Navigating market waves: Red Sea tensions, shipping and energy

Navigating market waves: Red Sea tensions, shipping and energy

Views 43K

Contents 88

Resource stock review ---- December 21st

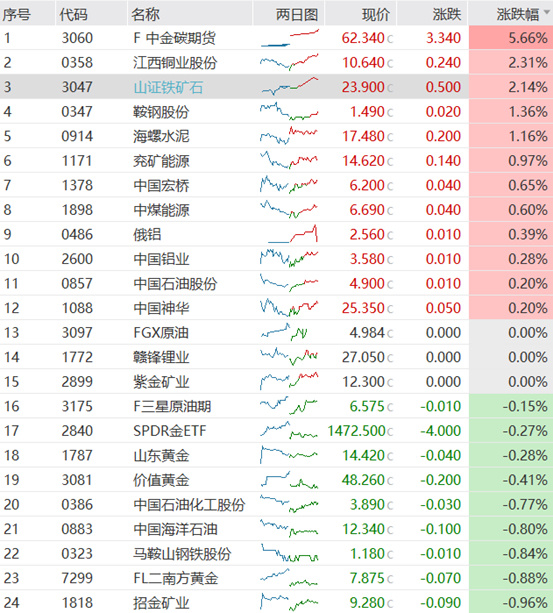

On December 21st, most domestic commodity futures markets closed higher, with the shipping index (Europe) block order contract hitting the limit up; chemicals all rose, glass rose by over 4%, styrene and pulp rose by over 2%; most basic metals rose, aluminum oxide rose by over 2%, while lithium carbonate fell by over 4%; most black series rose, iron ore rose by over 3%, coking coal rose by over 2%; agricultural products varied, rapeseed meal, cornstarch, and soybeans all rose by over 1%, while peanuts fell by over 1%; precious metals all rose. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$ Iron ore news:The Mongolian imported coking coal market has been weak recently. The large-scale snowfall in the northern region has led to a significant decline in port clearance, and the transportation vehicles of Mongolian coal have been affected by the decrease in temperature, making it difficult to load and unload container cargo, resulting in a decrease in clearance efficiency. According to Mysteel's statistical data, since mid-December, the daily average clearance at the three major ports has totaled 1535 vehicles, a decrease of 677 vehicles, a decrease of 30.61% compared to the previous period. The crisis in the Red Sea channel has pushed up global shipping costs and has limited impact on China's steel exports. According to feedback from an exporter in East China, the impact of the Red Sea crisis on ocean exports is minimal; in terms of deep-sea transportation, China's quotes for the European market, including Turkey, have not changed much, and there is a strong atmosphere of market wait-and-see. Quote update:China Resources Iron Ore (3047.HK) closed at HKD 23.9, up 2.14%.Accumulated returns: 1 week: 0.59% 1 month: 4.18% 3 months: 17.16% 6 months: 40.59% Since listing: 220.81% Hong Kong resource stocks situation:Spot gold maintains an intraday rebound trend, with the gold price now quoted near $2,035 per ounce. The rally in global stocks and bonds has stalled, as investors reassess their excitement about the prospect of lower interest rates in the coming year. Investors need to pay special attention to the release of US initial jobless claims, Philadelphia Fed manufacturing, and Gross Domestic Product (GDP) data later today. $SD GOLD (01787.HK)$ Houthi rebels have launched multiple attacks on merchant ships in the Red Sea in a single day, causing several oil companies to suspend their routes in the Red Sea. Geopolitical risks are once again in the spotlight, indicating that the bullish pattern for crude oil and energy is becoming more attractive. Crude oil prices have experienced a sharp decline in the past few months, dropping more than 30% from around $95 per barrel in October to around $67 per barrel in December. It seems that a bullish pattern is forming now, and crude oil prices may have bottomed out. $SINOPEC CORP (00386.HK)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more 1

1