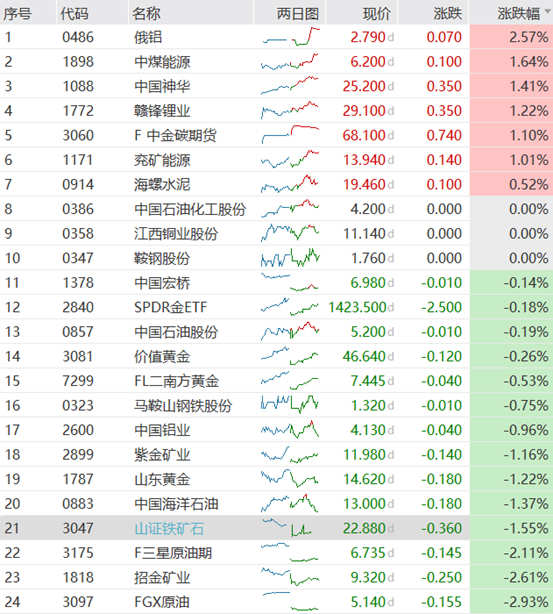

Resource stock reorder ---- November 16

On November 16, most of the domestic commodity futures markets closed up. Most black products rose more than 3%, coke rose more than 2%, and iron ore fell more than 1%; most energy chemicals rose, PTA and paraxylene rose more than 2%, pulp rose nearly 2%, and crude oil fell more than 2%; most basic metals rose, Shanghai lead rose nearly 2% and alumina rose more than 1%; agricultural products had mixed ups and downs. Eggs, beans, peanuts rose more than 1%, vegetable oil fell more than 1%; precious metals had mixed ups and downs, with Shanghai banks rising more than 1%. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

Iron ore news:

On the evening of November 15, Dafang issued the “Notice on Adjusting the Trading Limits and Trading Margin Levels for Iron Ore Futures Contracts”. According to the “Risk Management Measures of the Dalian Commodity Exchange”, after research and determination, Dashang will make the following adjustments to iron ore futures contract transaction limits and trading margin levels:

1. Starting from November 17, 2023 (that is, the night trading session on November 16), non-futures company members or customers must not open more than 500 lots in a single day on iron ore futures I2401, I2402, I2403, I2404 and I2405 contracts, and no more than 2,000 lots in a single day on other iron ore futures contracts. This daily position opening volume refers to the sum of the number of positions bought and opened by non-futures company members or customers on a single contract on the same day. The number of positions opened in a single day for hedging transactions and market making transactions is not limited by the above standards. Accounts with actual control relationships are managed as one account.

2. Starting from the settlement on November 20, 2023 (Monday), the margin level for speculative trading of iron ore futures contracts will be adjusted from 13% to 15%. For contracts that also meet the “Dalian Commodity Exchange Risk Management Measures” relating to the adjustment of transaction margin requirements, the transaction deposit is collected according to the larger value of the prescribed transaction margin value.

Offer update:

Shanshen Iron Ore (3047.HK) closed at HK$22.88, down -1.55%

Cumulative return: 1 week: 3.06% January: 10.85% March: 29.27% June: 45.18% Since listing: 207.11%

Status of the Hong Kong Resources Stock:

Crude oil prices are under pressure as U.S. crude oil inventories surpassed expectations, record production in the world's largest oil producer, and heightened concerns about Asian demand. Today, Thursday, the opening of oil prices was still under pressure, and overnight fundamental factors still had a negative impact on it. Although oil prices are currently fluctuating, Saudi Arabia is expected to extend its production reduction plan of 1 million b/d until the beginning of 2024. According to foreign media surveys of traders and analysts, as global oil demand growth slows and supply increases, Saudi Arabia may maintain the production reduction plan that began this summer until January next year, or even longer. $Global X S&P Crude Oil Futures Enhanced ER ETF (03097.HK)$ $Samsung S&P GSCI Crude Oil ER (03175.HK)$

Iron ore news:

On the evening of November 15, Dafang issued the “Notice on Adjusting the Trading Limits and Trading Margin Levels for Iron Ore Futures Contracts”. According to the “Risk Management Measures of the Dalian Commodity Exchange”, after research and determination, Dashang will make the following adjustments to iron ore futures contract transaction limits and trading margin levels:

1. Starting from November 17, 2023 (that is, the night trading session on November 16), non-futures company members or customers must not open more than 500 lots in a single day on iron ore futures I2401, I2402, I2403, I2404 and I2405 contracts, and no more than 2,000 lots in a single day on other iron ore futures contracts. This daily position opening volume refers to the sum of the number of positions bought and opened by non-futures company members or customers on a single contract on the same day. The number of positions opened in a single day for hedging transactions and market making transactions is not limited by the above standards. Accounts with actual control relationships are managed as one account.

2. Starting from the settlement on November 20, 2023 (Monday), the margin level for speculative trading of iron ore futures contracts will be adjusted from 13% to 15%. For contracts that also meet the “Dalian Commodity Exchange Risk Management Measures” relating to the adjustment of transaction margin requirements, the transaction deposit is collected according to the larger value of the prescribed transaction margin value.

Offer update:

Shanshen Iron Ore (3047.HK) closed at HK$22.88, down -1.55%

Cumulative return: 1 week: 3.06% January: 10.85% March: 29.27% June: 45.18% Since listing: 207.11%

Status of the Hong Kong Resources Stock:

Crude oil prices are under pressure as U.S. crude oil inventories surpassed expectations, record production in the world's largest oil producer, and heightened concerns about Asian demand. Today, Thursday, the opening of oil prices was still under pressure, and overnight fundamental factors still had a negative impact on it. Although oil prices are currently fluctuating, Saudi Arabia is expected to extend its production reduction plan of 1 million b/d until the beginning of 2024. According to foreign media surveys of traders and analysts, as global oil demand growth slows and supply increases, Saudi Arabia may maintain the production reduction plan that began this summer until January next year, or even longer. $Global X S&P Crude Oil Futures Enhanced ER ETF (03097.HK)$ $Samsung S&P GSCI Crude Oil ER (03175.HK)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment