Selling Apple and Snowflake, Buffett keeps hoarding cash. Can US stocks still play?

On August 15, Beijing time, the mystery surrounding “Buffett reduced his holdings of US stocks” was finally solved — Berkshire released the US stock holdings report for the 2nd quarter (Form 13F) after the market until the last day of the statutory reporting period as of August 15, Beijing time.

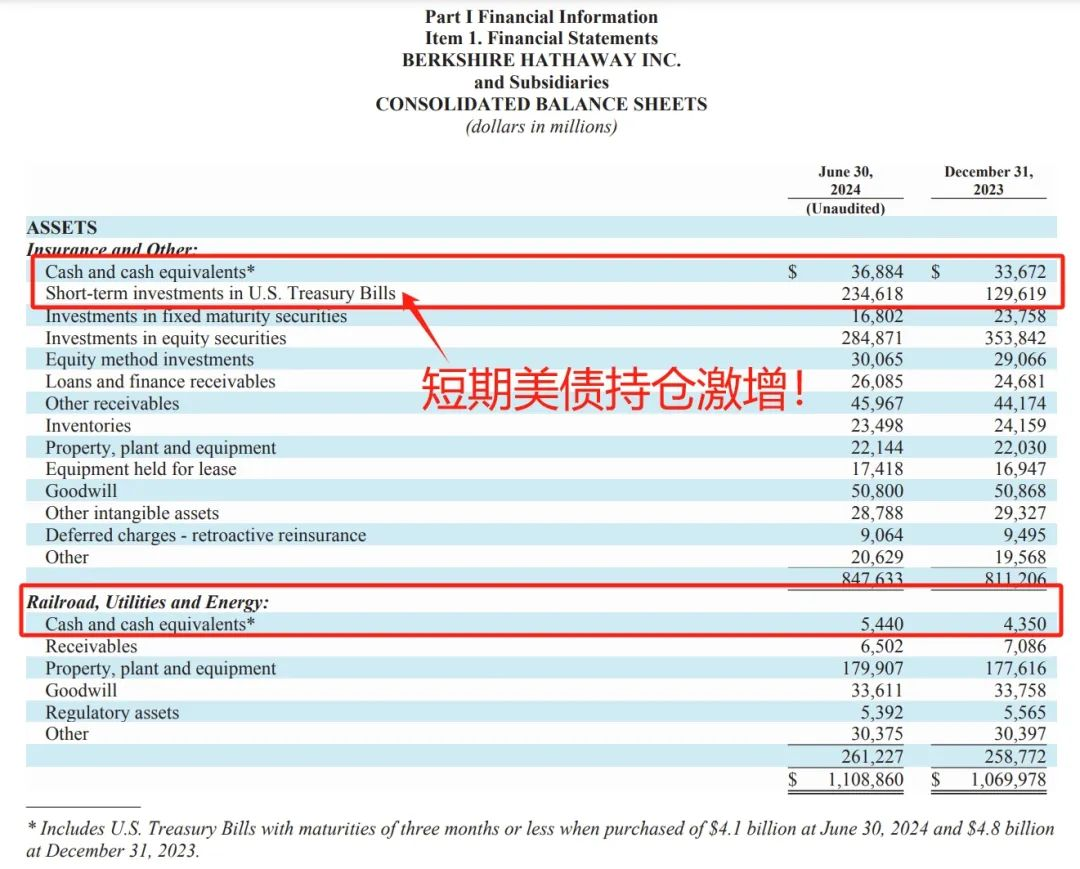

In Berkshire's second quarterly report on August 3, Berkshire's disclosure of “cutting Apple holdings” attracted global market attention. In that earnings report, Berkshire revealed that the company reduced its stock holdings by about $75 billion, while the cash level rose to an astonishing $276.9 billion. Among them, short-term US bond holdings with an annualized yield of about 5% rose to 234.6 billion US dollars, which is more than that of the Federal Reserve.

Since then, the market has been waiting for this 13F watch to see what exactly Buffett did.

Documents released last Thursday showed that as of the end of the second quarter, the value of Berkshire's US stock holdings was 279.969 billion US dollars, down 52.1 billion US dollars from the end of the first quarter (332 billion US dollars).

