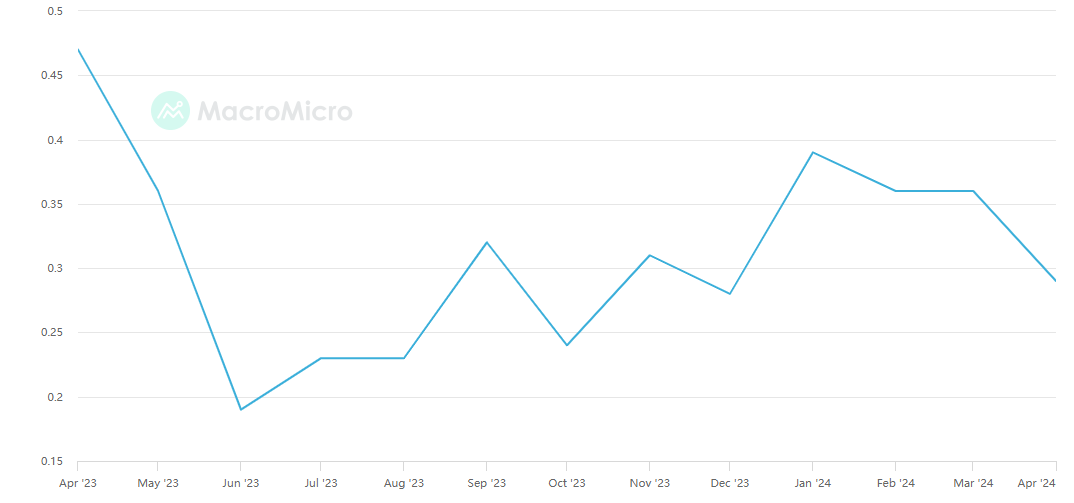

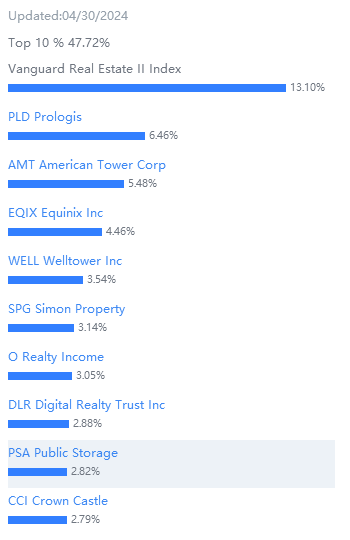

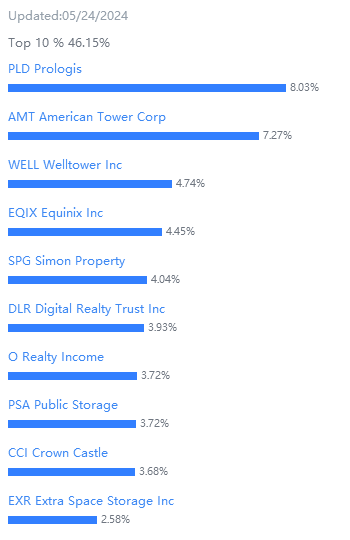

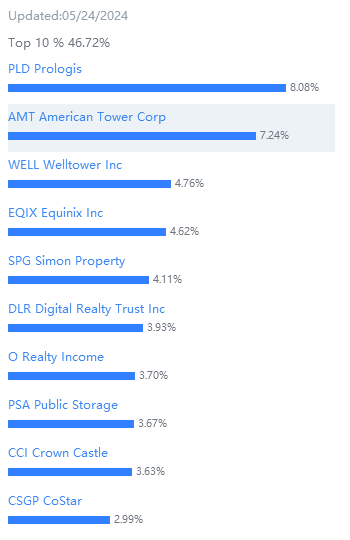

In this macroeconomic context, Real Estate Investment Trusts (REITs), serving as a crucial bridge between the real estate and capital markets, are increasingly highlighting their investment value amid expectations of interest rate cuts. As REITs investment expert Ralph L. Block noted, "The prices of REITs rise with the cash flows from properties and the increase in asset values, making them ideal for investors seeking dividend income and moderate price appreciation." Therefore, with the growing anticipation of the rate cuts, exploring REIT investment strategies is of significant importance for portfolio construction.