NVIDIA QUARTERLY REPORT 📑 GOOD BUY or GOODBYE⁉️🤔 - DOCUMENTATION 📄 BEATS SPECULATION 🧐 AND CONVERSATION 🗣

$NVIDIA (NVDA.US)$ - the stock everybody has an OPINION on 🗣

DOCUMENTATION 📄 BEATS SPECULATION 🧐 AND CONVERSATION 🗣

Pullbacks corrections retracements are normal - Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

.

Most People Don’t Know This About $NVIDIA (NVDA.US)$

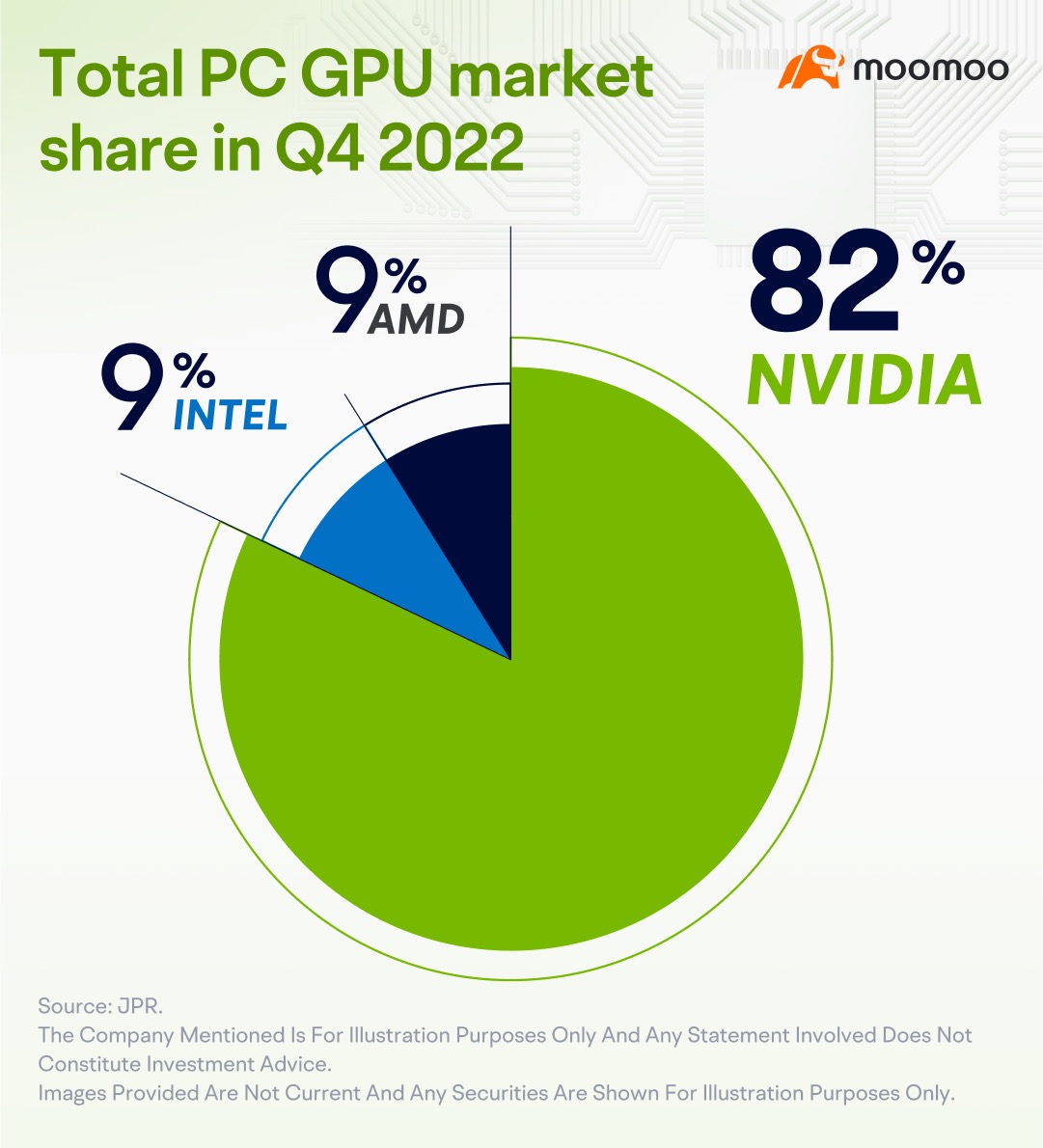

Nvidia has never been beaten by high end graphics in computer gaming. We’re talking since 1999 25 years‼️ no company not AMD or any beat nvidia in high end gaming. What do you think that means⁉️

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years⁉️ That tells you something…

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years⁉️ That tells you something…

.

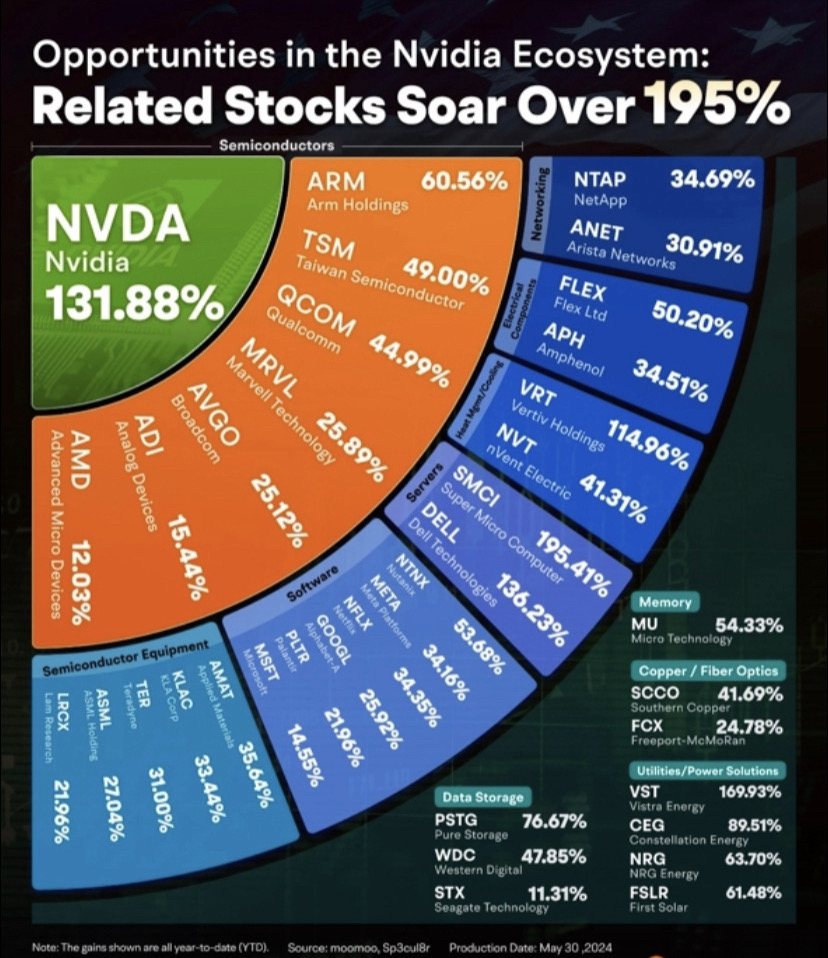

$NVIDIA (NVDA.US)$ Owns 4 Stocks — One Is Doing Even Better Than It Is

Nvidia owns stakes in four U.S.-listed stocks — Arm Holdings (ARM), Recursion Pharmaceuticals (RXRX), SoundHound AI (SOUN) and Serve Robotics (SERV) — says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge.

One of these positions is up even more than shares of Nvidia.

Shares of SoundHound AI — a maker of AI chat systems — has gained 131.8% so far this year. That's marginally better than the AI king's own shares — astonishingly up more than 130%.

Nvidia owns stakes in four U.S.-listed stocks — Arm Holdings (ARM), Recursion Pharmaceuticals (RXRX), SoundHound AI (SOUN) and Serve Robotics (SERV) — says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge.

One of these positions is up even more than shares of Nvidia.

Shares of SoundHound AI — a maker of AI chat systems — has gained 131.8% so far this year. That's marginally better than the AI king's own shares — astonishingly up more than 130%.

https://www.investors.com/etfs-and-funds/sectors/sp500-nvidia-owns-4-stocks-one-is-doing-even-better-than-it-is/#:~:text=Nvidia%20owns%20stakes%20in%20four,more%20than%20shares%20of%20Nvidia

.

☝🏽 This stock, at the current price, fillowing the EPS trend and demand, will likely to get a PE ratio of 32 next year, so no reason to worry... At 170 next year, look for EPS projection again then decide whether to sell if at all. Also pay attention to macroeconomy, when GDP rate gets low and jobless/debt explode, people can exit the market…

.

What’s new⁉️

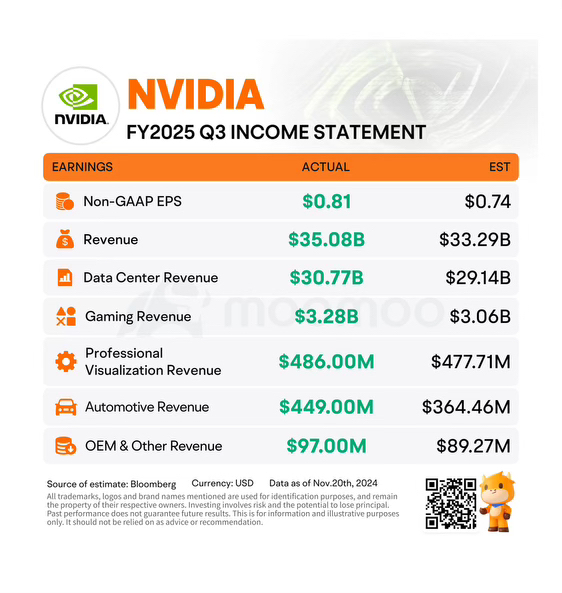

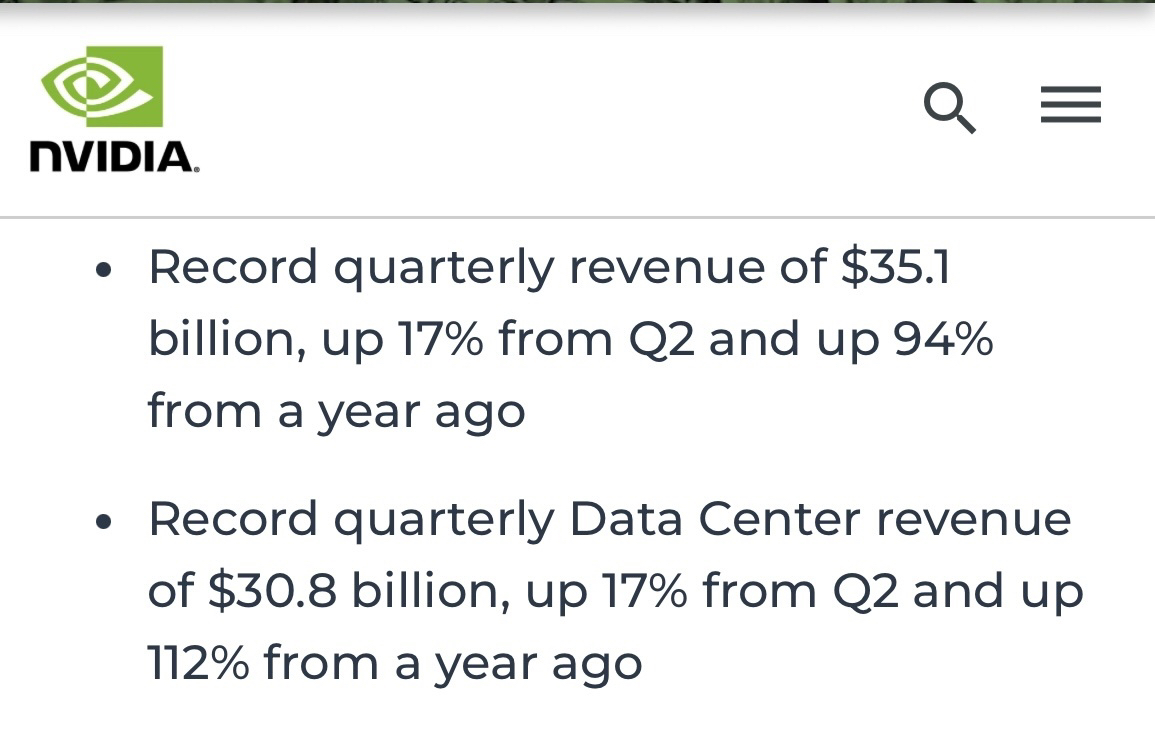

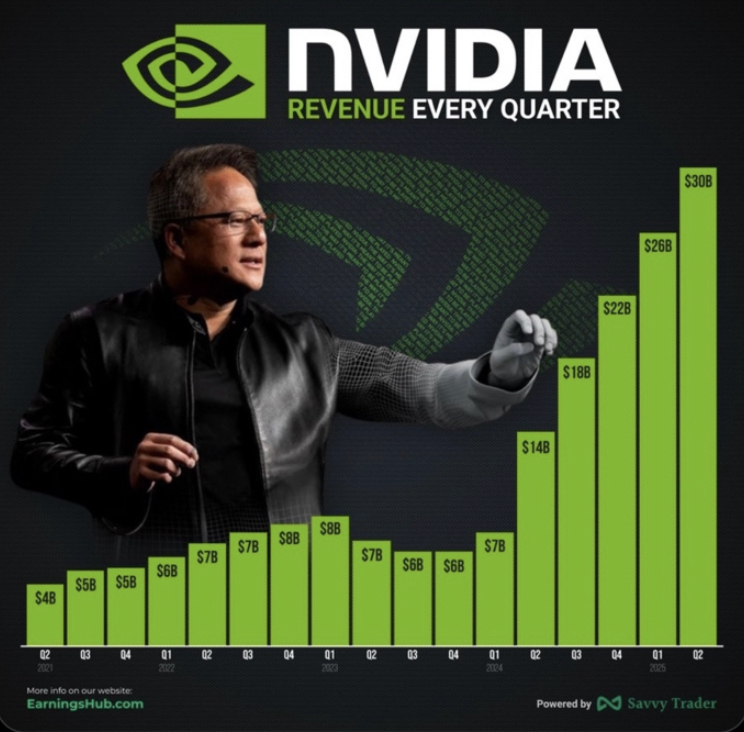

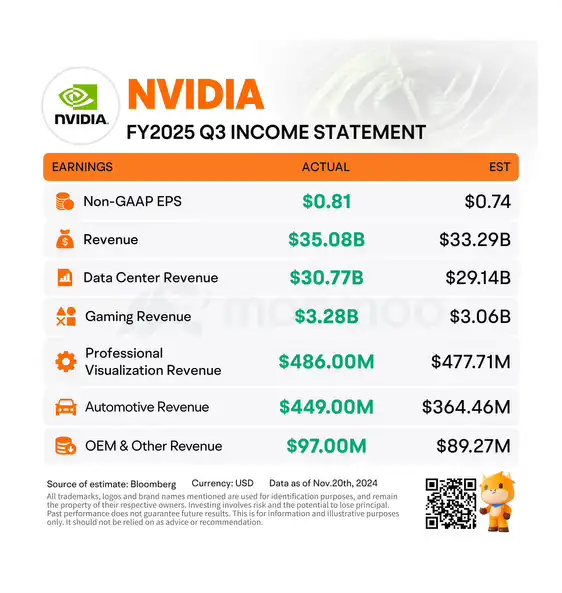

On Wednesday, November 20, 2024, Nvidia surpassed expectations in its third-quarter earnings report, demonstrating robust growth driven by persistent high demand for its advanced artificial intelligence (AI) chips.

The tech giant expects fourth-quarter sales to be around $37.5 billion, give or take 2%, which is higher than the $37.08 billion forecasted by analysts surveyed by LSEG. This projection indicates a year-over-year growth of about 70%, a significant figure, though it marks a slowdown from the remarkable 265% growth seen in the same period last year.

Nvidia’s stock underwent a brief turbulence on Thursday, initially plunging more than 3% before rebounding to close with a modest 0.53% gain. While the exact catalyst for this temporary downturn remains elusive, it likely stems from the lofty expectations surrounding this AI powerhouse.

