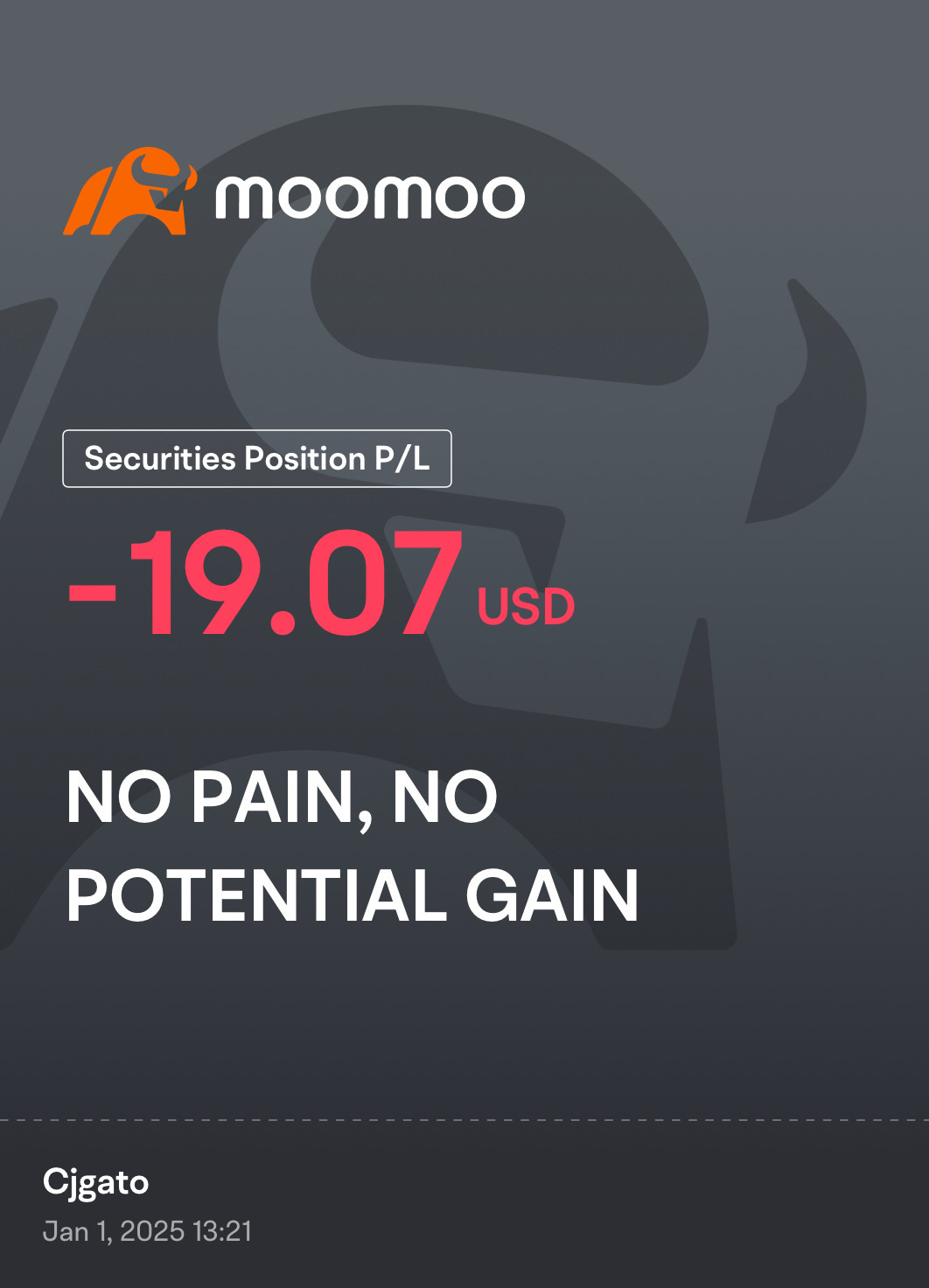

regret that I missed out on the rally for the most part. Just not in a position to take a lot of risk. I use this platform to hold extremely safe assets. Everything from US treasury bills in the form of ETF to collateralized loan obligations. I was able to make a solid five or 6% on money that I wasn’t willing to take a risk on. The alternative in a CD would have been lower. This is really modest, but I enjoyed the fact that there were so many opportunities to learn. about things like option trading. About companies. Some of the features that I found particularly useful included the tutorials that taught me about everything from cash flow, to reading a balance sheet, to technical analysis, and to the content that was prepared in preparation for important market events, like fed meetings, or major earnings reports. I respect this customer service very much, and I also suspect that these features that I took advantage of me will be valuable in the future when I decide to take on more risk and invest in equities. I think that I will use covered calls quite a bit in the future. And I think that following the supply and demand from the auctions of US treasuries will be important this year. Also, and lastly, international affairs. How will the market in Europe hold up. What about Korea? China continued slow down? Japanese currency relative evaluation. It will be an interesting year. I have attached my photos to show you my profit and loss, etc. thank you for reading.