Salesforce (CRM) Revenue Contribution From Agentforce platform To Watch

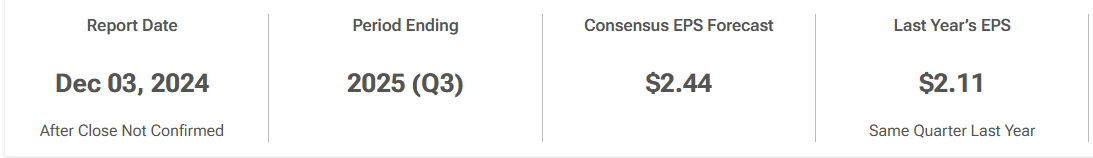

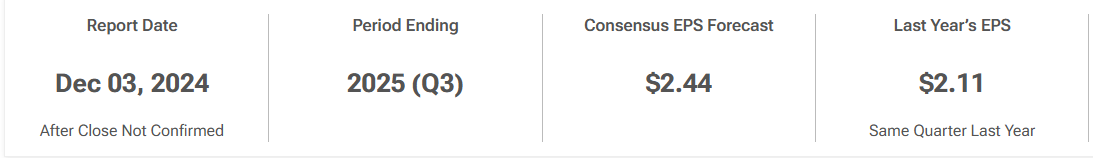

$Salesforce (CRM.US)$ is scheduled to release its fiscal third-quarter 2025 results on 03 Dec 2024.

Salesforce is projecting the total revenues between $9.31 billion and $9.36 billion (midpoint $9.335 billion). Market consensus estimates for the revenue is expected at $9.34 billion, which indicates an increase of 7.1% from the year-ago quarter’s reported figure.

Salesforce anticipates their non-GAAP earnings per share in the band of $2.42-$2.44 for the third quarter. Market consensus for non-GAAP earnings has remained unchanged at $2.44 per share, which calls for a 15.2% increase from the year-ago quarter.

This is at the higher band of Salesforce own forecast.

Salesforce (CRM) Strong FIscal Second Quarter 2025 Results

Salesforce's second quarter fiscal 2025 results were strong, with revenue up 8% year-over-year and profit increasing sharply.

Revenue: $9.33 billion, up 8% year-over-year and 9% in constant currency

Profit: $2.56 per share, excluding one-off items, up from $2.12 per share in the same period last year

Operating margin: 19.1% GAAP and 33.7% non-GAAP

Operating cash flow: $0.89 billion, up 10% year-over-year

Free cash flow: $0.76 billion, up 20% year-over-year

Share repurchases: $4.3 billion

Dividend payments: $0.4 billion

Salesforce's strong results were driven by higher sales, cost-restructuring initiatives, and demand for its cloud and business software. The company also integrated artificial intelligence into its offerings, such as Slack and Einstein GPT.

Salesforce’s steady earnings and cash flow growth after it attended the Salesforce Agentforce World Tour. Salesforce’s new product catalysts and increased innovation cycle can potentially boost future revenue. Something to look out would be the impact of Agentforce on the automation, healthcare, and contact center industries, this hopefully translate to better revenue contributor.

Salesforce To Benefit From Growing AI Demand. YTD Returns Set To Improve.

Investors interest around software companies which are positioned to benefit from GenAI has increased, moreover we are also seeing rotation happen out of the hardware chips, and interest is moving towards AI software companies.

This makes Salesforce’s Agentforce platform appears well positioned. Salesforce's stock price has gained roughly 30% since Salesforce’s Dreamforce event in September and the unveiling of its Agentforce suite of autonomous AI agents.

Salesforce partner checks has suggested that demand for Salesforce environment has improved following the September event, with 71% of those surveyed reporting more customer interest in AI, “showcasing optimism in the ecosystem.

For Salesforce investors , they have enjoyed more than 25% of returns, though we have seen some decline of less than 3% in recent weeks, but Salesforce for the long term AI demand play, should be something investors can consider.