As the focus of the market's biggest concern, Berkshire reduced its holdings of 10 securities in the second quarter of this year. Of course, Apple was the harshest in cutting positions, which fell directly from 0.789 billion shares to 0.4 billion shares. Additionally, US cloud computing company Snowflake and media group Paramount Global were the only stocks that were cleared by Berkshire during the reporting period.

This move not only reminds people of his actions in the 70s and before the 2008 financial crisis, but also raised concerns about future economic recessions and even economic crises.Many investors expressed concern: “Does Buffett's sale mean US stocks can't be bought?”

In fact, historically, Buffett's two classic stock sell-offs occurred in the early 1970s and before the 2008 financial crisis. In both of these sell-offs, Buffett chose to clear his inventory or drastically reduce his stock holdings due to excessive market valuations, not because he anticipated an impending crisis. In fact, Buffett's investment principles have always been based on”Don't buy stocks that are too expensive” This is a simple yet effective idea.

Buffett's sale, US stocks fluctuate

1970s clearance operations:

In 1969, Buffett believed that stocks on the market were generally too expensive and could not find a suitable investment target, so he decided to clear the stock and close the investment company. Although the market experienced a round of bull markets in 1970 and 1972, he chose not to participate and did not re-enter the market until 1973 when the market plummeted. This operation proved that he attached importance to valuation rather than predicting short-term market fluctuations.

High cash holdings before the 2008 financial crisis:

In the mid-2000s, Buffett began drastically reducing his stock holdings and hoarding cash, also because he was unable to find investment opportunities with reasonable valuations. Although Buffett's performance lagged behind the market in those years, he successfully bottomed out after the 2008 financial crisis, proving that his decision to hold large amounts of cash a few years earlier was wise.

Current market operations:

Now, once again, Buffett has adopted a similar strategy, selling off a large number of US stocks and amassing huge amounts of cash. This suggests that he may think that the current market is overvalued and lacks sufficiently attractive investment opportunities, rather than simply based on concerns about a short-term economic crisis. Buffett's actions reflect his consistent investment logic: he would rather hold cash than risk buying overvalued stocks in an overvalued market.

Judging from Buffett's past operations, he does not rely on complicated market predictions, but instead adheres to simple but effective investment principles. Although this method is simple, it requires a great deal of patience and discipline to implement. For ordinary investors, although it is difficult to completely copy Buffett's actions, his emphasis on market valuation and his investment principles of being patient are certainly worth learning from.

In the current market, Buffett's actions may mean that market valuations are already at a high level, and risks are accumulating. However, when it comes to whether to follow Buffett to sell stocks, everyone needs to make decisions based on their own investment goals and patience. As Buffett said, the key to investing successfully is to avoid overvalued stocks and maintain sufficient capital and patience when opportunities arise.

Can we continue to invest in US stocks?

Investors naturally became uneasy when Buffett began selling off his long-held stocks such as Apple (Apple) and Snowflake, and hoarded large amounts of cash.

So does this series of actions mean that US stocks are about to face huge risks, or even difficult to continue investing?

Xiaobian will analyze this issue for you from multiple perspectives.

1. What do Buffett's actions mean?

This isn't the first time Buffett has sold shares in Apple and Snowflake. In fact, he has reduced his holdings of these shares in the past, but that doesn't necessarily mean he has lost confidence in the company's long-term prospects. More often, this is based on considerations of portfolio management, risk control, and finding other investment opportunities. At the same time, hoarding cash indicates that Buffett may think that the overall valuation of the market is too high or that there are no attractive investment targets, so he chose to hold cash temporarily. Buffett's strategies are usually based on long-term considerations and do not fully reflect short-term market trends. As a result, his actions are more of a defensive strategy than a clear prediction of an impending market crash.

2. Can US stocks still be played?

Whether US stocks can continue to be invested cannot be judged by Buffett's actions alone. Although Buffett reduced his holdings of some technology stocks, this does not mean that the entire market has lost investment value. On the contrary, there are still many companies with growth potential in the market. Investors should consider the following aspects:

Industry and individual stock options: In the current market pattern, although the overall valuation is high, some industries (such as technology, green energy, artificial intelligence) still have great potential for development. Investors can choose industries and individual stocks with long-term growth potential rather than just following market trends.

