NVDA

NVIDIA

-- 133.230 TSLA

Tesla

-- 403.310 DJT

Trump Media & Technology

-- 42.910 AMD

Advanced Micro Devices

-- 117.320 PLTR

Palantir

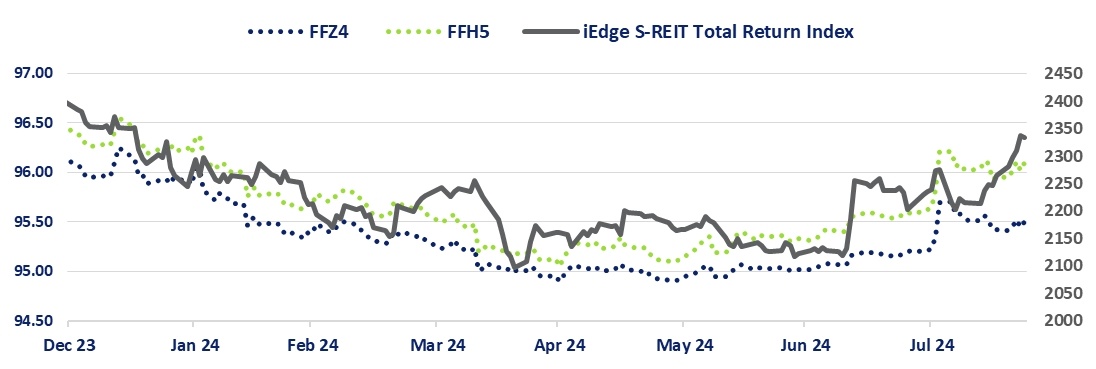

-- 64.980 Notwithstanding limited historical data for S-REITs, the sector’s share price performance is dependent, in our view, on the driver and rationale behind rate cuts by the Federal Reserve (Fed)," the team writes in its August 23 report.

Invest With Cici : Great article!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101567985 : Is there a perspective if reduce by 25basis points now but structured over a period,is it boon or bane for S REITs?given it is also a signal of recession?thanks:))

103297413 : good

103143701 : interesting

102714373 : H

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103613928 : Ok

Alice Lim choo : have the opportunity

YYOO :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

xing6600 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...