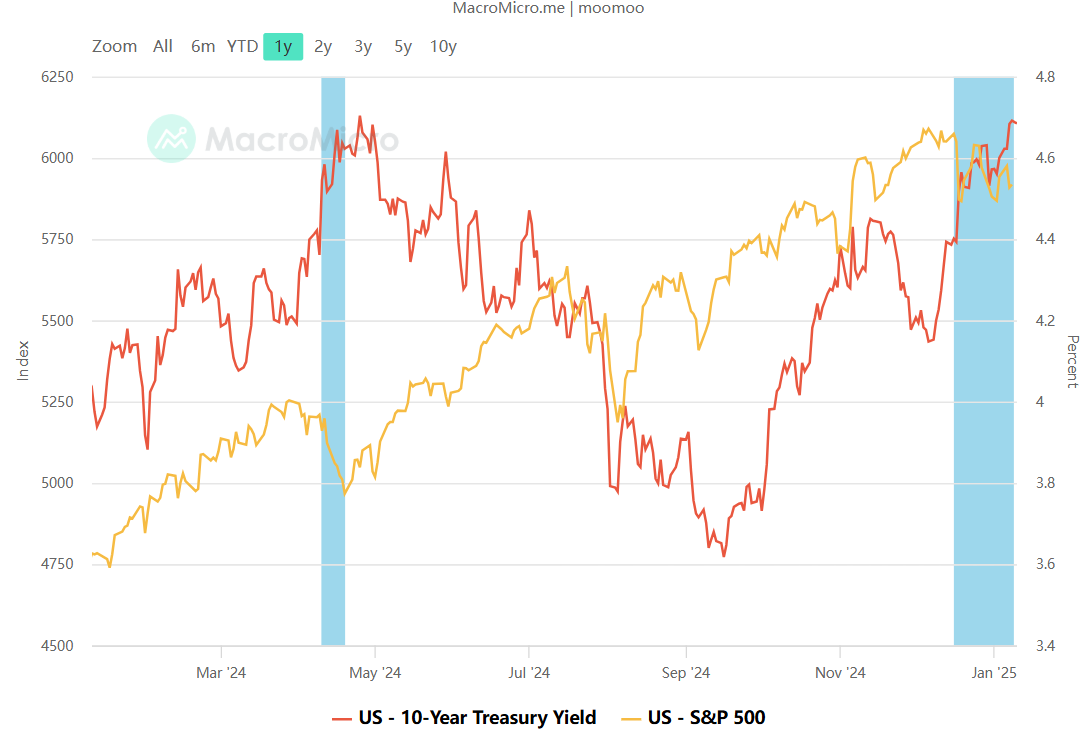

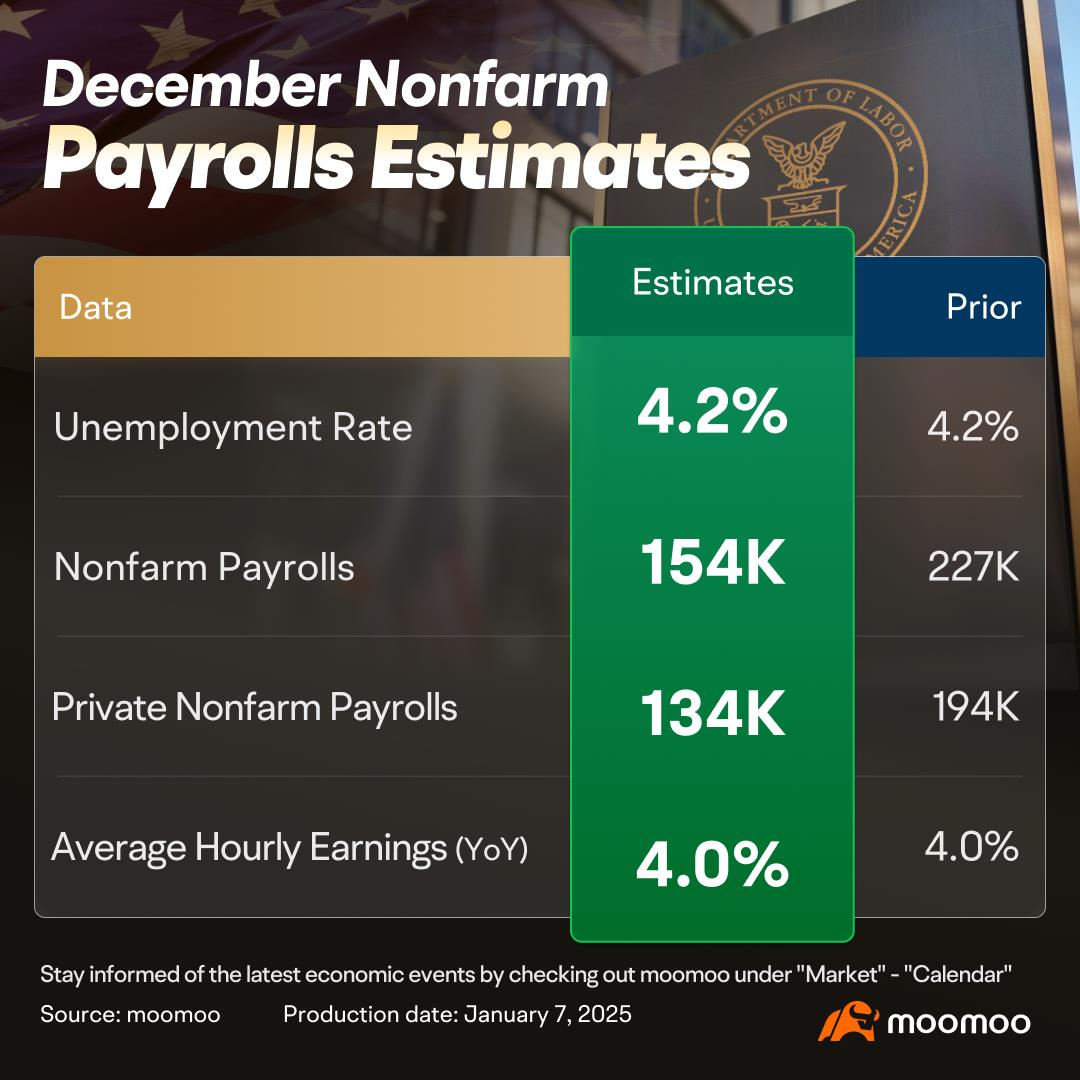

This week, a series of economic data releases and comments from Federal Reserve officials have dampened expectations for interest rate cuts, causing the 10-year U.S. Treasury yield to soar to approximately 4.7%. Major U.S. indices remain under pressure, continuing a consolidation phase that began in December, as investors appear to lack a clear direction. On Wednesday, Bitcoin experienced a sharp decline, nearing the $100,000 mark, and after three consecutive days of losses, it briefly dropped to $91,000 on Thursday. Risk assets are facing persistent challenges—when will they find relief?

Buy n Die Together❤ :

103137415 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)