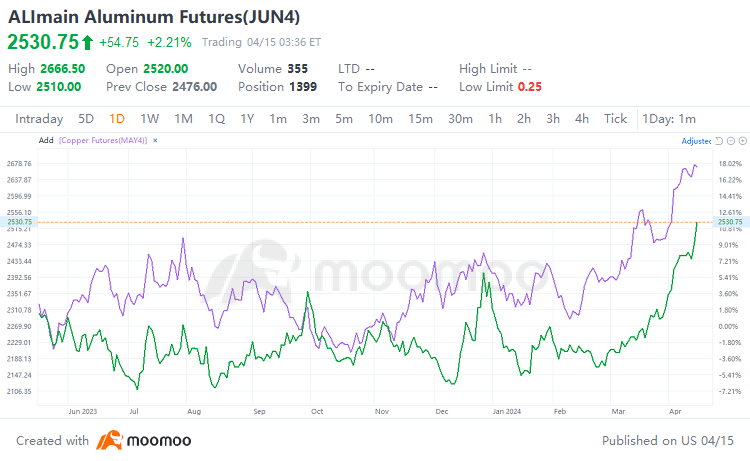

Russia plays an important role in the global non-ferrous metal market, accounting for 4%, 5%, and 6% of global copper, aluminum, and nickel supply, respectively. Its role in the London Metal Exchange is even more significant, with Russian copper, aluminum, and nickel accounting for 62%, 91%, and 36% in LME warehouses as of the end of March. Therefore, in the short term, the sanctions on Russian metals are likely to disrupt global non-ferrous metal supply, thus supporting metal prices. In the medium to long term, analysts point out that copper and aluminum, which are subject to long-term supply-demand imbalances, may have greater upward price support, while nickel, which is relatively oversupplied and has lower warehouse pressure, may require further observation for upward potential.

72MonkeySurvival : is a good time to fix One OZ Gold to Twenty-five Barrels of OIl.

104901579 : I’m

152252817 : I know US dollar and treasuries were a safe haven but goodness me can they be considered that today with the insanity of its financial health.