Retailers Are Cutting Outlooks, and There Are Indications that Deflation Could Be on the Way

The upcoming holiday season is expected to be tough for U.S. retailers across various sectors such as apparel, electronics, and home improvement. Moody's Investors Service predicts that holiday sales will only grow by 1% to 3% this year, indicating that higher discounts may not necessarily drive significant spending during this crucial period.

Retailers predict a weak holiday

On Tuesday, $Best Buy (BBY.US)$ and $Lowe's Companies (LOW.US)$ cut their forecasts and warned that shoppers were pulling back on big-ticket items like appliances ahead of the holiday season. $Kohl's Corp (KSS.US)$ reported its seventh-straight drop in comparable sales, as a partnership with Sephora drew in customers but didn't spur them to spend more money on other items at the department stores. Even positive results at some retailers left investors wanting more as shares slumped at $Abercrombie & Fitch (ANF.US)$ and $American Eagle (AEO.US)$.

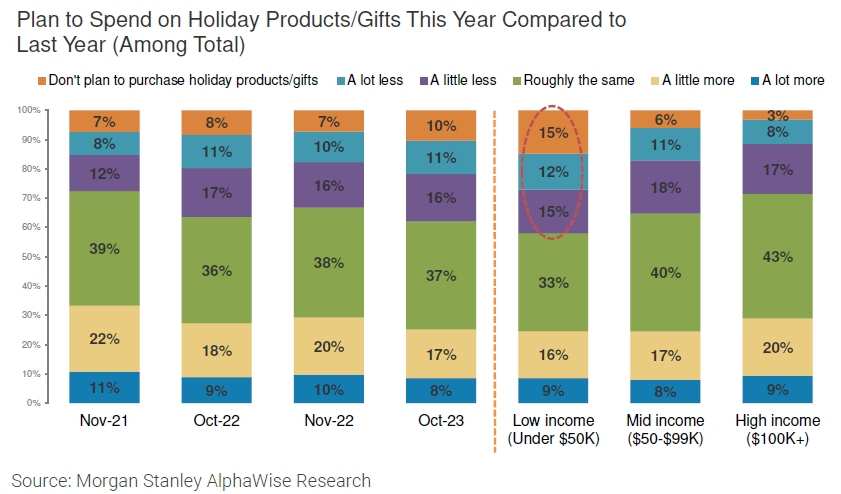

A new study of roughly 2000 consumers' holiday shopping plans from Morgan Stanley shows that consumers may hold back this season.The number of Americans who say they will forgo holiday gift buying altogether rose significantly this year. Some 10% of consumers now say they don't plan on doing any holiday shopping, up from just 7% in October 2021 and 8% in November of 2022.

Moreover, the upper-middle-class segment that powered a spending boom in the past is also slowing down its spending ahead of Black Friday. In the three months ahead of the all-important holiday shopping season, a group of retailers that cater to the upper middle class — including $Apple (AAPL.US)$, Coach and $Nordstrom (JWN.US)$ — saw its biggest sales drop in two years, according to Bloomberg.

Consumer stocks are being sold off

Hedge funds sold U.S. consumer staples at the fastest pace since April 2020, and the sector suffered one of the heaviest selling spells of the past five years, according to Goldman Sachs.

Companies toting household goods, alcohol and tobacco in the week ending Nov. 17 made up the second weakest performing group in the S&P 500.

Meanwhile, $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ reported no stake in consumer stocks including $Johnson & Johnson (JNJ.US)$, $Procter & Gamble (PG.US)$, and $Mondelez International (MDLZ.US)$ in Q3, as per regulatory filings.

These stocks are generally known to deliver consistent and higher returns than U.S. Treasuries, but have been no match for recent soaring government bond yields.

Deflation could be coming this holiday season

Last week, Walmart CEO Doug McMillon warned deflation could be coming as general merchandise and key grocery items, such as eggs, chicken and seafood get cheaper.

In the U.S., we may be managing through a period of deflation in the months to come," he said.

Furthermore, Cathie Wood has indicated that deflation is already underway across industries in the US, beginning with commodities and extending to airline and auto prices. She predicts an era of falling prices, driven by emerging technologies such as AI, electric vehicles, robotics, genomic sequencing, and blockchain.

Mooers, will we see deflation this holiday season?

Source: Bloomberg, Reuters, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment