDA

NVIDIA

-- 128.910 TSLA

Tesla

-- 440.130 QUBT

Quantum Computing

-- 25.680 MU

Micron Technology

-- 103.900 RGTI

Rigetti Computing

-- 10.6900

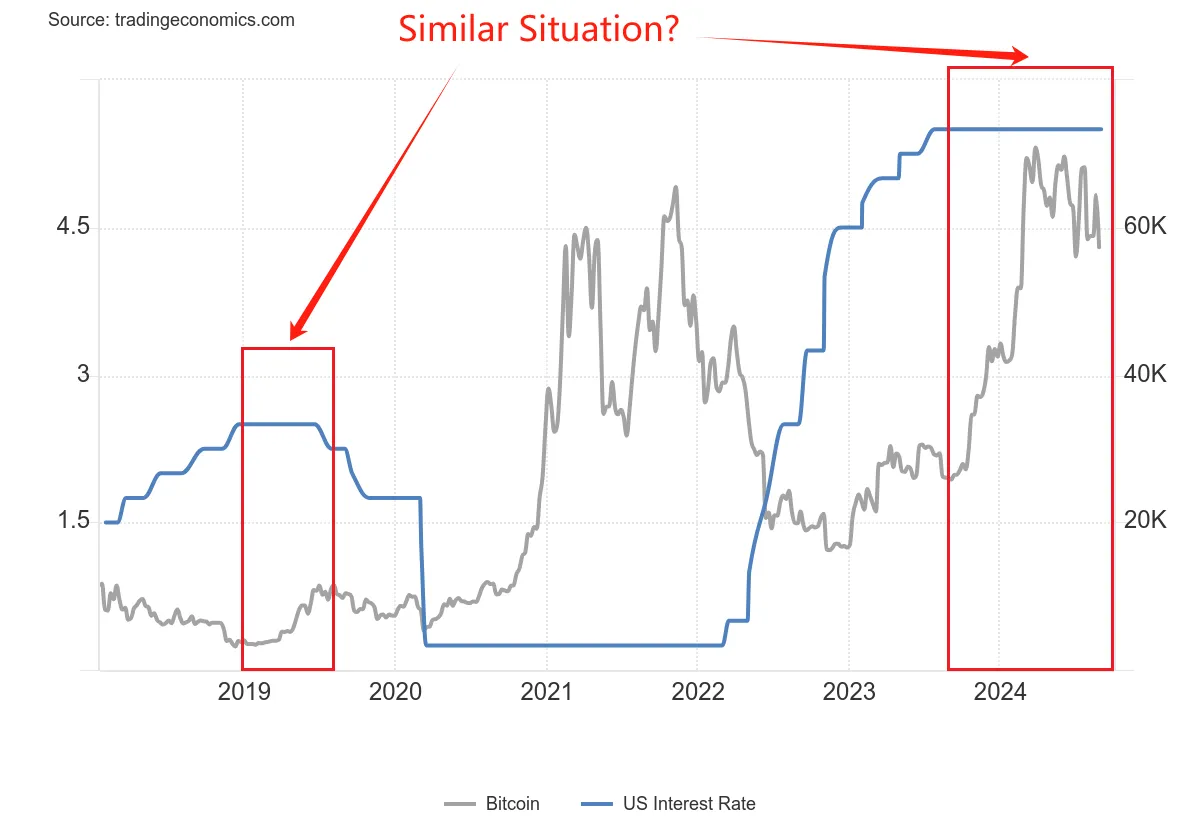

Bitcoin halving refers to the event where the mining rewards for Bitcoin are cut in half, significantly reducing the rate at which new coins are supplied.

Risk Warning: Bitcoin is a high-risk investment and investors are advised to be aware of the risk of investment loss. This article is for reference only and does not constitute investment advice.

Vincent TS :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101681940 : Ggh

SHAHROM NEZAN : Not available in the moomoo app for trading Bitcoin

103165865 : good

Shyang : Why can’t i trade?

SHAHROM NEZAN Shyang : trading app luno

73279472 : i

104671293 DW : May be

104476495 : h

101550592 :

View more comments...