Market fluctuations and investment opportunities: Market volatility may increase, but for prepared investors, this is also a good time to look for undervalued opportunities. Even in a bear market, some companies can perform well, so keeping an eye on it and being flexible to adjust your portfolio is critical.

Asset Allocation and Risk Management: Investors can reduce risk in a single market or industry by diversifying investments and rationally allocating assets. A moderate cash holding ratio can also help cope with market fluctuations while entering the market at the right time.

3. Was Buffett's action a warning?

Buffett's actions have undoubtedly raised concerns about market valuations. However, the short-term trend of the market is not entirely driven by valuation, but is also affected by factors such as liquidity, policies, and corporate profit expectations. Buffett's strategy is more of a defensive arrangement, reminding investors to be cautious when the market is high.

For ordinary investors, the key is not to blindly follow suit, but to make moderate adjustments according to their own risk tolerance and investment goals.

Interest rate cuts are coming, the economy is doing well, and there are still plenty of opportunities for US stocks

The recent return of optimism in the market can be attributed to the following four key aspects:

1. Inflation data weakens: the economy cools rather than recedes

The July inflation data fell short of expectations, with CPI and PPI increasing by 2.9% and 2.2%, respectively. In various categories such as food, clothing, new and used cars, and air tickets, monthly prices have declined, indicating that consumer prices are slowly falling. However, prices in the housing and rental sectors remain high, and the cost of motor vehicle insurance remains high. Although inflation in these areas is falling slowly, over time, these prices will gradually return to rationality and further support the downward trend in overall inflation.

The slowdown in inflation is significant for both the market and the Federal Reserve. For consumers, a reduction in the cost of living will help increase their desire to spend, which will further stimulate economic activity. For the Federal Reserve, cooling inflation has made it more feasible to achieve the 2.0% PCE inflation target. Therefore, the further decline in inflation data in the next few months will be an important reference basis for the Federal Reserve to adjust its monetary policy, which may prompt it to start a cycle of interest rate cuts.

2. Economic data exceeds expectations: consumer spending and the job market are stable

Although the market was worried about the recession due to the poor performance of the July non-farm payrolls report, a series of recent economic data performance exceeded expectations, easing these concerns. For example, retail sales increased by 1% in July, far exceeding market expectations of 0.4%, and the consumer expectations index was also higher than expected. Meanwhile, initial jobless claims have declined steadily over the past few weeks, indicating that although the labor market has slowed down, it has not deteriorated dramatically.

The improvement in economic data shows that although the US economy is cooling down, it is still on a healthy growth trajectory. The increase in retail sales shows consumer resilience, which is critical to the overall economy, as consumer spending accounts for more than 70% of US GDP. However, the decline in the unemployment rate shows that although the growth rate of the labor market has slowed, there has been no large-scale wave of unemployment. These data will further support the market's expectations for a “soft landing,” where economic growth will slow but not fall into recession.

3. The Federal Reserve's policy path: is the interest rate cut cycle about to begin?

As inflation data weakens and economic data improves, market expectations that the Federal Reserve will start a cycle of interest rate cuts at the September 18 FOMC meeting have gradually increased. Although the market speculates that the Federal Reserve may cut interest rates by 50 basis points at once, current economic data do not indicate that such aggressive monetary policy adjustments are needed. Therefore, the Federal Reserve may choose a more cautious approach and gradually adjust its policy by cutting interest rates slightly.

The Federal Reserve's interest rate cut will have a profound impact on the financial market, especially when the current market's expectations for future economic growth are optimistic. Interest rate cuts will not only reduce financing costs for enterprises, but will also boost market sentiment and push the stock market up. However, the Federal Reserve's interest rate cut policy may also cause some investors to re-evaluate asset allocation strategies, especially for high-risk, high-return growth assets. Therefore, the future direction of the Federal Reserve's monetary policy will be the focus of market attention.

4. Market outlook: a diversified leading upward pattern may be formed

Against the backdrop of slowing inflation and improving economic data, the market has recently seen a significant rebound, particularly in the areas of technology and growth. As the Federal Reserve may begin a cycle of interest rate cuts, market leadership may expand from previously large technology stocks to more industries, such as industry and utilities. Diversification of market leadership is likely to be a new theme over the next 18 months, which will open up broader opportunities for investment portfolios.

Historical experience shows that if the Federal Reserve starts cutting interest rates and the economy achieves a soft landing, the market usually performs well. Investors may diversify their investments from overly concentrated technology stocks and shift to other value and cyclical industries. Therefore, investors should pay attention to diversified allocation opportunities in future market fluctuations, especially those benefiting from economic recovery and slowing inflation, such as industry, utilities, and finance. As market uncertainty gradually subsides, diversified investment strategies will help address future risks and seize potential revenue opportunities.

Through in-depth analysis of these four key points, it can be seen that the current return of market optimism has a solid foundation. As inflation data continues to improve, the economy grows steadily, and uncertainty about the Federal Reserve's policies gradually weakens, the market may enter a new recovery cycle.

In the current context where interest rate cuts are about to begin and the economic situation is relatively stable, the following types of ETFs are worth paying attention to:

1. Large value ETF

As the interest rate cut cycle begins, the environment of stable economic conditions and lower interest rates will help improve the performance of value stocks, especially those with steady profitability and stable cash flow. These companies are generally able to show greater resilience during economic cycles.

Value ETFs, such as the Vanguard Value ETF (VTV) or the iShares Russell 1000 Value ETF (IWD), may benefit from this trend.

2. High dividend ETF

In a low interest rate environment, investors tend to prefer assets that provide stable dividend returns because such assets can provide more reliable returns when interest rates fall.

High-dividend ETFs such as the Vanguard High Dividend Yield ETF (VYM) or iShares Select Dividend ETF (DVY) are options worth considering.

3. Real Estate Investment Trusts (REITs) ETFs

Interest rate cuts generally benefit the real estate market, particularly real estate investment trusts (REITs), as lower interest rates can reduce financing costs and increase property values.

REITs ETFs, such as the Vanguard Real Estate ETF (VNQ) or Schwab US REIT ETF (SCHH), may perform better in an interest-rate cut environment.

4. Technology and growth ETF

Although value stocks may perform well in this environment, technology and growth stocks may also continue to benefit as economic growth is maintained, especially when interest rate cuts bring lower financing costs.

Technology ETFs, such as Invesco QQQ Trust (QQQ) or Vanguard Information Technology ETF (VGT), can continue to benefit from long-term growth trends.

5. Cyclical industry ETF

Steady economic growth also usually drives the performance of cyclical industries, such as the industrial, financial, and materials industries. The performance of these industries is closely linked to the economic cycle and generally performs well during periods of economic expansion.

Cyclical sector ETFs, such as the Industrial Select Sector SPDR Fund (XLI) or Financial Select Sector SPDR Fund (XLF), may be worth watching.

In a context where interest rate cuts are about to begin and the economy remains stable, investors can choose a more credible brokerage firm to allocate ETFs in value, high dividend, REITs, technology and growth, and cyclical industries. For example, Carson Wealth Management is a world-renowned investment brokerage firm. If you open an account with Carson Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) to the multi-asset wallet BiyaPay, and then withdraw fiat money to Jiaxin Securities to invest in US stocks. You can also directly search its code on the BiyaPay platform to invest in this type of asset. It can not only provide potential benefits when interest rates fall, but also benefit in an environment of steady economic growth.

Finally, Xiaobian would like to say that although Buffett's sell-off has raised concerns about the US stock market, this does not mean that US stocks are no longer worth investing in. There are still opportunities in the market, and the key is how investors can identify these opportunities and properly manage risk. Buffett's strategy reminds us to be calm and cautious when the market is overvalued, while also emphasizing the importance of cash. However, every investor's situation is different, and decisions should be based on one's own investment goals and understanding of the market, rather than simply following Buffett's footsteps.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment