RBC Earnings Preview: HSBC Addition Accretive, Credit Costs and Safe Dividend in the Spotlight

$Royal Bank of Canada (RY.CA)$ is scheduled to announce Q2 earnings results on Thursday, May 30th, before market open. Royal Bank of Canada may show core loan and deposit growth challenges, reflecting weaker macroeconomic conditions. However, the safe and growing dividend of the RBC is one of the features that is attractive to investors.

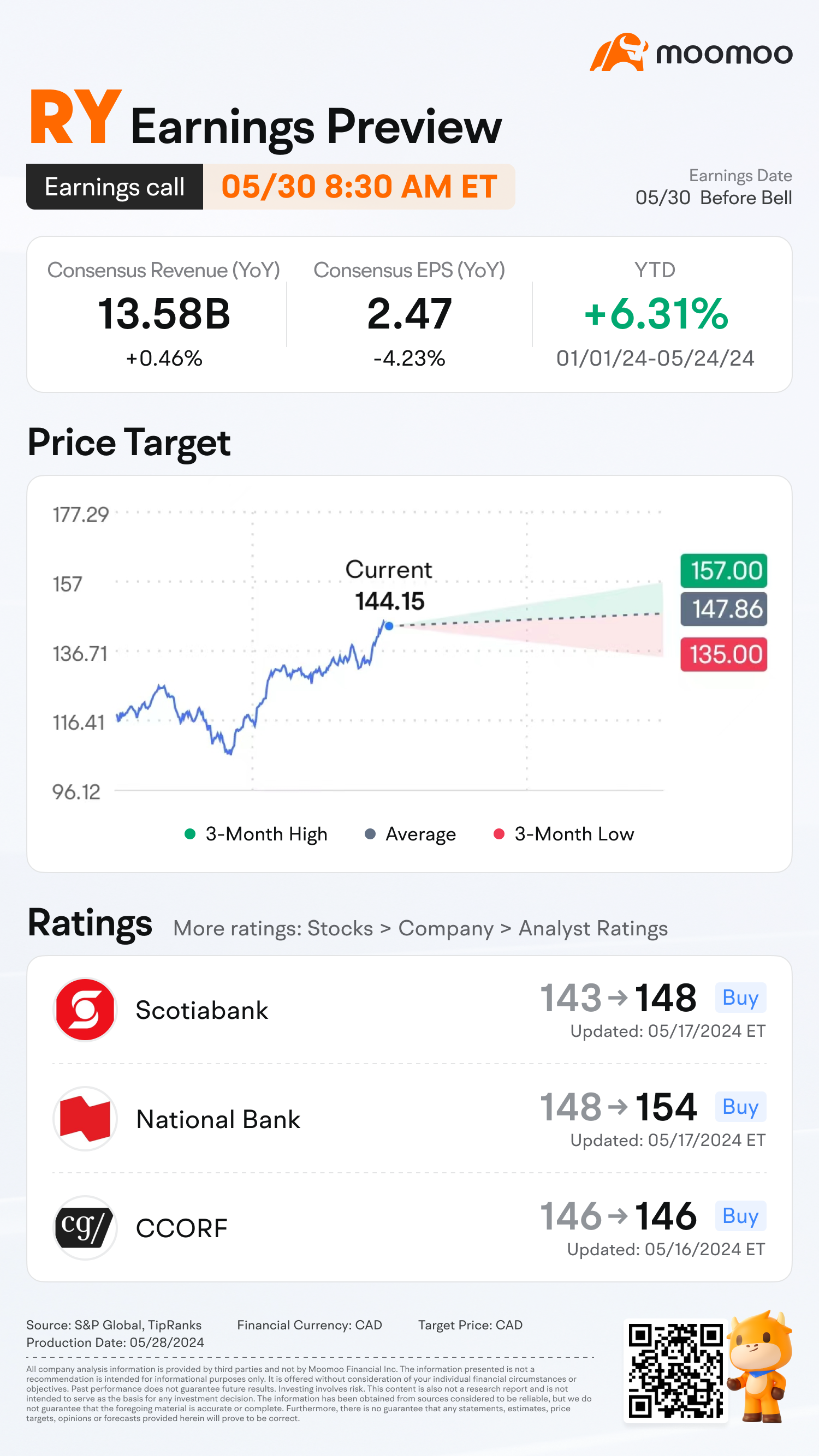

Consensus Estimates

• RBC is expected to post quarterly earnings of C$2.47 per share in its upcoming report, which represents a year-over-year change of -4.23%.

• Revenues are expected to be C$13.58 billion, up 0.46% from the year-ago quarter.

Here are the key points that investors need to focus on:

RBC may show core loan and deposit growth challenges, yet HSBC addition accretive

According to Bloomberg Intelligence, slower growth in Canada's economy has reduced loan gains to single from double digits, as high interest rates don't offer upside to interest margin at RBC's Personal and Commercial (P&C) business, yet the addition of HSBC's Canada operations in March could aid market growth.

The sale of HSBC's Canadian operation is a scarce banking opportunity of that size in the domestic market. It will expand RBC's already leading position, combining the largest and seventh biggest Canadian banking operations will expand RBC's domestic footprint by about 13% in loans (8% in retail, 35% in commercial) and 15% in deposits. Net interest income should expand due to HSBC revenue, and interest margin (NIM) might see a sequential uptick.

RBC's impaired-loan provisions could surpass normalized levels

Royal Bank of Canada's reserves may climb 40% in fiscal 2024, potentially surpassing normalized levels according to Bloomberg. The lender expects its impaired-provisions ratio to be in the range of 30-35 bps. As RBC anticipates weaker economic growth ahead, it may continue building performing reserves through H2. Management noted risks in commercial real estate, yet sees most mortgage vulnerability in 2025-26.

Last week, Canada’s banking regulator warned of a payment shock faced by homeowners who are renewing their mortgages and may be faced with the prospect of their interest payments rising dramatically. The Office of the Superintendent of Financial Institutions warned that 76 per cent of outstanding mortgages as of February are coming up for renewal by the end of 2026, which represents a risk to the banks that hold these mortgages.

RBC supports a safe and growing dividend

Investors often hold Royal Bank of Canada shares as a core holding in their diversified investment portfolios. They expect its dividend to be safe and grow over time. Indeed, RBC stock has a 1-, 3-, 5-, 10-, and 15-year dividend growth rate of approximately 7 to 8%.

As of today, Royal Bank of Canada currently has a 12-month trailing dividend yield of 3.82% and a 12-month forward dividend yield of 3.84%. This suggests an expectation of increased dividend payments over the next 12 months.

In addition, another support for a safe dividend is that its payout ratio is sustainable. Typically, in a normal operating environment, the big Canadian banks, RBC included, maintain a payout ratio of about 50% of earnings. This year, RBC’s payout ratio is estimated to be about 52% of diluted earnings. So, its dividend looks safe.

What do analysts say about RBC?

$National Bank of Canada (NA.CA)$ raised the firm's price target on Royal Bank of Canada to C$154 from C$148 and keeps an Outperform rating on the shares. $Bank of Nova Scotia (BNS.CA)$ also lifted the RBC's price target to C$148 from C$143 and keeps an Outperform rating on the stock.

$Jefferies Financial (JEF.US)$ analyst John Aiken upgraded Royal Bank of Canada to Buy from Hold with a price target of C$157, up from C$136. RBC's acquisition of HSBC Canada provides significant growth and efficiency opportunities. “With no material disruptions emanating from the integration, there are few impediments to outsized growth against its peers," the analyst tells investors in a research note.

Source: Bloomberg, The Fly, The Motley Fool

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73944362 : french