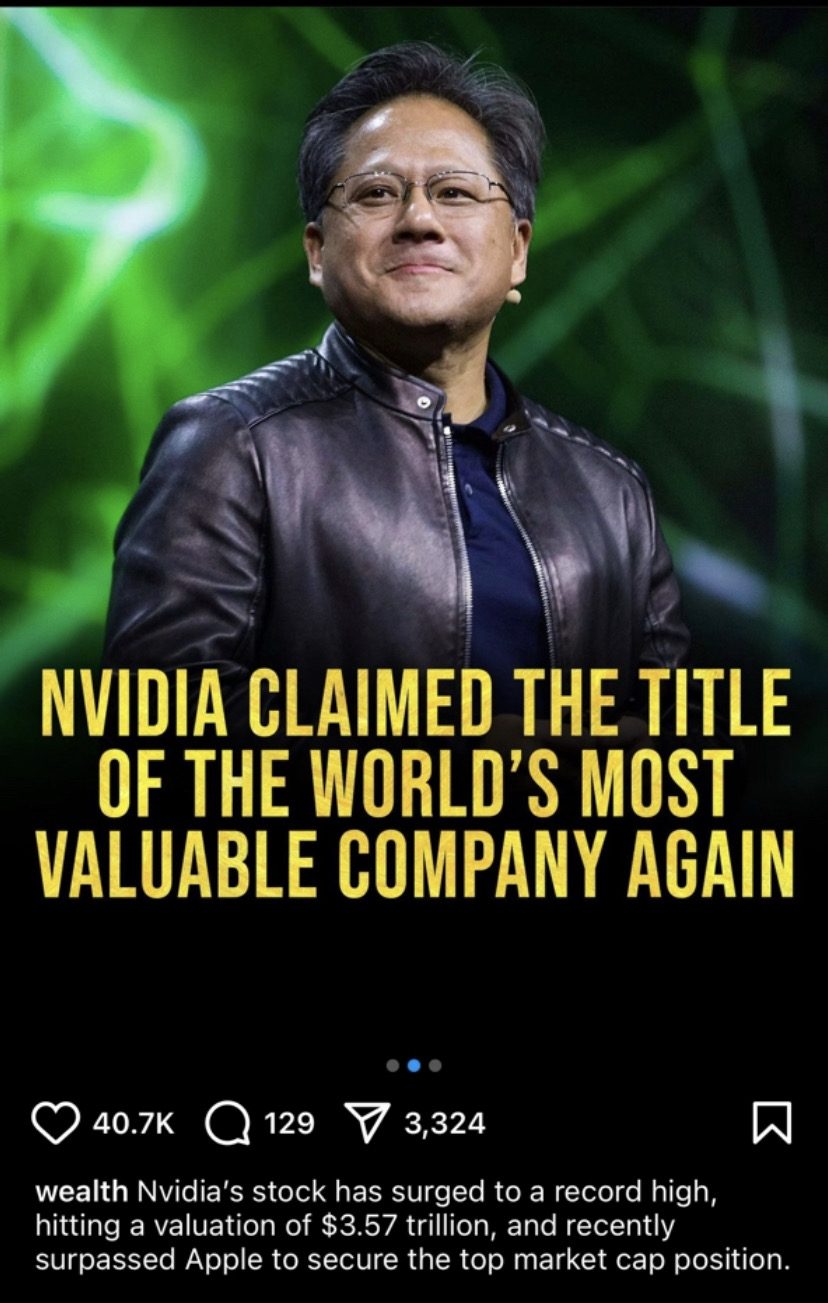

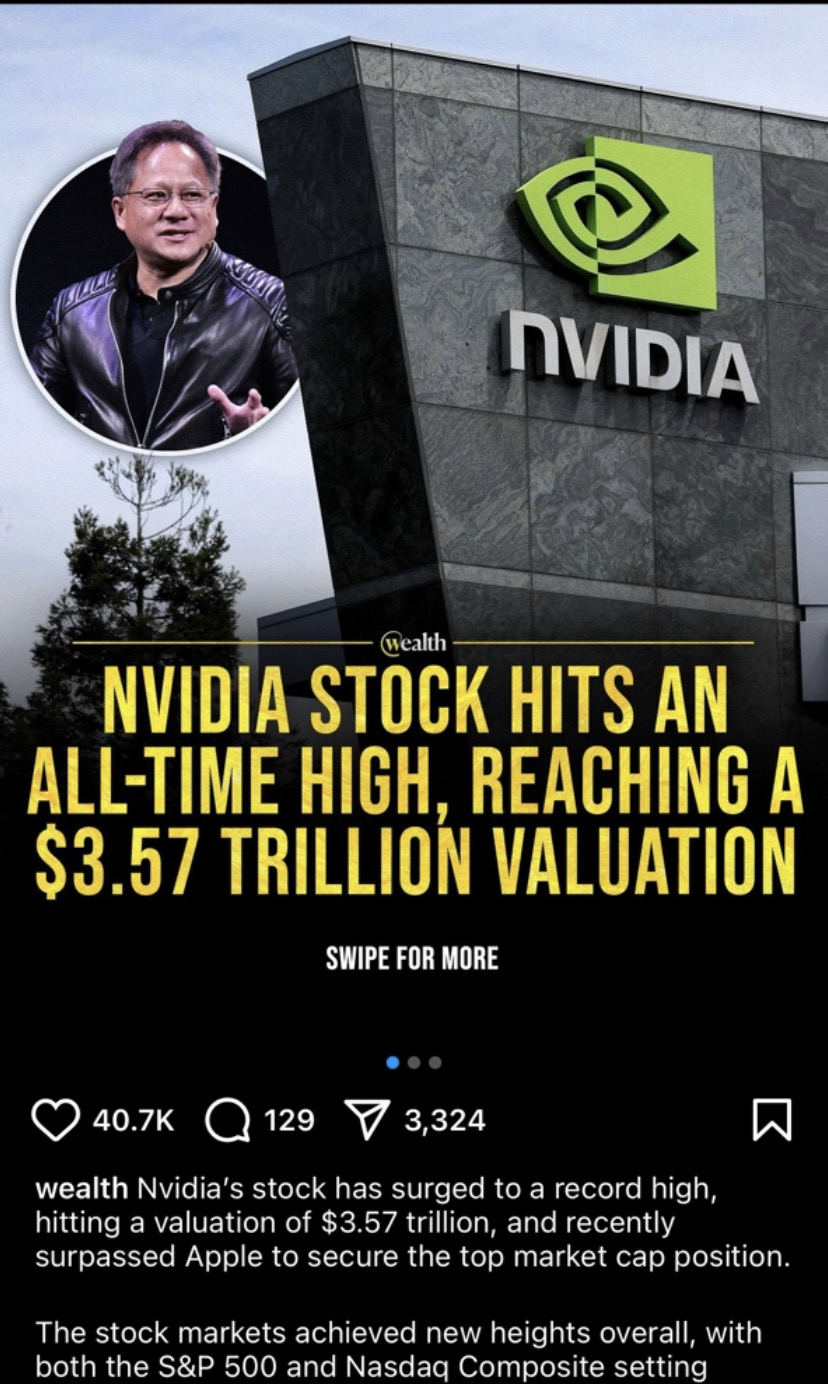

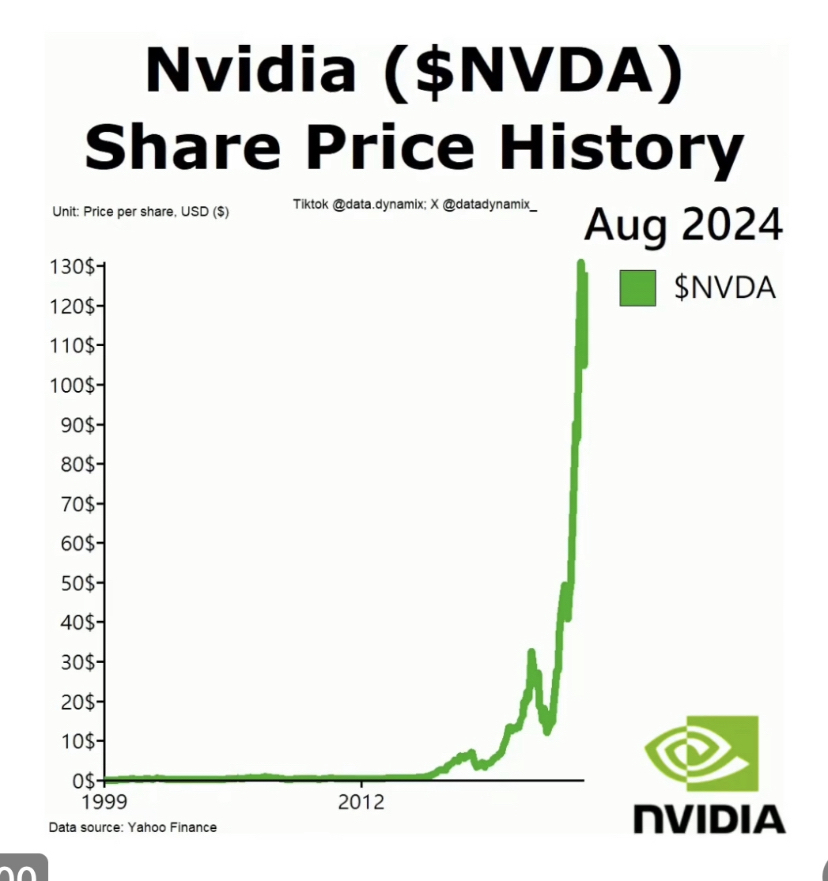

Nvidia has emerged as the primary beneficiary of the ongoing AI revolution. Its shares have nearly tripled in value throughout 2024, catapulting the company to become the most valuable publicly traded entity globally.

On Wednesday, November 20, 2024, Nvidia surpassed expectations in its third-quarter earnings report, demonstrating robust growth driven by persistent high demand for its advanced artificial intelligence (AI) chips.

The tech giant expects fourth-quarter sales to be around $37.5 billion, give or take 2%, which is higher than the $37.08 billion forecasted by analysts surveyed by LSEG. This projection indicates a year-over-year growth of about 70%, a significant figure, though it marks a slowdown from the remarkable 265% growth seen in the same period last year.

Nvidia’s stock underwent a brief turbulence on Thursday, initially plunging more than 3% before rebounding to close with a modest 0.53% gain. While the exact catalyst for this temporary downturn remains elusive, it likely stems from the lofty expectations surrounding this AI powerhouse.

Nvidia has emerged as the primary beneficiary of the ongoing AI revolution. Its shares have nearly tripled in value throughout 2024, catapulting the company to become the most valuable publicly traded entity globally.

$Goldman Sachs (GS.US)$ Toshiya Hari on Nvidia’s earnings: “Nvidia’s FY 3Q results exceeded expectations. We see strong demand for Blackwell, continued Hopper shipments through 2025, and supply constraints as the main challenge. We maintain a Buy rating on NVDA, which remains on the Americas Conviction List.”

Goldman Sachs analysts project a 13% upside potential for Nvidia over the next year, with an average price target of $165.18. This positive outlook reflects broader market sentiment. According to moomoo data, NVDA stock has a Strong Buy consensus rating, supported by 40 Buy recommendations compared to just one Hold.

Nvidia’s stock (NVDA) is exhibiting a robust uptrend, navigating within a well-defined ascending channel over recent months, as evidenced by the daily chart. The share price has recently approached the lower boundary of the established channel, which may suggest a temporary shift in market sentiment. While this movement could be interpreted as short-term bearish pressure, it’s important to note that such fluctuations are common within broader trends. At this juncture, the overall uptrend and the structure of the ascending channel appear to remain in place, though investors should continue to monitor future price action and relevant market factors for any significant changes.

● NVDA’s moving averages (MAs) are displaying a bullish configuration, with the shorter-term MAs positioned above their longer-term counterparts. This alignment is considered a robust indicator of positive market sentiment, suggesting sustained upward momentum for the stock.

● The MACD indicator has recently exhibited a bearish crossover while remaining above the zero line. This technical formation suggests a potential short-term pullback or consolidation phase, despite the overall bullish trend.

● A morning star pattern has materialized amidst a temporary price retracement, manifesting as a three-candlestick bullish reversal formation accompanied by heightened market volatility. This important candlestick pattern might signal a return of positive momentum, suggesting the stock’s upward movement might resume soon.

● A potential support level to watch has emerged around $131, with aligns with the previous resistance high set on August 26. This price point is significant as it marks where the stock broke through former resistance, leading to new all-time highs.

In conclusion, although NVDA has experienced some short-term selling pressure, its overall trend and established price channel seem to be holding steady. The stock reached a new record high after its third-quarter results, despite increased volatility. This behavior may reflect a typical market reaction, with some investors opting to take profits after recent gains. Such actions can often result in periods of price stabilization.

This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve.

All investment involves risk, including the potential loss of principal, and there can be no guarantee that any investment strategy will be successful.

Goldman Sachs analysts project a 13% upside potential for Nvidia over the next year, with an average price target of $165.18. This positive outlook reflects broader market sentiment. According to moomoo data, NVDA stock has a Strong Buy consensus rating, supported by 40 Buy recommendations compared to just one Hold.

Nvidia’s stock (NVDA) is exhibiting a robust uptrend, navigating within a well-defined ascending channel over recent months, as evidenced by the daily chart. The share price has recently approached the lower boundary of the established channel, which may suggest a temporary shift in market sentiment. While this movement could be interpreted as short-term bearish pressure, it’s important to note that such fluctuations are common within broader trends. At this juncture, the overall uptrend and the structure of the ascending channel appear to remain in place, though investors should continue to monitor future price action and relevant market factors for any significant changes.

● NVDA’s moving averages (MAs) are displaying a bullish configuration, with the shorter-term MAs positioned above their longer-term counterparts. This alignment is considered a robust indicator of positive market sentiment, suggesting sustained upward momentum for the stock.

● The MACD indicator has recently exhibited a bearish crossover while remaining above the zero line. This technical formation suggests a potential short-term pullback or consolidation phase, despite the overall bullish trend.

● A morning star pattern has materialized amidst a temporary price retracement, manifesting as a three-candlestick bullish reversal formation accompanied by heightened market volatility. This important candlestick pattern might signal a return of positive momentum, suggesting the stock’s upward movement might resume soon.

● A potential support level to watch has emerged around $131, with aligns with the previous resistance high set on August 26. This price point is significant as it marks where the stock broke through former resistance, leading to new all-time highs.

In conclusion, although NVDA has experienced some short-term selling pressure, its overall trend and established price channel seem to be holding steady. The stock reached a new record high after its third-quarter results, despite increased volatility. This behavior may reflect a typical market reaction, with some investors opting to take profits after recent gains. Such actions can often result in periods of price stabilization.

This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve.

All investment involves risk, including the potential loss of principal, and there can be no guarantee that any investment strategy will be successful.

.

• Best Case Scenario NVDA beats and shuts up the haters for a day or 2 🤣 like Jake Paul did the OG Iron Mike Tyson…

• Mid case they don’t beat but still keep crushing it like they have been since I got in few years back…

• Worse Case Scenario they’re on a silent decline and their #3 client $Super Micro Computer (SMCI.US)$ gets delisted and all hell breaks lose which would actually impact our economy so no clue why so many are betting against NVDA it’s asinine counterintuitive and counterproductive hustling backwards.

I could be wrong but it’s most likely Best or Mid case scenario for NVDA - option 3 would do more harm than good 😌 even for the Bears 🐻

.

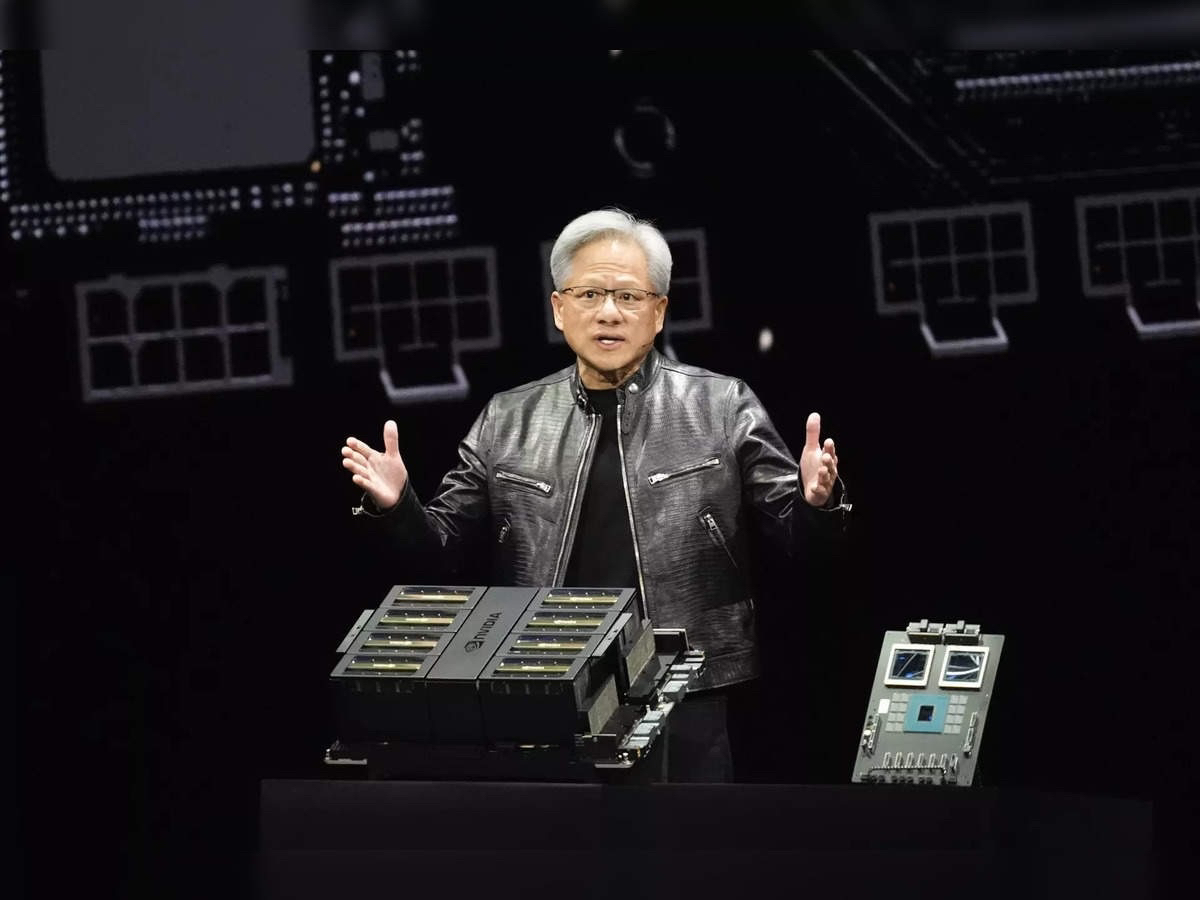

$NVIDIA (NVDA.US)$ CEO Jensen Huang announced three scalable robot types—automobiles, drones, and humanoid robots.

Nvidia has reduced the marginal cost of computing by a factor of 1 million in the last decade. Generative AI enables seamless information flow across disciplines, but achieving optimal AI answers will take years. Huang likened AI’s growth to Moore’s Law, driven by scaling laws.

Nvidia has reduced the marginal cost of computing by a factor of 1 million in the last decade. Generative AI enables seamless information flow across disciplines, but achieving optimal AI answers will take years. Huang likened AI’s growth to Moore’s Law, driven by scaling laws.

.

$NVIDIA (NVDA.US)$ 👈🏽 This stock, at the current price, fillowing the EPS trend and demand, will likely to get a PE ratio of 32 next year, so no reason to worry...

At 170 next year, look for EPS projection again then decide whether to sell if at all. Also pay attention to macroeconomy, when GDP rate gets low and jobless/debt explode, people can exit the market.

.

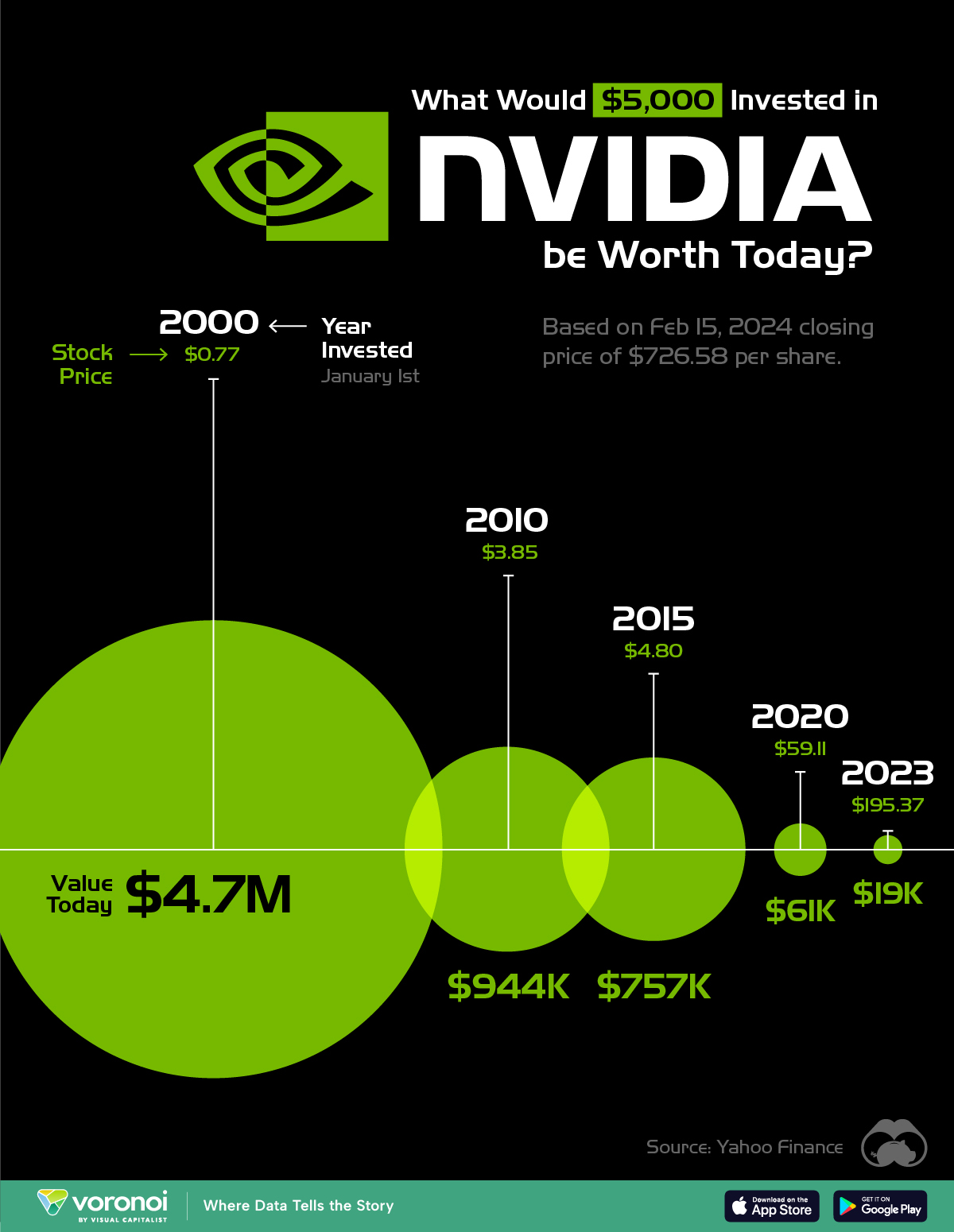

$NVIDIA (NVDA.US)$ when i told my friends to buy it 4 years ago they were making fun of me 🤣

.

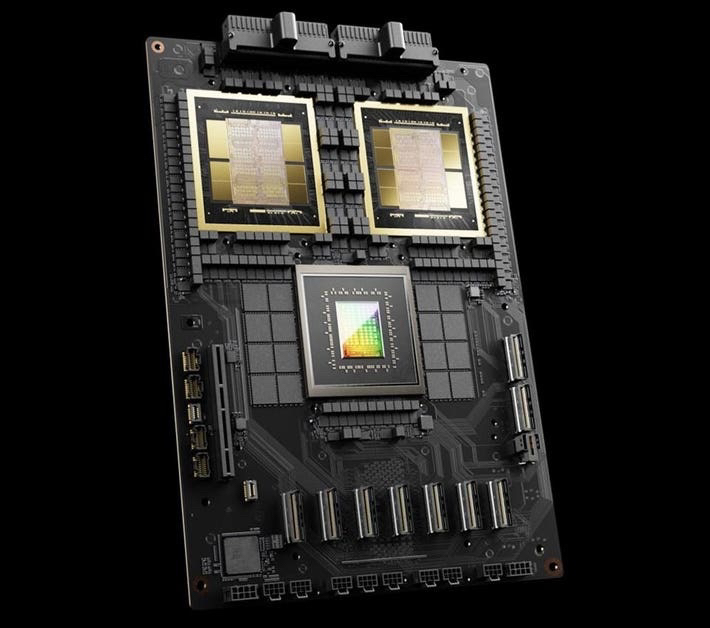

Nvidia GB 200 Grace Blackwell Superchip. 🤤 💰 150 is not an if, but a when. ⬆️

Morgan Stanley says Hopper/Blackwell demand is strong

- Nvidia’s Blackwell chips are now entering volume production, with demand from major customers driving significant growth potential for the company

- The Hopper H200 chips are seeing increased demand from smaller cloud service providers and sovereign AI projects

- Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia

- While Nvidia is still resolving some technical challenges with its GB200 server racks, these issues are part of the normal debugging process for new product launches

- Hon Hai, Nvidia’s assembly partner, is reportedly on track to begin shipments of the GB200 server rack by late Q4 2024

Blackwell is Nvidia's next-gen chip going into scale production this quarter. Many investors were concerned about pushouts. But instead, production is on track, and demand is off the charts.

Blackwell comes in a single configuration (contains two GPUs), which can go into existing data centers, or in large configurations like the GB200 NVL72, which packs 72 Blackwell chips (equivalent to 144 H100s).

One of these "chips" sells for ~$3M and contains ~2 miles of cables costing $100K just in cabling alone.

.

What we learned...

Earlier this month, Foxconn's CEO said that demand for Blackwell is "crazy" - adding a new facility in Mexico to satisfy Blackwell orders.

What we learned...

Earlier this month, Foxconn's CEO said that demand for Blackwell is "crazy" - adding a new facility in Mexico to satisfy Blackwell orders.

These comments came right after Nvidia's CEO, Jensen Huang, stated that production is on track and demand for Blackwell is "insane."

In addition, an important event took place two weeks ago — the Open Compute Project (OCP)— where data center companies showcased their latest and greatest products.

The key takeaway from this event was that everyone wants the GB200 NVL72. Positive for content, margins, and the rest of the value chain.

.

$Microsoft (MSFT.US)$ announced that Azure is the first cloud service to run the Blackwell system GB200 and reportedly increased its orders from 300–500 racks (mainly NVL36) to about 1,400–1,500 racks (about 70% NVL72), 5x increase. Subsequent Microsoft orders will primarily focus on NVL72. While this is unconfirmed, it is in-line with what we heard at OCP.

$Microsoft (MSFT.US)$ announced that Azure is the first cloud service to run the Blackwell system GB200 and reportedly increased its orders from 300–500 racks (mainly NVL36) to about 1,400–1,500 racks (about 70% NVL72), 5x increase. Subsequent Microsoft orders will primarily focus on NVL72. While this is unconfirmed, it is in-line with what we heard at OCP.

On the volume side, $Taiwan Semiconductor (TSM.US)$ just reported earnings and implied that they are doubling their packaging capacity from 40K/month to 80-100K/month exiting '25. In terms of GPU capacity, this implies that Blackwell should be exiting the year at 2M units/quarter.

And here is the best part, according to comments from the CEO, Blackwell is now "sold out"!

This is great news for Nvidia but also very positive for the rest of the value chain, including networking plays: connectors, cables, switches, interconnects, etc.

Nvidia, the GB200 NVL 72 is important because it is margin accretive as it contains many Nvidia networking products).

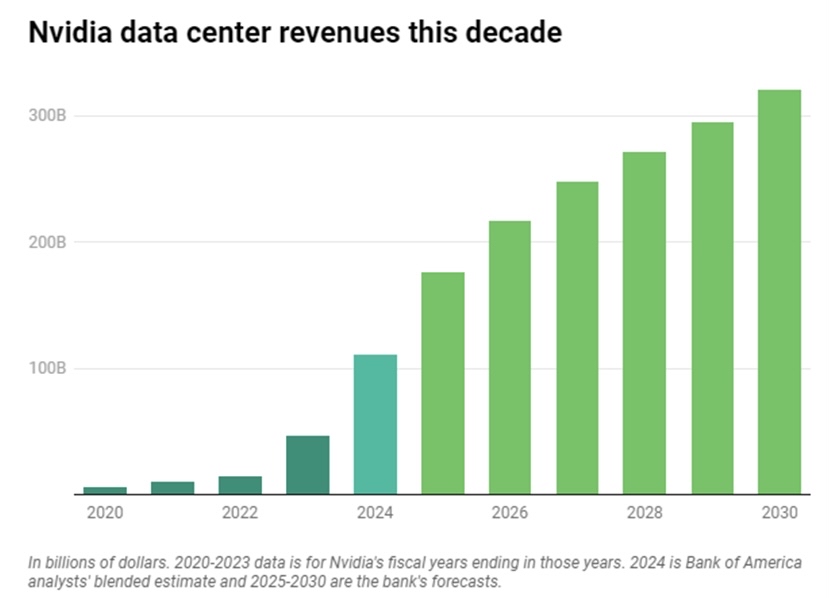

While Hopper (the prior generation GPU) took Nvidia 's Data Center revenues from $20B to >$100B, Blackwell has the potential to take it above $200B.

.

Pullbacks corrections retracements are normal.

Pullbacks corrections retracements are normal.

Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

Me and my ⭕️ have a Long Term Vision… Buy & Hold aka HODL.

.

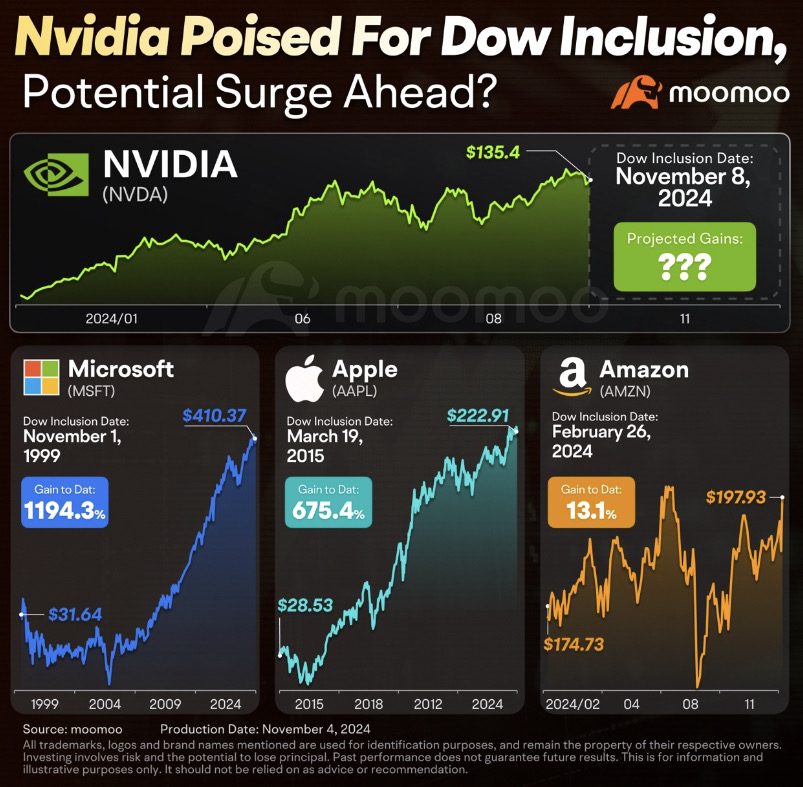

$NVIDIA (NVDA.US)$ is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021.

In 2024, NVIDIA is still at a P/E of 64, but the stock price has risen to $142.

This highlights how a stock can appear expensive based on valuation metrics like P/E, yet still not be overvalued if the company’s growth potential justifies the price.

Looking back, it’s clear that NVIDIA was not overvalued at $15 in 2021, despite its high P/E ratio. Since then, it has increased tenfold, proving that while it seemed expensive, it was a valuable investment.

It required a vision to see beyond the numbers in 2021, to recognize NVIDIA’s potential and the impact its GPUs would have on the world.

i see a lot of upside

76% of NVDA EMPLOYEES ARE MILLIONAIRES OR MULTIMILLIONAIRES (stock options)

That’s never been seen before not even at Apple 🍎. This company is going all the way to 10 trillion’.

It’s a MONSTER not just a gorilla 🦍

This could be King Kong 🦍 not 900 pound more like 9000 kilos ⚖️

Most don’t know this:

Nvidia has never been beaten by high end graphics in computer gaming. We’re talking since 1999 25 years‼️ no company not AMD or any beat nvidia in high end gaming. What do you think that means⁉️

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years⁉️ That tells you something…

.

.

Someone said:

Blackwell chips overheating, smci one of their biggest clients under scrutiny 🧐

Reality is:

Champions win 🏆 regardless of challenges

Facts change truth don’t but we gone see from today and for the next 5-10 years what happens w the 900+ LB Gorilla 🦍 Benefits more people if and WHEN they win 🏆

Blackwell chips overheating, smci one of their biggest clients under scrutiny 🧐

Reality is:

Champions win 🏆 regardless of challenges

Facts change truth don’t but we gone see from today and for the next 5-10 years what happens w the 900+ LB Gorilla 🦍 Benefits more people if and WHEN they win 🏆

.

2024

.

SoftBank to Get First New Nvidia Chips for Japan Supercomputer

https://www.bloomberg.com/news/articles/2024-11-13/softbank-to-get-first-new-nvidia-chips-for-japan-supercomputer

.

Jensen leaves everyone speechless 😶

- YouTube NVDA

.

Nvidia Stock Tops $1,000 As Blackwell Could Aid Tenfold Rise By 2026

.

AI-RAN: Revolutionizing Telecom with NVIDIA's Cutting-Edge Technology

Jensen speeding up telecoms networks for 5G ☝🏽 Buy the CEO 👨🏻💼

.

• Why is $NVIDIA (NVDA.US)$ on track to reach a new record high closing price⁉️

• $Alphabet-A (GOOGL.US)$ ordered 400K GB200 chips valued at $10B.

• $Microsoft (MSFT.US)$ purchased 60K GB200 chips worth $2B.

• $Meta Platforms (META.US)$ acquired 360K GB200 chips for $8B.

Demand for Nvidia's Blackwell chip is absolutely INSANE 🤩

Prediction: Nvidia Stock Is Going to Soar After Nov. 20 | The Motley Fool

.

Palantir Stock vs. Nvidia Stock: Billionaire Ken Griffin Buys One and Sells the Other | The Motley Fool

.

Google Cloud and NVIDIA Expand Partnership to Advance AI Computing, Software and Services

.

CEO Jensen Huang Just Delivered Fantastic News for Nvidia Investors | The Motley Fool

$NVIDIA (NVDA.US)$ 76% of NVDA EMPLOYEES ARE MILLIONAIRES OR MULTIMILLIONAIRES - stock options

That’s never been seen before not even at Apple 🍎. This company is going all the way to 10 trillion’.

It’s a MONSTER not just a gorilla 🦍

This could be King Kong 🦍 not 900 pound more like 9000 kilos ⚖️

$NVIDIA (NVDA.US)$ Growth Prospects Over the Next 12 Months

Nvidia is positioned for significant growth over the next year, driven by several key factors:

1. Strong Position in AI and Data Centers: Nvidia is expected to leverage its robust portfolio in AI chips and data center solutions. This strategic focus is anticipated to drive substantial revenue growth, as the demand for AI technologies continues to surge.

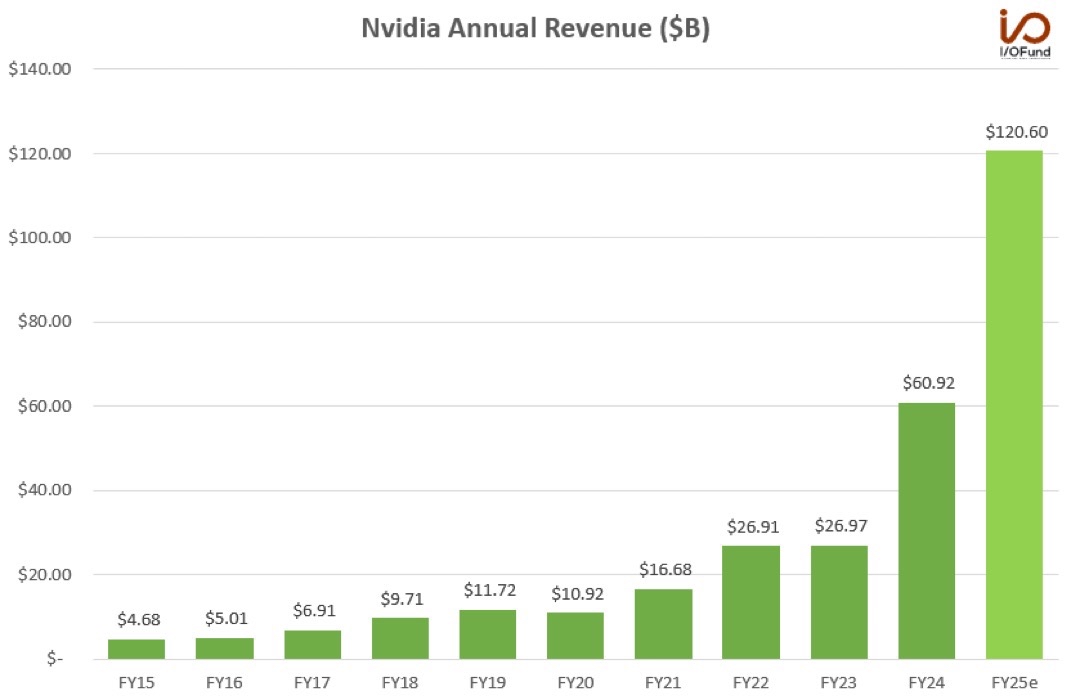

2. Revenue Projections: Wall Street analysts project that Nvidia's sales will increase significantly. The company reported sales of $45 billion in the last 12 months, and it is expected to reach $59.16 billion in fiscal 2024 and $94.46 billion in fiscal 2025. This growth trajectory underscores Nvidia's expanding influence in the tech industry.

3. Market Valuation and Stock Performance: Nvidia's stock is trading at a premium, reflecting high investor expectations. It is valued at 35 times forward earnings, which is significantly higher than the S&P 500 average of 21 times forward earnings. This premium valuation suggests that investors are optimistic about Nvidia's future growth prospects.

4. Operating Expenses and Financial Management: Nvidia's operating expenses are projected to grow in the mid- to upper-40% range for the full year. This increase in expenses is likely tied to investments in research and development, as well as scaling operations to meet growing demand.

5. Challenges and Market Dynamics: Despite the positive outlook, Nvidia faces potential challenges, including maintaining its competitive edge in the rapidly evolving AI market and managing its high valuation. However, the company's strategic investments and market leadership position it well to navigate these challenges.

Overall, Nvidia's growth over the next 12 months is expected to be driven by its leadership in AI and data center markets, strong revenue growth projections, and strategic financial management.

Nvidia Surpasses Apple to Become World’s Largest Company

Most don’t know this:

Nvidia has never been beaten by high end graphics in computer gaming. We’re talking since 1999 25 years‼️ no company not AMD or any beat nvidia in high end gaming. What do you think that means⁉️

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years⁉️ That tells you something…

Let’s GOOO 🚀🌙

• Nvidia is joining the storied Dow Jones Industrial Average.

We learned on Friday the chipmaker would be added to the blue-chip index, ending months of speculation that began in May when Nvidia split its stock 10-to-1.

Nvidia Joined Dow 30 After 6,000x Increase-It’s Time To Replace Index

• Extra Credit:

$NVIDIA (NVDA.US)$ is a company with so many sub categories and divisions . It’s constantly evolving… It’s a chip company! But with so much more underlying.

I don’t think we quite know the complete extent of its impact on the world 🌍 But for sure 👌🏽 it’s going to be massive 🤯

Nvidia To Join Dow Jones Industrial Average, Replacing Intel

NVIDIA is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021. In 2024, NVIDIA is still at a P/E of 64, but the stock price has risen to $142.

This highlights how a stock can appear expensive based on valuation metrics like P/E, yet still not be overvalued if the company’s growth potential justifies the price.

Looking back, it’s clear that NVIDIA was not overvalued at $15 in 2021, despite its high P/E ratio. Since then, it has increased tenfold, proving that while it seemed expensive, it was a valuable investment.

It required a vision to see beyond the numbers in 2021, to recognize NVIDIA’s potential and the impact its GPUs would have on the world.

i see a lot of upside

Blackwell is Nvidia's next-gen chip going into scale production this quarter. Many investors were concerned about pushouts. But instead, production is on track, and demand is off the charts.

Blackwell comes in a single configuration (contains two GPUs), which can go into existing data centers, or in large configurations like the GB200 NVL72, which packs 72 Blackwell chips (equivalent to 144 H100s).

One of these "chips" sells for ~$3M and contains ~2 miles of cables costing $100K just in cabling alone.

What we learned...

Earlier this month, Foxconn's CEO said that demand for Blackwell is "crazy" - adding a new facility in Mexico to satisfy Blackwell orders.

These comments came right after Nvidia's CEO, Jensen Huang, stated that production is on track and demand for Blackwell is "insane."

In addition, an important event took place two weeks ago — the Open Compute Project (OCP)— where data center companies showcased their latest and greatest products. The key takeaway from this event was that everyone wants the GB200 NVL72. Positive for content, margins, and the rest of the value chain.

Microsoft (NASDAQ:MSFT) announced that Azure is the first cloud service to run the Blackwell system GB200 and reportedly increased its orders from 300–500 racks (mainly NVL36) to about 1,400–1,500 racks (about 70% NVL72), 5x increase. Subsequent Microsoft orders will primarily focus on NVL72. While this is unconfirmed, it is in-line with what we heard at OCP.

On the volume side, TSMC (NYSE:TSM) just reported earnings and implied that they are doubling their packaging capacity from 40K/month to 80-100K/month exiting '25. In terms of GPU capacity, this implies that Blackwell should be exiting the year at 2M units/quarter.

And here is the best part, according to comments from the CEO, Blackwell is now "sold out"!

This is great news for Nvidia but also very positive for the rest of the value chain, including networking plays: connectors, cables, switches, interconnects, etc.

Nvidia, the GB200 NVL 72 is important because it is margin accretive as it contains many Nvidia networking products).

While Hopper (the prior generation GPU) took Nvidia 's Data Center revenues from $20B to >$100B, Blackwell has the potential to take it above $200B.

Nvidia's future Blackwell Ultra GPUs reportedly renamed to the B300 series

AI BOOM 💥

While $NVIDIA (NVDA.US)$ dominates semiconductor headlines during the AI boom, several other companies also hold monopolistic positions in the evolving digital economy -- here's a cheat sheet of the top 10 👇

1. $ASML Holding (ASML.US)$ | ASML Holding

• They hold a monopoly in lithography machines, which are essential for enabling the mass production of ultra-small, efficient chips crucial for AI applications. Their technology is foundational in pushing the boundaries of miniaturization and performance in semiconductor manufacturing.

2. $Taiwan Semiconductor (TSM.US)$ | Taiwan Semiconductor Manufacturing

• They remain the world’s largest dedicated independent semiconductor foundry, with unmatched capabilities in manufacturing advanced chips that are crucial for AI technologies. They are the only manufacturer with sufficiently advanced technology to produce the most sophisticated AI chips.

3. $KLA Corp (KLAC.US)$ | KLA Corporation

• They specialize in process control and yield management solutions. Their equipment and services are essential for the semiconductor manufacturing industry, ensuring the production of high-quality chip performance at micro and nano-levels, which is critical for the reliable operation of AI systems.

4. $Applied Materials (AMAT.US)$ | Applied Materials

• They excel in materials engineering solutions used to produce virtually every new chip and advanced display in the world. Their innovations in metal deposition and etch systems are essential for creating smaller, faster, and more reliable electronic devices needed in AI applications.

5. $Lam Research (LRCX.US)$ | Lam Research

• They are pivotal in the semiconductor fabrication process, providing advanced wafer fabrication equipment and services. Their technology is crucial for the production of highly sophisticated semiconductor devices, making them indispensable for manufacturers aiming to meet the increasing demands for more powerful and efficient AI chips.

6. $Micron Technology (MU.US)$ | Micron

• They are leaders in providing memory and storage solutions crucial for AI data processing. Their competitive advantage comes from their cutting-edge DRAM and NAND technologies, which significantly enhance the speed and capacity of AI systems.

7. $Broadcom (AVGO.US)$ | Broadcom

• Their range of semiconductor devices supports data center networking and broadband capabilities, crucial for AI ecosystems. Their broad product line and innovation in 5G technology position them as a key infrastructure provider in the rapidly expanding AI market.

8. $Qualcomm (QCOM.US)$ | Qualcomm

• They have a near-monopoly in mobile phone chips and is now integrating AI into its Snapdragon processors. This positions Qualcomm at the forefront of AI applications in mobile devices, enabling advanced features like natural language processing and on-device AI models.

9. $Marvell Technology (MRVL.US)$ | Marvell Technology

• Their technology excels in creating solutions that enhance data center performance and capacity, critical for AI data handling. Their specialized chipsets for cloud and enterprise applications position them as leaders in the data infrastructure market.

10. $Texas Instruments (TXN.US)$ | Texas Instruments

• They specialize in analog ICs and embedded processors, used extensively in automated applications and smart devices, pivotal for modern industrial applications.

.

SoftBank to Get First New Nvidia Chips for Japan Supercomputer

https://www.bloomberg.com/news/articles/2024-11-13/softbank-to-get-first-new-nvidia-chips-for-japan-supercomputer

.

Jensen leaves everyone speechless 😶

- YouTube NVDA

.

Nvidia Stock Tops $1,000 As Blackwell Could Aid Tenfold Rise By 2026

.

AI-RAN: Revolutionizing Telecom with NVIDIA's Cutting-Edge Technology

Jensen speeding up telecoms networks for 5G ☝🏽 Buy the CEO 👨🏻💼

.

• Why is $NVIDIA (NVDA.US)$ on track to reach a new record high closing price⁉️

• $Alphabet-A (GOOGL.US)$ ordered 400K GB200 chips valued at $10B.

• $Microsoft (MSFT.US)$ purchased 60K GB200 chips worth $2B.

• $Meta Platforms (META.US)$ acquired 360K GB200 chips for $8B.

Demand for Nvidia's Blackwell chip is absolutely INSANE 🤩

Prediction: Nvidia Stock Is Going to Soar After Nov. 20 | The Motley Fool

.

Palantir Stock vs. Nvidia Stock: Billionaire Ken Griffin Buys One and Sells the Other | The Motley Fool

.

Google Cloud and NVIDIA Expand Partnership to Advance AI Computing, Software and Services

.

CEO Jensen Huang Just Delivered Fantastic News for Nvidia Investors | The Motley Fool

$NVIDIA (NVDA.US)$ 76% of NVDA EMPLOYEES ARE MILLIONAIRES OR MULTIMILLIONAIRES - stock options

That’s never been seen before not even at Apple 🍎. This company is going all the way to 10 trillion’.

It’s a MONSTER not just a gorilla 🦍

This could be King Kong 🦍 not 900 pound more like 9000 kilos ⚖️

$NVIDIA (NVDA.US)$ Growth Prospects Over the Next 12 Months

Nvidia is positioned for significant growth over the next year, driven by several key factors:

1. Strong Position in AI and Data Centers: Nvidia is expected to leverage its robust portfolio in AI chips and data center solutions. This strategic focus is anticipated to drive substantial revenue growth, as the demand for AI technologies continues to surge.

2. Revenue Projections: Wall Street analysts project that Nvidia's sales will increase significantly. The company reported sales of $45 billion in the last 12 months, and it is expected to reach $59.16 billion in fiscal 2024 and $94.46 billion in fiscal 2025. This growth trajectory underscores Nvidia's expanding influence in the tech industry.

3. Market Valuation and Stock Performance: Nvidia's stock is trading at a premium, reflecting high investor expectations. It is valued at 35 times forward earnings, which is significantly higher than the S&P 500 average of 21 times forward earnings. This premium valuation suggests that investors are optimistic about Nvidia's future growth prospects.

4. Operating Expenses and Financial Management: Nvidia's operating expenses are projected to grow in the mid- to upper-40% range for the full year. This increase in expenses is likely tied to investments in research and development, as well as scaling operations to meet growing demand.

5. Challenges and Market Dynamics: Despite the positive outlook, Nvidia faces potential challenges, including maintaining its competitive edge in the rapidly evolving AI market and managing its high valuation. However, the company's strategic investments and market leadership position it well to navigate these challenges.

Overall, Nvidia's growth over the next 12 months is expected to be driven by its leadership in AI and data center markets, strong revenue growth projections, and strategic financial management.

Nvidia Surpasses Apple to Become World’s Largest Company

Most don’t know this:

Nvidia has never been beaten by high end graphics in computer gaming. We’re talking since 1999 25 years‼️ no company not AMD or any beat nvidia in high end gaming. What do you think that means⁉️

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years⁉️ That tells you something…

Let’s GOOO 🚀🌙

• Nvidia is joining the storied Dow Jones Industrial Average.

We learned on Friday the chipmaker would be added to the blue-chip index, ending months of speculation that began in May when Nvidia split its stock 10-to-1.

Nvidia Joined Dow 30 After 6,000x Increase-It’s Time To Replace Index

• Extra Credit:

$NVIDIA (NVDA.US)$ is a company with so many sub categories and divisions . It’s constantly evolving… It’s a chip company! But with so much more underlying.

I don’t think we quite know the complete extent of its impact on the world 🌍 But for sure 👌🏽 it’s going to be massive 🤯

Nvidia To Join Dow Jones Industrial Average, Replacing Intel

NVIDIA is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021. In 2024, NVIDIA is still at a P/E of 64, but the stock price has risen to $142.

This highlights how a stock can appear expensive based on valuation metrics like P/E, yet still not be overvalued if the company’s growth potential justifies the price.

Looking back, it’s clear that NVIDIA was not overvalued at $15 in 2021, despite its high P/E ratio. Since then, it has increased tenfold, proving that while it seemed expensive, it was a valuable investment.

It required a vision to see beyond the numbers in 2021, to recognize NVIDIA’s potential and the impact its GPUs would have on the world.

i see a lot of upside

Blackwell is Nvidia's next-gen chip going into scale production this quarter. Many investors were concerned about pushouts. But instead, production is on track, and demand is off the charts.

Blackwell comes in a single configuration (contains two GPUs), which can go into existing data centers, or in large configurations like the GB200 NVL72, which packs 72 Blackwell chips (equivalent to 144 H100s).

One of these "chips" sells for ~$3M and contains ~2 miles of cables costing $100K just in cabling alone.

What we learned...

Earlier this month, Foxconn's CEO said that demand for Blackwell is "crazy" - adding a new facility in Mexico to satisfy Blackwell orders.

These comments came right after Nvidia's CEO, Jensen Huang, stated that production is on track and demand for Blackwell is "insane."

In addition, an important event took place two weeks ago — the Open Compute Project (OCP)— where data center companies showcased their latest and greatest products. The key takeaway from this event was that everyone wants the GB200 NVL72. Positive for content, margins, and the rest of the value chain.

Microsoft (NASDAQ:MSFT) announced that Azure is the first cloud service to run the Blackwell system GB200 and reportedly increased its orders from 300–500 racks (mainly NVL36) to about 1,400–1,500 racks (about 70% NVL72), 5x increase. Subsequent Microsoft orders will primarily focus on NVL72. While this is unconfirmed, it is in-line with what we heard at OCP.

On the volume side, TSMC (NYSE:TSM) just reported earnings and implied that they are doubling their packaging capacity from 40K/month to 80-100K/month exiting '25. In terms of GPU capacity, this implies that Blackwell should be exiting the year at 2M units/quarter.

And here is the best part, according to comments from the CEO, Blackwell is now "sold out"!

This is great news for Nvidia but also very positive for the rest of the value chain, including networking plays: connectors, cables, switches, interconnects, etc.

Nvidia, the GB200 NVL 72 is important because it is margin accretive as it contains many Nvidia networking products).

While Hopper (the prior generation GPU) took Nvidia 's Data Center revenues from $20B to >$100B, Blackwell has the potential to take it above $200B.

Nvidia's future Blackwell Ultra GPUs reportedly renamed to the B300 series

AI BOOM 💥

While $NVIDIA (NVDA.US)$ dominates semiconductor headlines during the AI boom, several other companies also hold monopolistic positions in the evolving digital economy -- here's a cheat sheet of the top 10 👇

1. $ASML Holding (ASML.US)$ | ASML Holding

• They hold a monopoly in lithography machines, which are essential for enabling the mass production of ultra-small, efficient chips crucial for AI applications. Their technology is foundational in pushing the boundaries of miniaturization and performance in semiconductor manufacturing.

2. $Taiwan Semiconductor (TSM.US)$ | Taiwan Semiconductor Manufacturing

• They remain the world’s largest dedicated independent semiconductor foundry, with unmatched capabilities in manufacturing advanced chips that are crucial for AI technologies. They are the only manufacturer with sufficiently advanced technology to produce the most sophisticated AI chips.

3. $KLA Corp (KLAC.US)$ | KLA Corporation

• They specialize in process control and yield management solutions. Their equipment and services are essential for the semiconductor manufacturing industry, ensuring the production of high-quality chip performance at micro and nano-levels, which is critical for the reliable operation of AI systems.

4. $Applied Materials (AMAT.US)$ | Applied Materials

• They excel in materials engineering solutions used to produce virtually every new chip and advanced display in the world. Their innovations in metal deposition and etch systems are essential for creating smaller, faster, and more reliable electronic devices needed in AI applications.

5. $Lam Research (LRCX.US)$ | Lam Research

• They are pivotal in the semiconductor fabrication process, providing advanced wafer fabrication equipment and services. Their technology is crucial for the production of highly sophisticated semiconductor devices, making them indispensable for manufacturers aiming to meet the increasing demands for more powerful and efficient AI chips.

6. $Micron Technology (MU.US)$ | Micron

• They are leaders in providing memory and storage solutions crucial for AI data processing. Their competitive advantage comes from their cutting-edge DRAM and NAND technologies, which significantly enhance the speed and capacity of AI systems.

