Real Estate Stocks Surge Tuesday After Better-Than-Expected CPI Report

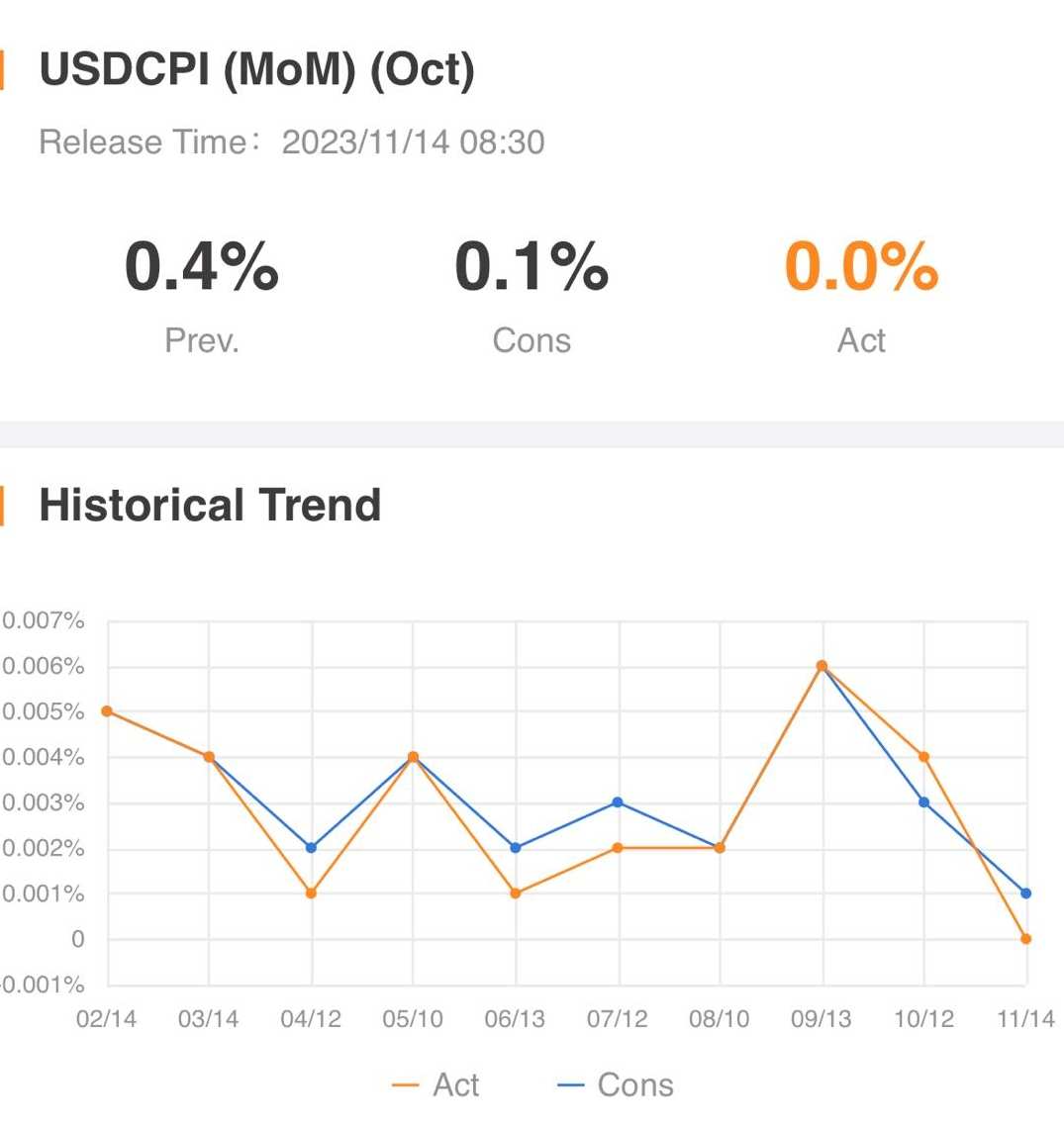

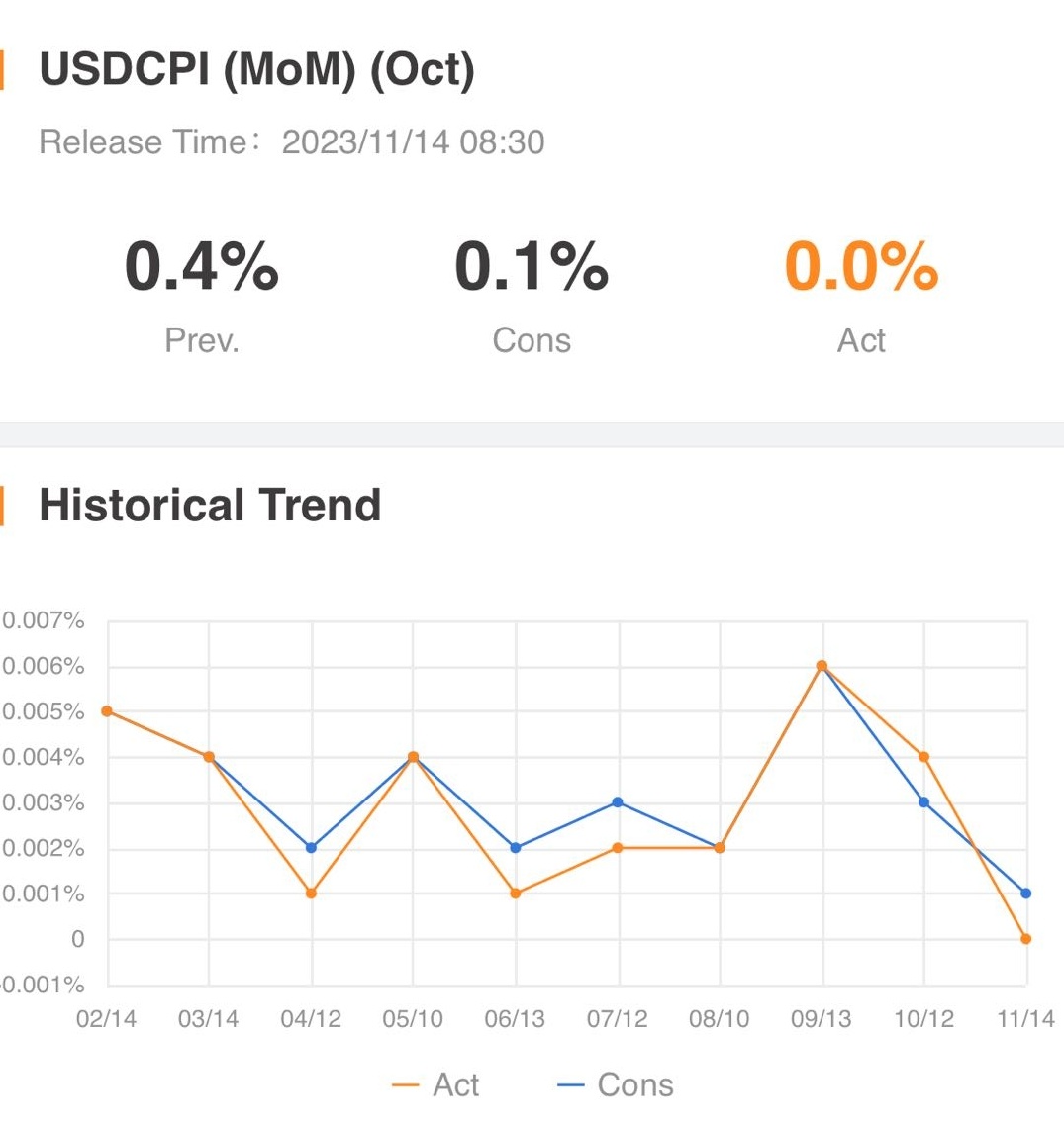

Shares of real-estate names are trading higher Tuesday following better-than-expected inflation readings, with core consumer prices falling to a fresh two-year low.

The U.S.'s largest homebuilder, $D.R. Horton (DHI.US)$, rose 6.4%, $KB Home (KBH.US)$ gained 7.1%, and $Toll Brothers (TOL.US)$ increased 8.2%.

Shares of online real-estate platforms are also on the rise. $Opendoor Technologies (OPEN.US)$ rocketed over 15% on Tuesday, while shares of $Zillow-C (Z.US)$ jumped nearly 11%, shares of $Redfin (RDFN.US)$ rose almost 14%, and shares of $RE/MAX Holdings (RMAX.US)$ increased roughly 10%.

Mortgage rates, the main concern of real estate firms, might have passed the peak. The market now expects the Federal Reserve to cut rates even sooner.

The CME Group's FedWatch is now pricing in no chance that the Fed will lift the benchmark federal funds rate by a quarter-point, to between 5.5% and 5.75%, when it meets next month in Washington. The odds of a cut in May rose to 47.05% from 30.64 a day ago.

The real estate industry was buoyed by the news. "Calmer inflation means lower mortgage rates, eventually," Lawrence Yun, NAR's chief economist, said in a statement to MPA.

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment