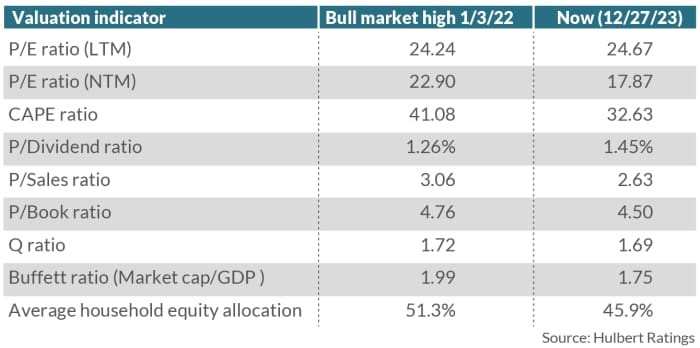

It's worth noting that the market in early 2022 was extremely overvalued,so investors shouldn't make too much of the valuation improvement in the case of the other eight indicators. For example, the Cyclically Adjusted P/E (CAPE) ratio, which has seen one of the most notable declines over the last two years—to 32.6 from 41.1—still ranks above 90.1% of all monthly measurements since 1881, as per the database maintained by Yale University's Robert Shiller.

Ben Chor : Cool