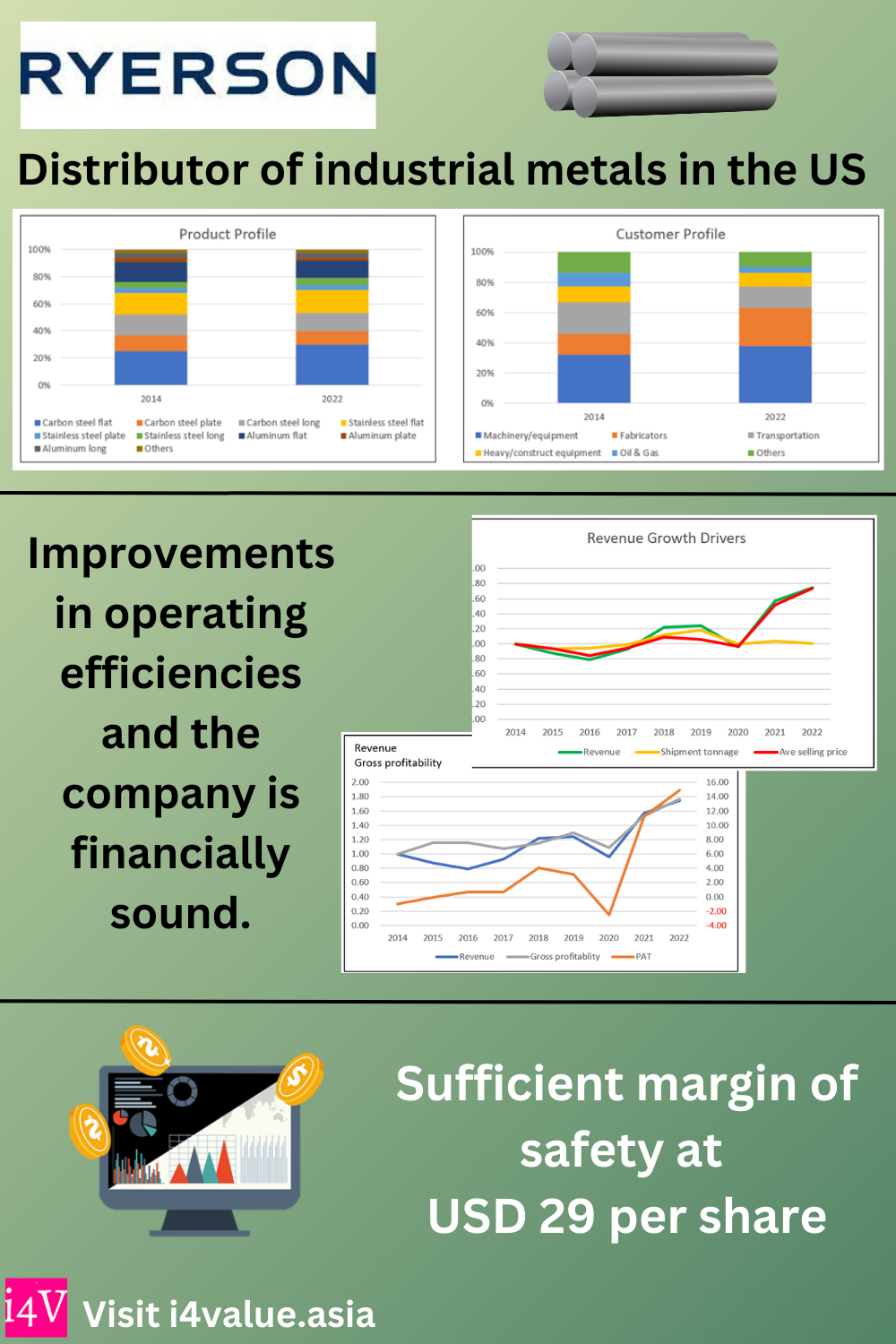

RYI's revenue growth from 2014 to 2022 was driven by changes in selling price rather than tonnage growth. The price growth, especially the price spike in the past 2 years, enabled it to generate strong earnings. But there were improvements in operating efficiencies and the company is financially sound.