Reap the rewards: Your complete guide to master earnings season

The second earnings season will officially kick off release on July 12. As usual, bank stocks will lead the earnings season— $JPMorgan (JPM.US)$, $Wells Fargo & Co (WFC.US)$, $Citigroup (C.US)$,and $Bank of New York Mellon (BK.US)$will report their earnings later.

Prior to this, the $S&P 500 Index (.SPX.US)$ has reached new highs for the 34th time this year since hitting its low last October, driven by the AI boom and bets on Federal Reserve rate cuts. Therefore, it makes valuations more expensive, with the benchmark P/E ratio approaching 22, compared to a long-term average P/E ratio of 16.

According to some Wall Street strategists, it is said that U.S. companies need to achieve strong growth in the quarterly earnings season to continue the record-breaking rally in the U.S. stock market.

How to invest during earning season on moomoo?

Before investing: Gain insights into earnings reports overview

For new mooers we've summarized the most basic "Four-Step Method" courses to understand financial reports, which are completely friendly and stress-free for new mooers.

Click to view step 1 >>> Introduction to earnings report

Stock selection: Pick a good company

After understanding the basics of financial reports, how can you determine whether a company is good?

With so many indicators like net earnings per share, ROE, EPS and ROA, which ones should you focus on?

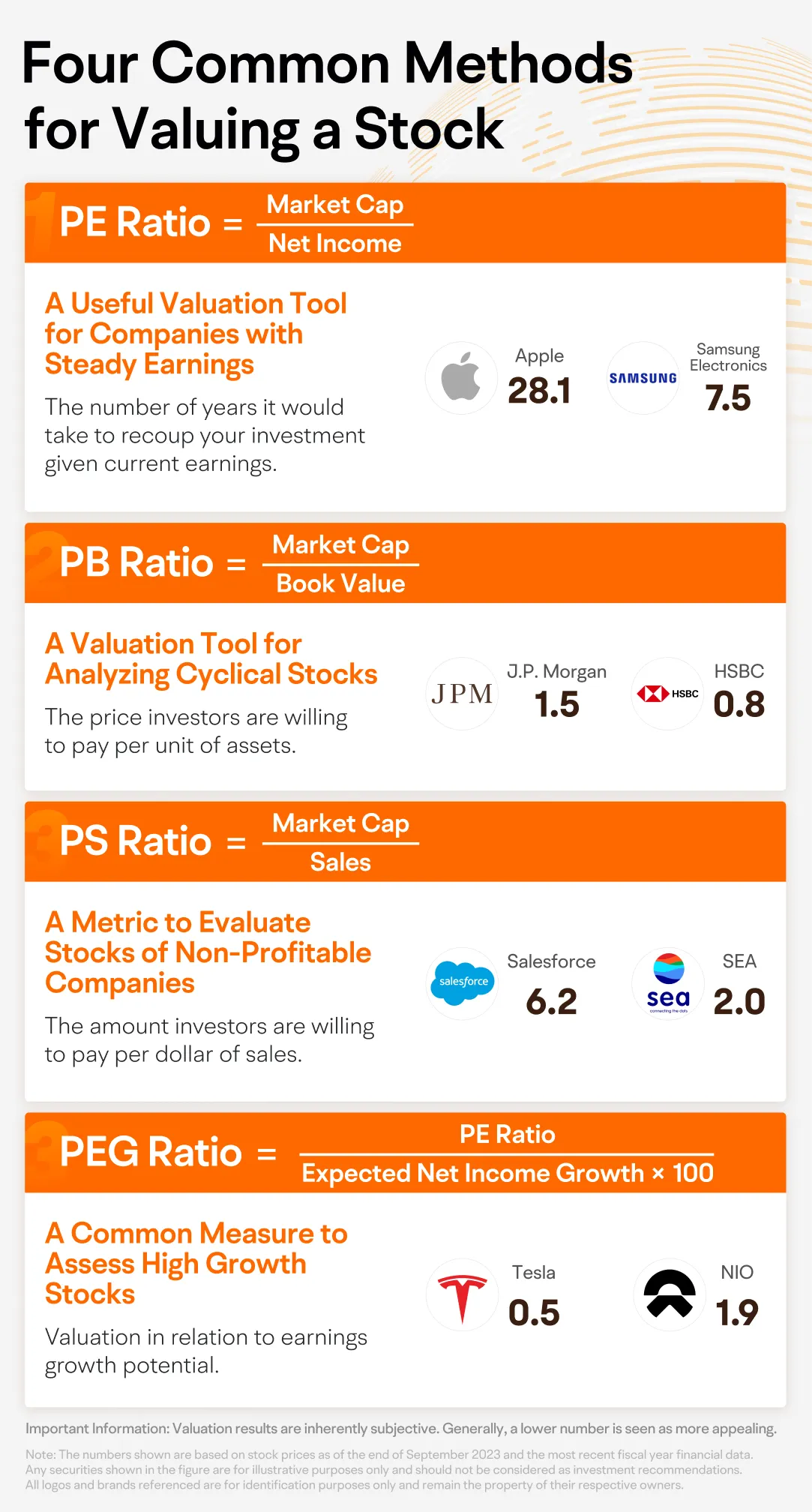

You may find the answers with straightforward infographics! For example, mooers can learn to value a stock in following steps:

Click to view step 2 >>> Decode earnings with 12 infographics

While these financial metrics are indeed important, before delving into them, we need to assess whether the company is worth spending significant time researching.

Therefore, understanding the company's operational status, guarding against potential bankruptcies, and getting a clear picture of the company's "fundamentals" are crucial.

No worries! You are expected to dive deeply into different strategies to pick out good companies.

Click to view step 3 >>> Understand the income statement

Finding the timing: uncover potential trading points

Don't know how to identify stock price trends? Worried about buying high and selling low? How can you seize investment opportunities during the earnings season?

Moomoo emphasizes key metrics from the company's business model and industry to provide a more comprehensive perspective for improving the accuracy of financial forecast reports, such as $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$, $Apple (AAPL.US)$, $PDD Holdings (PDD.US)$, $Meta Platforms (META.US)$,and more.

Take the $JPMorgan (JPM.US)$as an example, we dive into its three focal points: earnings stability, risk-based capital metrics, and shareholder returns. These areas may shed light on JPMorgan's capacity for sustained market leadership and investor value creation.

Click to view step 4 >>> Deciphering earnings of big names

For Our Premium Mooers

At Moomoo Learn, we offer exclusive high-quality courses designed to help you capitalize on trading opportunities. Our Tuesday course, Technical Tracking, provides insights on trending stocks, while our Thursday course, Opportunity Mining, focuses on recent investment opportunities.

As a premium user, you'll also have access to our exclusive chat groups where professional analysts are available to answer your questions. In the chat group with our special TA @Invest With Cici you'll get expert insights and guidance to help refine your investment strategy and make informed trading decisions.

If you're interested in these premium services, please add @Invest With Cici as your friend and join our community of successful traders.

The 24Q2 earnings season is coming, what trading strategies will you choose this earnings season? Mooers are welcome to share your trading results and insights during the earnings season.

Post your earnings season gains and trading insights in the comments section, here are some questions to consider when sharing your insights:

· What are your trading strategies this earnings season?

· How do you determine your entry and exit points?

· What investment portfolio have you deployed this earnings season?

By participating, you have a chance to win generous points rewards!

Post and Get Rewards: The first 20 mooers to share their trading results (entry/exit points, portfolio composition, profit/loss, any of these) will receive 20 points each! ![]()

Popularity Sharing Award: Select the top 3 users with the highest interaction who have shared content with real transaction screenshots, a minimum of 100 words, and at least 20 interactions. Each will be rewarded with 66 points! ![]()

Activity Period

From July 12 to July 19, 2024.

Notes

· Each user can participate unlimited times; however, the same user/content can only win once.

· Content must be original, and trading results must be genuine and from moomoo. Any non-original or fake content will be disqualified.

· Users acknowledge and agree that the organizer may edit, reuse, transmit, transfer, and publish the user's nickname, avatar, moomoo ID, and posted content (including text and images) for profit or non-profit purposes in any media for publication, promotion, or exhibition during this activity.

· Activity rewards will be distributed within 20 working days after the end of the activity. If you have any questions, please contact @Moomoo learn.

· Moomoo reserves the final interpretation right of the topic.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Invest With Cici : Hiii my all mates, cici is here.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Are you ready for this earnings season? What's your strategy? Come and join us!

Are you ready for this earnings season? What's your strategy? Come and join us!

Wonder : under the following circumstances:

1. px direction is uncertain

2. even if earnings beat estimates but forward guidance is lacking

3. earnings must beat super high bar

perhaps deploying a straddle strategy will work

Max The Water Blower : Bursa has a rule, where for every quarter ending, QR from companies must be announced within 2 months after quarter ending, this opens a lot of opportunities to educated guess what is the most likely result of the QR from the price movement within this period of time.

$HEGROUP (0296.MY)$ has been catching the trend of Data Center, with it's PE of 28, ROE of 19 and PB of 5.54,it catches a lot of market attention and it keeps up trending since it's IPO listed.

During the recent adjustments, I noticed the opportunity has opened for me to enter. I see a few signs here:

1) down trending with MACD in red zone;

2) strong support at 0.665 queue volume;

3) total turnover is relatively low;

and most importantly, it is within 2 weeks after QR closing, where most likely insiders will know the results, because usually it takes the account department to conclude their monthly account within 2 weeks after month end.

If my above signals are correct, and the QR is a good result, I look forward for a major uptrend next week!

102362254 : I've learned to use options to protect against volatility after earnings and to target stocks that consistently deliver strong earnings surprises. This approach seems to be effective for me so far

ooi cm : look for FPE

NewtoUS : continue to DCA and hold for long term on the companies i believe in

PAUL BIN ANTHONY : find the best with this tq God bless

Amen

Amen

103132692 : Hai

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ZnWC : Great sharing![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...