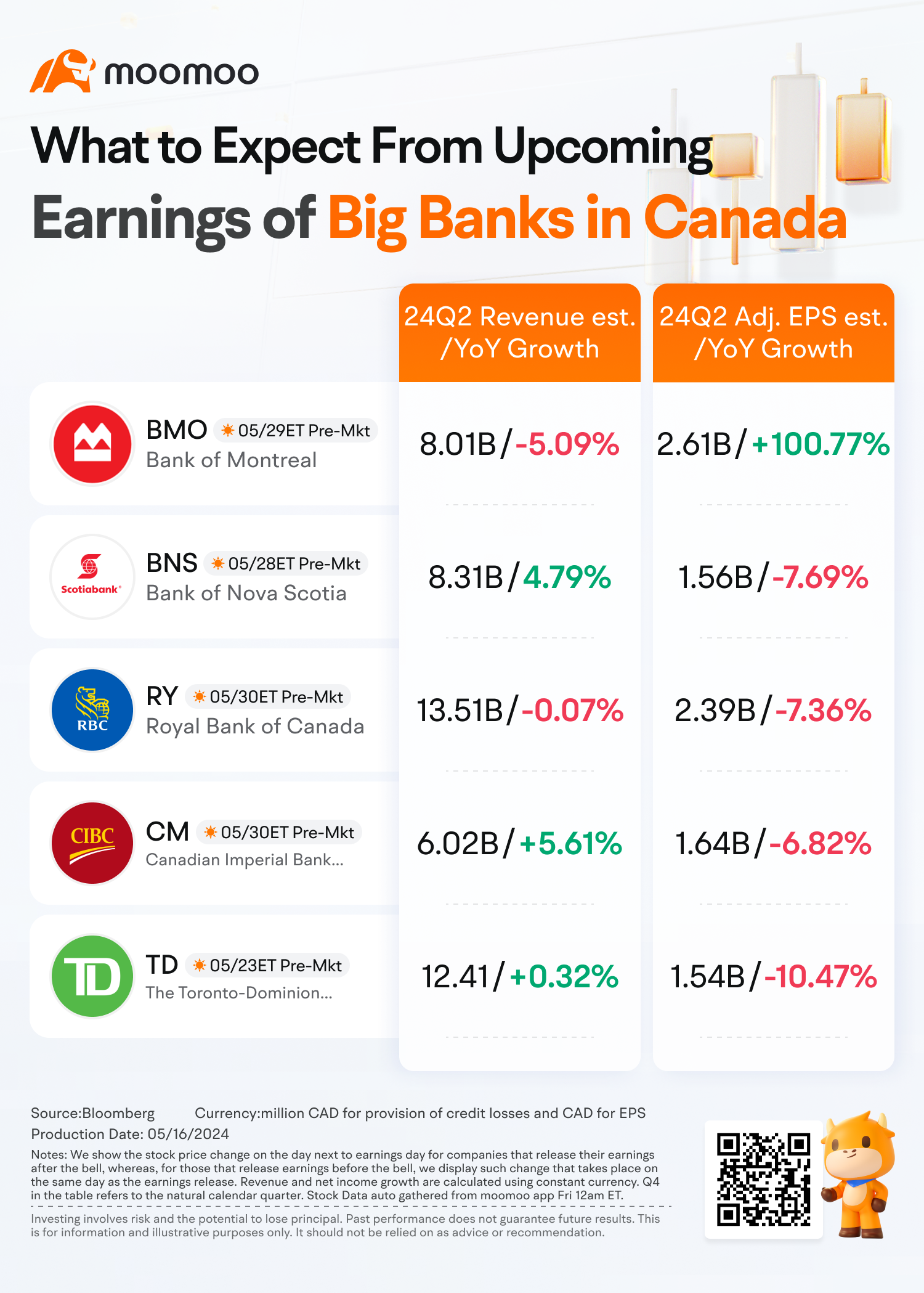

RBC, TD, Scotiabank, BMO, CIBC Earnings Preview: Will Continued High Interest Rates Hit Canada's Banks?

Canada's major banks are about to announce their Q2 financial quarter results. Sustained high interest rates pose challenges to residents' repayment ability. Banks' real estate exposure and credit card risks are the focus of investors' attention. Meanwhile, the recovery in the capital market means that banks' fee income may rebound.

The following are the indicators that investors need to focus on:

The delinquency rate is one of the most important indicators for banks. Mortgage loan and credit card delinquency rates are the top priorities.

According to the Canadian Bankers Association, in March, there was a slight uptick in serious mortgage delinquencies within the covered bond pools of Canadian banks, increasing by 1 basis point compared to the fourth quarter of the previous year. While the majority of these delinquencies remain below the levels seen before the pandemic, BMO experienced a rise of 7 basis points, and RBC saw a 2 basis point increase. On the other hand, CIBC reported a 4 basis point decrease, which can be attributed to the addition of new loans in November. Meanwhile, TD and Scotiabank's delinquency rates in these longer buckets remained roughly unchanged.

Source: Canadian Bankers Association Card-delinquency rates at Canada's top banks are rising as well, as consumers remain debt-burdened and interest rates remain elevated. BMO is at the forefront of the rise with a 65-basis point increase, followed by CIBC at a 44-basis point increase and RBC at 42 basis points. All five major peers have experienced significant increases. Late payments have seen a boost of 40 basis points in March compared to the same period last year.

On average, 10% of Canadian banks' loans go to the commercial real estate sector, with CIBC having the highest share of total loans, accounting for 12%, and National Bank the lowest, accounting for 8%.

In terms of property type, RBC's office real estate accounts for the highest proportion of CRE, reaching 19%, while Scotiabank only accounts for 7%.TD Bank and National Bank have a higher proportion of loans in residential properties.

Regionally, BMO and TD Bank have higher exposure to U.S. CRE than their peers.

In terms of credit card exposures, TD and CIBC's cards as a percentage of retail loans exceed 5%, which means that these two banks are more likely to be negatively impacted by an increase in credit card delinquencies. RBC's cards as a percentage of retail loans are about 4%, while National Bank has the lowest.

The surge in credit card balances at the six biggest Canadian banks may slow down from its current rapid double-digit rate, as rising inflation and increased spending fueled by surplus cash take a toll. Consumers are grappling with the adjustment of mortgage payments, which is restricting their capacity to spend. The general expectation is for credit card balance growth to be around 3-4% for the fiscal year 2024.

Credit card balances have eclipsed 4Q19's pre-pandemic levels, though Scotiabank and TD are laggards, while CIBC's balances benefited from the acquired Costco card portfolio.

A pickup in Canadian real estate sales this year could lead to a recovery in mortgage loan growth. The Canadian Real Estate Association predicts Canadian home sales may rise 10% in 2024,because expectations for lower interest rates and pent-up demand could aid activity after two years of contraction.Purchases are expected to advance 8% in 2025 on easing policy. That could support mortgage-lending volume.

CREA also sees an average home price increase of 5% in 2024 and 7% in 2025, while its index was down 4% in 2023.

Loans and assets are at variable rates in Canada and can be repriced at higher levels. The net interest margin of the banking industry increased slightly in the first quarter; the postponed interest rate cut expectations mean that NIM may remain stable.

However, the management of the duration gap between assets and liabilities is crucial. A mismatch, where the duration of assets significantly exceeds that of liabilities, can lead to NIM compression if the cost of funding increases faster than the income from long-term assets.

The capital adequacy ratios of major banks are higher than regulatory requirements and are expected to remain stable.

As of the first fiscal quarter ending in January, TD Bank's Common Equity Tier 1 (CET1) capital ratio stood at 13.9%, which is above the average for its peers.

Royal Bank of Canada's proposed all-cash purchase of HSBC Bank Canada for C$13.5 billion was finalized in March. This acquisition is anticipated to reduce RBC's CET1 ratio by approximately 250 basis points. Following the completion of the transaction, the bank forecasts its CET1 ratio to be around 12.5%.

Canadian banks' fee income is expected to benefit from recovering capital markets. Higher assets under management and slightly improving flow trends should support near-term fee revenue growth for wealth and asset management divisions. Demand for equity ETFs outpaced money-market funds in the first quarter. Year-to-date, ETF demand has been strong, with a 15% annualized rate of net issuance.

Overall, high interest rates have mixed effects on Canadian banks. A recovery in mortgage lending and active capital markets may partially offset the impact of rising delinquency rates. Meanwhile, the banking sector is at cheaper levels after several years of retreat.

In addition to direct investment in bank stocks, investors can also choose bank ETFs.

BMO Equal Weight Bank Index ETF (TSX:ZEB) has net assets of approximately CAD 3.88 billion and a management fee of 0.28%. Its largest holding is TD Bank, accounting for about 17.3% of the fund's assets. RBC, the smallest weighted fund, accounts for about 16% of the fund's assets.

Another option is the BMO Covered Call Canadian Banks ETF (TSX:ZWB). Due to the use of call options, the fund currently has an annualized dividend yield of about 7.5%, but it also has a higher management fee (0.71%). ZWB has a net asset value of approximately C$2.8 billion.

The iShares Canadian Financial Monthly Income ETF (TSX:FIE) is a diversified allocation ETF.Specifically, approximately 37% of the ETF's funds are allocated to Canada's six largest bank stocks, 19% to the preferred stocks of the iShares S&P/TSX Canadian Preferred Share Index ETF, and 10% to corporate bonds of the iShares Core Canadian Corporate Bond Index ETF.

Risk Disclosure: Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors.

Source: Bloomberg, CREA, Canadian Bankers Association

By Moomoo North America Team Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 24

24