Ready for Fed Rate Cuts? Biotech's Potential to Watch

The Federal Reserve appears poised to cut interest rates later this year. While the broader stock market might breathe a sigh of relief, certain sectors could be more significantly impacted than others. Biotechnology could be one of those sectors - at least, that's what Morgan Stanley believes.

In 2024, biotech stocks had a slow start, with the S&P Biotechnology Select Industry Index returning just under 4% in the first six months, compared to a 15% return for the S&P 500 Index.

However, optimism may be returning as inflation continues to decline and the likelihood of a Fed rate cut in September increases. In fact, since July 11, when the U.S. Consumer Price Index fell to a 3% annual rate for the first time in a year, the S&P Biotechnology Index has outperformed the broader market.

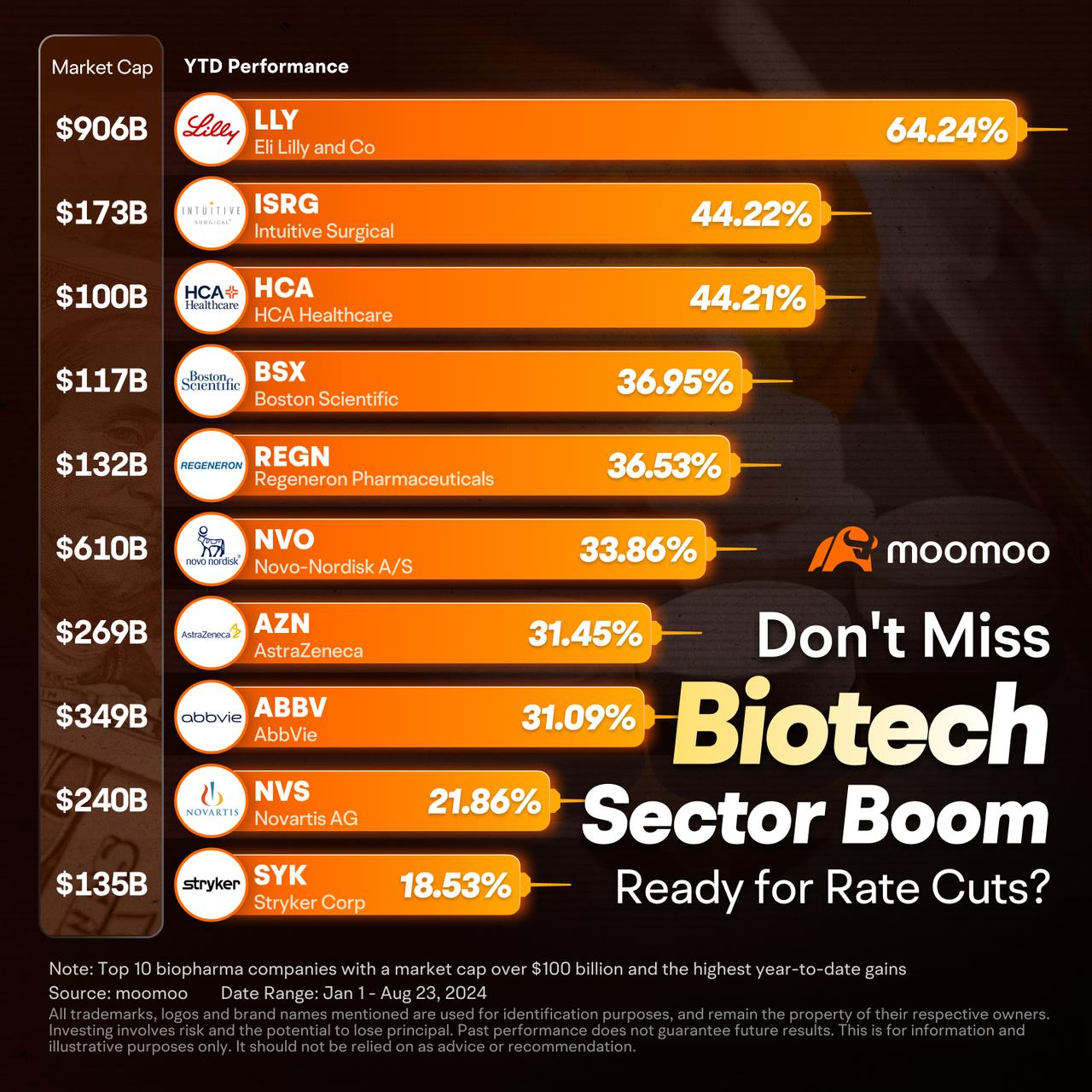

Along with the "Mag 7," biotech stocks have been quietly gaining ground this year. Weight loss drug leader $Eli Lilly and Co (LLY.US)$, robotic-assisted surgery leader $Intuitive Surgical (ISRG.US)$, healthcare provider $HCA Healthcare (HCA.US)$, biotech engineering firm $Boston Scientific (BSX.US)$, antibody pioneers $Regeneron Pharmaceuticals (REGN.US)$, etc., all have hit record highs this year, with gains ranging from 18% to 64%, and the highest increase even surpassing other tech giants except for Nvidia.

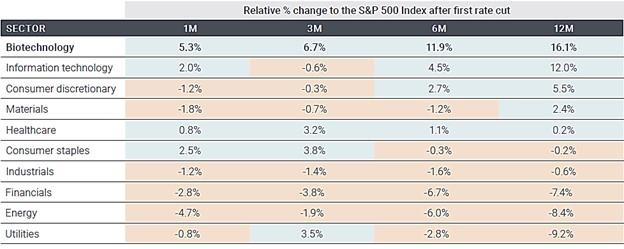

This difference in returns has a precedent. The biotech sector we posted gains in the one-month and six-month periods following the first rate cut in seven out of the last eight rate-cut cycles, according to an analysis by Redburn Atlantic. Twelve months later, the sector outperformed the S&P 500 by an average of 16%.

Why is biotech on the focus?

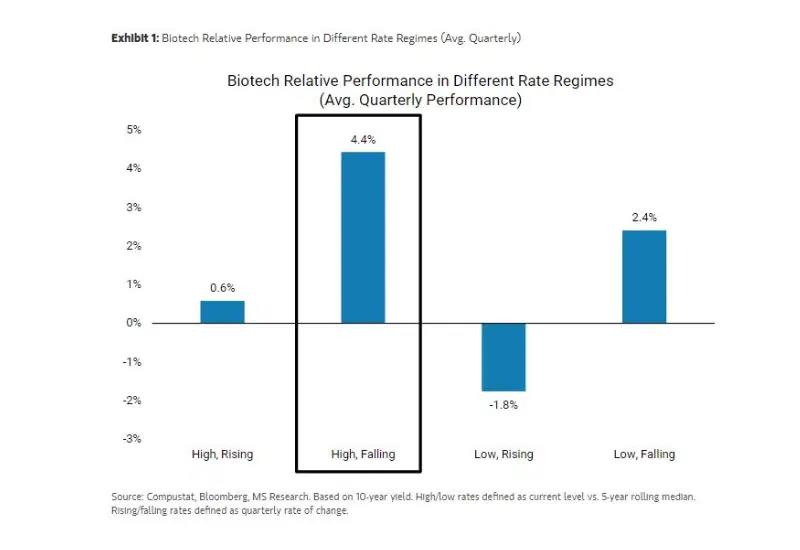

When interest rates decrease, the biotech sector - comprising companies at the forefront of medical technology - tends to outperform the broader market, especially when rates are still high but starting to decline. This is the scenario we're witnessing today.

Low valuations have helped support positive returns. Biotech valuations were depressed due to a three-year downturn that ended in late 2023. As a result, by mid-July, nearly 130 biotech companies had negative enterprise values - indicating that the pricing of these companies suggested any research and development (R&D) would only reduce, rather than add to, their value. While this number is down from a peak of 232 last year, it remains significantly higher than pre-recession levels.

Here's probably why this happens:

1. Since biotech companies typically focus on developing complex concepts and products that generate revenue over the long term, their cash flows are often far in the future. Remember, to calculate the present value of these future earnings, you discount them over time using the interest rate as the discount rate. The further into the future these cash flows are, the more significant the impact of the discount rate. Therefore, when interest rates decrease, the present value of these cash flows can increase substantially.

2. Lower interest rates reduce companies' borrowing costs. In the biotech industry, this makes it easier to finance the development of new products. For large companies looking to make acquisitions, this also means they are more likely to afford smaller biotech firms, even at higher prices.

3. Biotech companies tend to focus on the long-term development of unique, high-value treatments and therapies rather than on boosting short-term sales or profit margins. This means they are less affected by the typical reasons for interest rate cuts, such as reduced pricing power.

How should you allocate your assets with Fed rate cuts on the horizon?

Source: Janus Henderson, Redburn Atlantic

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104026079 : Good info, please post sector wise impacts on Fed Rate Cuts