7. $Broadcom (AVGO.US)$ | Broadcom

• Their range of semiconductor devices supports data center networking and broadband capabilities, crucial for AI ecosystems. Their broad product line and innovation in 5G technology position them as a key infrastructure provider in the rapidly expanding AI market.

8. $Qualcomm (QCOM.US)$ | Qualcomm

• They have a near-monopoly in mobile phone chips and is now integrating AI into its Snapdragon processors. This positions Qualcomm at the forefront of AI applications in mobile devices, enabling advanced features like natural language processing and on-device AI models.

9. $Marvell Technology (MRVL.US)$ | Marvell Technology

• Their technology excels in creating solutions that enhance data center performance and capacity, critical for AI data handling. Their specialized chipsets for cloud and enterprise applications position them as leaders in the data infrastructure market.

10. $Texas Instruments (TXN.US)$ | Texas Instruments

• They specialize in analog ICs and embedded processors, used extensively in automated applications and smart devices, pivotal for modern industrial applications.

Nvidia GB 200 Grace Blackwell Superchip. 🤤 💰 150 is not an if, but a when. ⬆️

Morgan Stanley says Hopper/Blackwell demand is strong

- Nvidia’s Blackwell chips are now entering volume production, with demand from major customers driving significant growth potential for the company

- The Hopper H200 chips are seeing increased demand from smaller cloud service providers and sovereign AI projects

- Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia

- While Nvidia is still resolving some technical challenges with its GB200 server racks, these issues are part of the normal debugging process for new product launches

- Hon Hai, Nvidia’s assembly partner, is reportedly on track to begin shipments of the GB200 server rack by late Q4 2024

Blackwell is Nvidia's next-gen chip going into scale production this quarter. Many investors were concerned about pushouts. But instead, production is on track, and demand is off the charts.

Blackwell comes in a single configuration (contains two GPUs), which can go into existing data centers, or in large configurations like the GB200 NVL72, which packs 72 Blackwell chips (equivalent to 144 H100s).

One of these "chips" sells for ~$3M and contains ~2 miles of cables costing $100K just in cabling alone.

What we learned...

Earlier this month, Foxconn's CEO said that demand for Blackwell is "crazy" - adding a new facility in Mexico to satisfy Blackwell orders.

These comments came right after Nvidia's CEO, Jensen Huang, stated that production is on track and demand for Blackwell is "insane."

In addition, an important event took place two weeks ago — the Open Compute Project (OCP)— where data center companies showcased their latest and greatest products. The key takeaway from this event was that everyone wants the GB200 NVL72. Positive for content, margins, and the rest of the value chain.

Microsoft (NASDAQ:MSFT) announced that Azure is the first cloud service to run the Blackwell system GB200 and reportedly increased its orders from 300–500 racks (mainly NVL36) to about 1,400–1,500 racks (about 70% NVL72), 5x increase. Subsequent Microsoft orders will primarily focus on NVL72. While this is unconfirmed, it is in-line with what we heard at OCP.

On the volume side, TSMC (NYSE:TSM) just reported earnings and implied that they are doubling their packaging capacity from 40K/month to 80-100K/month exiting '25. In terms of GPU capacity, this implies that Blackwell should be exiting the year at 2M units/quarter.

And here is the best part, according to comments from the CEO, Blackwell is now "sold out"!

This is great news for Nvidia but also very positive for the rest of the value chain, including networking plays: connectors, cables, switches, interconnects, etc.

Nvidia, the GB200 NVL 72 is important because it is margin accretive as it contains many Nvidia networking products).

While Hopper (the prior generation GPU) took Nvidia 's Data Center revenues from $20B to >$100B, Blackwell has the potential to take it above $200B.

Pullbacks corrections retracements are normal.

.

Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

Me and mi ⭕️ have a Long Term Vision… Buy & Hold aka HODL.

$NVIDIA (NVDA.US)$ is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021.

In 2024, NVIDIA is still at a P/E of 64, but the stock price has risen to $142.

This highlights how a stock can appear expensive based on valuation metrics like P/E, yet still not be overvalued if the company’s growth potential justifies the price.

Looking back, it’s clear that NVIDIA was not overvalued at $15 in 2021, despite its high P/E ratio. Since then, it has increased tenfold, proving that while it seemed expensive, it was a valuable investment.

It required a vision to see beyond the numbers in 2021, to recognize NVIDIA’s potential and the impact its GPUs would have on the world.

i see a lot of upside

76% of NVDA EMPLOYEES ARE MILLIONAIRES OR MULTIMILLIONAIRES (stock options)

That’s never been seen before not even at Apple 🍎. This company is going all the way to 10 trillion’.

It’s a MONSTER not just a gorilla 🦍

This could be King Kong 🦍 not 900 pound more like 9000 kilos ⚖️

Most don’t know this:

Nvidia has never been beaten by high end graphics in computer gaming. We’re talking since 1999 25 years‼️ no company not AMD or any beat nvidia in high end gaming. What do you think that means⁉️

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years⁉️ That tells you something…

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA

Morgan Stanley says Hopper/Blackwell demand is strong

- Nvidia’s Blackwell chips are now entering volume production, with demand from major customers driving significant growth potential for the company

- The Hopper H200 chips are seeing increased demand from smaller cloud service providers and sovereign AI projects

- Blackwell chips are expected to see 450,000 units produced in the fourth quarter of 2024, translating into a potential revenue opportunity exceeding $10 billion for Nvidia

- While Nvidia is still resolving some technical challenges with its GB200 server racks, these issues are part of the normal debugging process for new product launches

- Hon Hai, Nvidia’s assembly partner, is reportedly on track to begin shipments of the GB200 server rack by late Q4 2024

Blackwell is Nvidia's next-gen chip going into scale production this quarter. Many investors were concerned about pushouts. But instead, production is on track, and demand is off the charts.

Blackwell comes in a single configuration (contains two GPUs), which can go into existing data centers, or in large configurations like the GB200 NVL72, which packs 72 Blackwell chips (equivalent to 144 H100s).

One of these "chips" sells for ~$3M and contains ~2 miles of cables costing $100K just in cabling alone.

What we learned...

Earlier this month, Foxconn's CEO said that demand for Blackwell is "crazy" - adding a new facility in Mexico to satisfy Blackwell orders.

These comments came right after Nvidia's CEO, Jensen Huang, stated that production is on track and demand for Blackwell is "insane."

In addition, an important event took place two weeks ago — the Open Compute Project (OCP)— where data center companies showcased their latest and greatest products. The key takeaway from this event was that everyone wants the GB200 NVL72. Positive for content, margins, and the rest of the value chain.

Microsoft (NASDAQ:MSFT) announced that Azure is the first cloud service to run the Blackwell system GB200 and reportedly increased its orders from 300–500 racks (mainly NVL36) to about 1,400–1,500 racks (about 70% NVL72), 5x increase. Subsequent Microsoft orders will primarily focus on NVL72. While this is unconfirmed, it is in-line with what we heard at OCP.

On the volume side, TSMC (NYSE:TSM) just reported earnings and implied that they are doubling their packaging capacity from 40K/month to 80-100K/month exiting '25. In terms of GPU capacity, this implies that Blackwell should be exiting the year at 2M units/quarter.

And here is the best part, according to comments from the CEO, Blackwell is now "sold out"!

This is great news for Nvidia but also very positive for the rest of the value chain, including networking plays: connectors, cables, switches, interconnects, etc.

Nvidia, the GB200 NVL 72 is important because it is margin accretive as it contains many Nvidia networking products).

While Hopper (the prior generation GPU) took Nvidia 's Data Center revenues from $20B to >$100B, Blackwell has the potential to take it above $200B.

Pullbacks corrections retracements are normal.

.

Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

Me and mi ⭕️ have a Long Term Vision… Buy & Hold aka HODL.

$NVIDIA (NVDA.US)$ is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021.

In 2024, NVIDIA is still at a P/E of 64, but the stock price has risen to $142.

This highlights how a stock can appear expensive based on valuation metrics like P/E, yet still not be overvalued if the company’s growth potential justifies the price.

Looking back, it’s clear that NVIDIA was not overvalued at $15 in 2021, despite its high P/E ratio. Since then, it has increased tenfold, proving that while it seemed expensive, it was a valuable investment.

It required a vision to see beyond the numbers in 2021, to recognize NVIDIA’s potential and the impact its GPUs would have on the world.

i see a lot of upside

76% of NVDA EMPLOYEES ARE MILLIONAIRES OR MULTIMILLIONAIRES (stock options)

That’s never been seen before not even at Apple 🍎. This company is going all the way to 10 trillion’.

It’s a MONSTER not just a gorilla 🦍

This could be King Kong 🦍 not 900 pound more like 9000 kilos ⚖️

Most don’t know this:

Nvidia has never been beaten by high end graphics in computer gaming. We’re talking since 1999 25 years‼️ no company not AMD or any beat nvidia in high end gaming. What do you think that means⁉️

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years⁉️ That tells you something…

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

NVIDIAGAL : NVIDIA is king of AI! Good buy for sure.

Coach Donnie OP NVIDIAGAL : Yep NVDA CAGR and ROI is lit Game Over

Game Over

Coach Donnie OP : $NVIDIA (NVDA.US)$

Coach Donnie OP :

Coach Donnie OP : Nvidia earnings, forecasts top expectations as 'age of AI is in full steam'

Coach Donnie OP : Most don’t know this about $NVIDIA (NVDA.US)$

no company not AMD or any beat nvidia in high end gaming. What do you think that means

no company not AMD or any beat nvidia in high end gaming. What do you think that means

That tells you something…

That tells you something…

Nvidia has never been beaten by high end graphics in computer gaming. We’re talking since 1999 25 years

It means no other company is going to beat them In graphics or ai. So think about that. This stock I think going to 200 or better after earnings report. How many companies you know that’s never been beaten before in 25 years

Coach Donnie OP : Y’all OK $NVIDIA (NVDA.US)$ Bears

Coach Donnie OP : Demand for Blackwell expected to exceed supply for several quarter in fiscal 2026

Coach Donnie OP : NVIDIA | 10-Q: Quarterly report - moomoo

Coach Donnie OP : $NVIDIA (NVDA.US)$ says Blackwell demand is "staggering"

Blackwell, she said, is in full production, and Nvidia has shipped 13,000 GPU samples to customers in the third quarter, including one of the first Blackwell engineering samples to OpenAI.

View more comments...