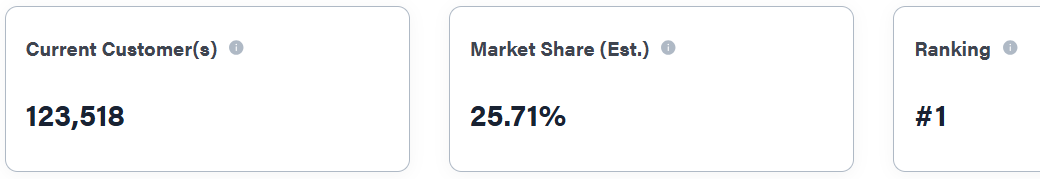

Salesforce Lead The CRM Space

Currently Salesforce lead the CRM space with its current count of 123,518 customers, with a market share of 25.71%, this is something we need to consider and acknowledge the potential of CRM as an investment. as we continued our conviction that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe.

Salesforce might be something we could consider as later section will show you where its competitors are behind Salesforce.

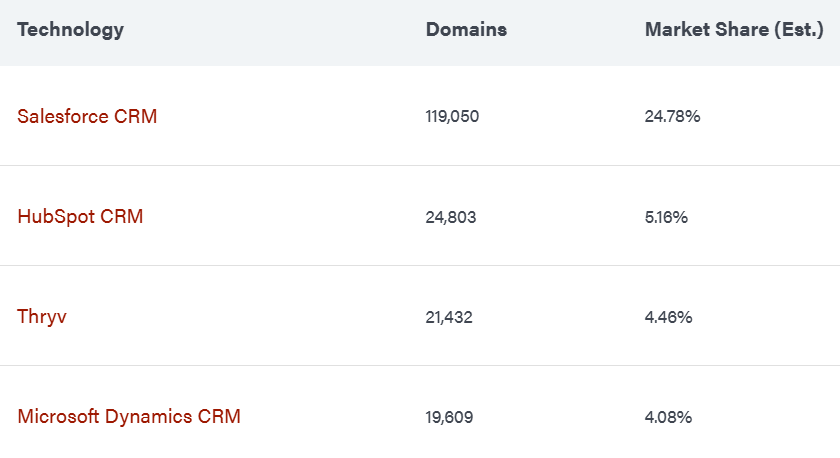

The top three of Salesforce’s competitors in the CRM Platforms category are Salesforce CRM with 24.78%, HubSpot CRM with 5.16%, Thryv with 4.46% market share.

With Microsoft Dynamics CRM which has been some enterprises preferred software for managing their customers and sales relationship have cames in with only 4.08% market share at the 4th position.

