$S&P 500 Index (.SPX.US)$ On a price-to-earnings basis, the ...

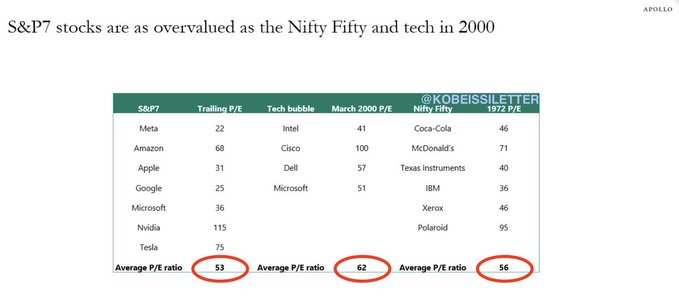

$S&P 500 Index(.SPX.US$ On a price-to-earnings basis, the S&P 7 is now as overvalued as tech in 2000 and the Nifty Fifty in 1972.

These are the same stocks that have accounted for 95% of the S&P 500's gain this year.

The P/E ratio on some components of the S&P 7 is now more than DOUBLE the levels seen in previous bubbles.

For example, Nvidia, $NVIDIA(NVDA.US$ , now has a P/E ratio of 115x.

However, without these 7 companies, the S&P 500 is up just 4% this year.

These are the same stocks that have accounted for 95% of the S&P 500's gain this year.

The P/E ratio on some components of the S&P 7 is now more than DOUBLE the levels seen in previous bubbles.

For example, Nvidia, $NVIDIA(NVDA.US$ , now has a P/E ratio of 115x.

However, without these 7 companies, the S&P 500 is up just 4% this year.

$Meta Platforms(META.US$ $Amazon(AMZN.US$ $Apple(AAPL.US$ $Alphabet-C(GOOG.US$ $Microsoft(MSFT.US$ $Tesla(TSLA.US$

Can these stocks continue to carry the entire market?

Can these stocks continue to carry the entire market?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment