History shows bull market in gold after rate hikes: boon or bane?

History shows bull market in gold after rate hikes: boon or bane?

Views 563K

Contents 68

Resource stocks review ---- November 1

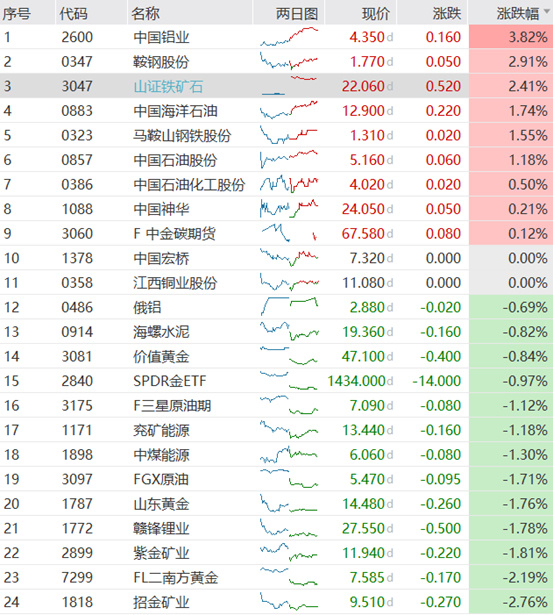

On November 1, the domestic commodity futures market closed with mixed ups and downs. Most petrochemical products rose, LPG increased by over 3%; most base metals fell, Shanghai tin fell by over 4%, Shanghai nickel fell by over 2%; most black products rose, iron ore rose by over 2%, ferrosilicon rose by nearly 1%; precious metals all fell, Shanghai silver fell by over 2%; agricultural products varied, apples rose by over 1%, Zheng cotton, cotton yarn, and rapeseed meal fell by over 1%. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$ Iron ore news:Recently, the General Administration of Customs issued the "Implementation Plan of the General Administration of Customs on Promoting the Sustainable and High-Quality Development Reform of Processing Trade", which mentioned supporting the import of energy commodities such as crude oil, coal, natural gas, as well as resource commodities such as iron ore, copper concentrate, and staple foods, setting up bonded warehouses in major import areas in central-western and northeastern China, and conducting processing trade on-site. It also supports the central-western and northeastern regions to leverage the advantages of comprehensive bonded zones policy and develop the comprehensive bonded zones into demonstration zones for undertaking the transfer of processing trade industries. Quote update:Shanxi Iron Ore (3047.HK) closed at HKD 22.06, up 2.41%.Cumulative returns: 1 week: 6.16% 1 month: 8.14% 3 months: 22.97% 6 months: 40.06% Since listing: 196.11% Hong Kong resource stocks situation:Despite the unfavorable macroeconomic environment at home and abroad, investors remained cautious about the release of US economic data. However, the southwest region is about to face a dry season, and the tight electricity supply issue has raised concerns in the market about the supply of electrolytic aluminum. The restriction on electrolytic aluminum production has been basically confirmed, and most manufacturers are holding inventory to support prices and reluctant to sell. These factors have overshadowed the market's bearish sentiment, leading to a strong upward trend in Shanghai aluminum today, presenting a "unique" trend. The current market focus is starting to shift to the two-day Federal Reserve meeting scheduled to start on Tuesday. There is still some uncertainty about whether Federal Reserve Chairman Powell and his colleagues will raise interest rates again at the meeting, temporarily supporting the US dollar. The uncertainty continues to keep bond yields at high levels, thereby limiting the upside potential for gold from safe-haven trades. $CHALCO (02600.HK)$ $ZHAOJIN MINING (01818.HK)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more