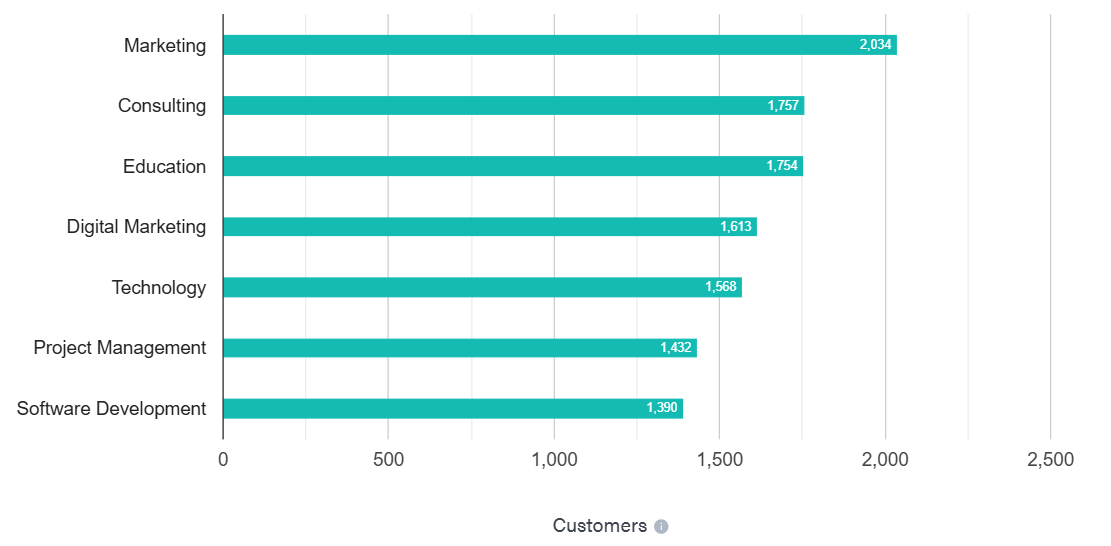

Salesforce Customers In The U.S. and Marketing Area Still The Main Group

Something we need to be aware is Salesforce geographics of its customers in the top 3 regions, United States (U.S.) still takes up most of the percentage with a significant 67.72%, followed by United Kingdom with 8,447(8.25%), India with 5,056(4.94%) customers respectively.

In terms of customers products and services offering, the customers that use Salesforce for CRM Platforms are Marketing (2,034), Consulting (1,757), Education (1,754).

This would mean that the main concentration of customers are into marketing, this would make the AI enhanced new features of the CRM more appealing to this group, so we could be looking at a significant growth this upcoming earnings result.

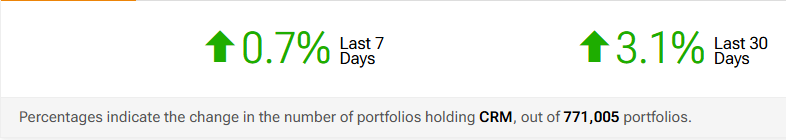

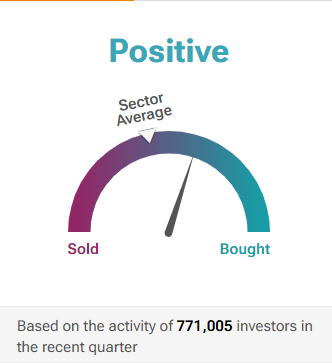

Investors Are Positive And Increasing Their Holdings In Portfolio

From what we have seen since the beginning of 2024, Salesforce have worked towards cost-cutting by having combined 700 job cuts earlier this year and 8,000 in January 2023, it’s cut 9,000 over the past two years, or about 11% of its total workforce at the end of 2022.

Salesforce is working to cut costs while still investing in new products. In mid-July, Salesforce cut about 300 jobs as it searched for the right balance between innovation and austerity.

So this strategy seems to be welcomed by investors as Salesforce might have strike the right tone by cost cutting and continued to invest in new products which has resulted in a strong fiscal second quarter 2025 result.

Technical Analysis - MACD and Multi-timeframe (MTF)

Though CRM have suffered a decline in its trading, but it is still trading comfortably above the short-term and long-term MA, and though MACD is showing signs of bearish crossover, I believe this might be short-term.

Investors have not decreased their holdings of CRM in their portfolio, this show the confidence and sentiment from them as the ownership structure of Salesforce (CRM) stock is a mix of institutional, retail, and individual investors. Approximately 69.70% of the company’s stock is owned by Institutional Investors, 2.97% is owned by Insiders, and 27.33% is owned by Public Companies and Individual Investors.

So I am expecting investors confidence to return and I would be monitoring how CRM would be trading on Monday (02 Dec) before its earnings result as MTF show some promising upside.

Summary

As I have mentioned in one of my earlier article that chips sector might be rotating out, so investors might be shifting towards software, particularly AI focused software companies, one of the promising one I would say is Salesforce.

Salesforce have been working well on its cost cutting and continued to invest in new products, this strategy should put them in a good stead to capture the AI demand.

I would be monitoring this stock as I am looking for more AI software companies to invest into.

Appreciate if you could share your thoughts in the comment section whether you think Salesforce would continue to produce a strong fiscal third quarter result.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment