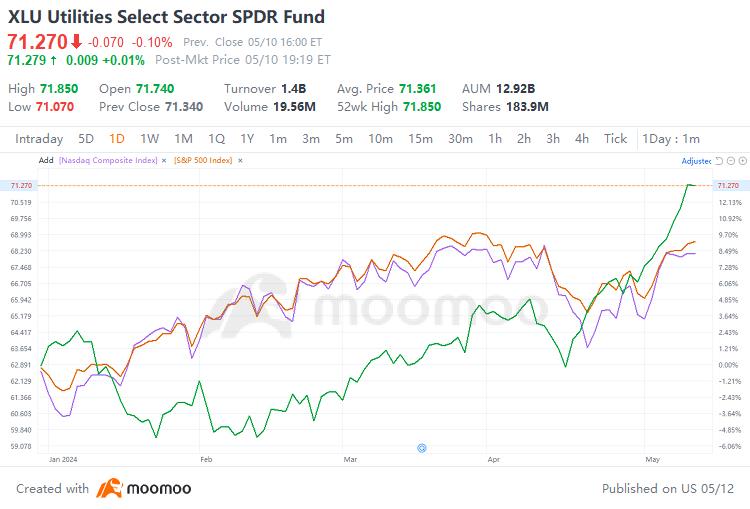

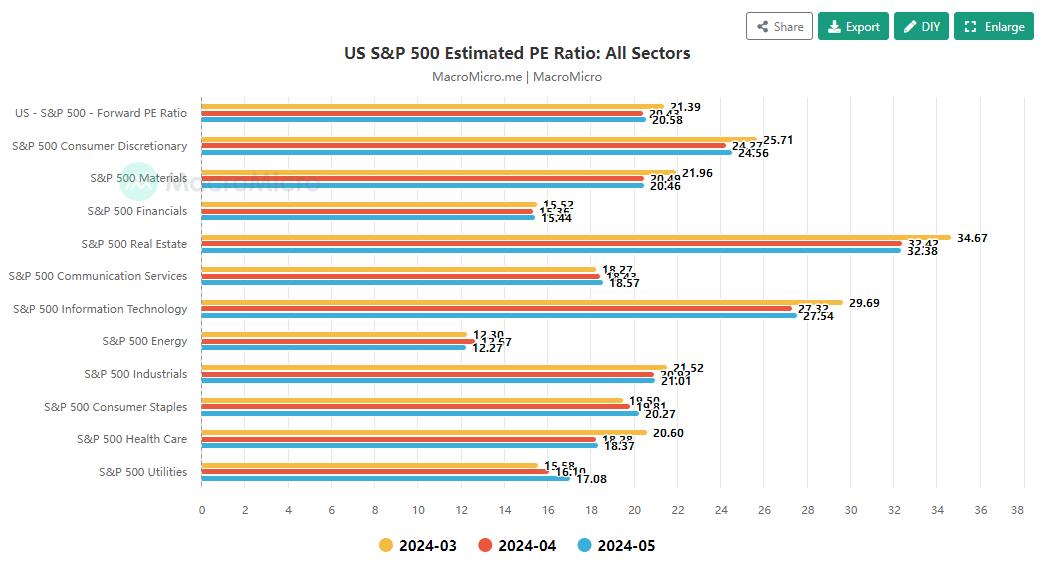

As demand for basic public services such as electricity, natural gas, and water typically changes little, and most utility companies are regulated monopolies, their revenue is relatively stable. Therefore, utility stocks are often seen as defensive assets. Since the end of last year, geopolitical risks have been rising and global inflation remains sticky, while the AI market is still "hot." As a result, utility stocks have become the best "offensive and defensive" option.

10baggerbamm : all these so-called experts they're late to the game as usual typically they downgrade at a bottom and upgrade at a near top. I was buying utsl pounding the table telling people to buy it at $14 and hit 29 this past Friday. now I'm buying DRN..ETF, 12 months this is going to be north of $20. for the most undervalued individual stock equity in the US marketplace...its KNDI. TRADING AT 1.6 TIMES REVENUE IT'S RIDICULOUS THE COMPANY IS NOW PROFITABLE THE COMPANY BOUGHT BACK 30 MILLION WORTH OF STOCK THE FIRST QUARTER IN THE OPEN MARKET 4TH QUARTER LAST YEAR THE COMPANY COMPLETED ITS US DISTRIBUTION NETWORK THE US MARKET SHARE GREW OVER 50% LAST QUARTER REVENUE GROWTH. the stock's been over $20 in the past when it was nowhere near as well run and able to execute like they are today.. this company should be trading at a minimum 5 to 10 times revenues right now which would put this stock between 10 and 20 and once people realize what it is they just got to deal with the NFL the right to use their marketing and they're building EVS tagged with all the NFL teams it just was announced this past weekend they're growing their executing and rather than Chase yesterday's hero nothing wrong with Microsoft I own it I've owned it 20 years but I'm not going to get tenfold price increase in Microsoft in 2 years or one year and I believe I will in kndi.