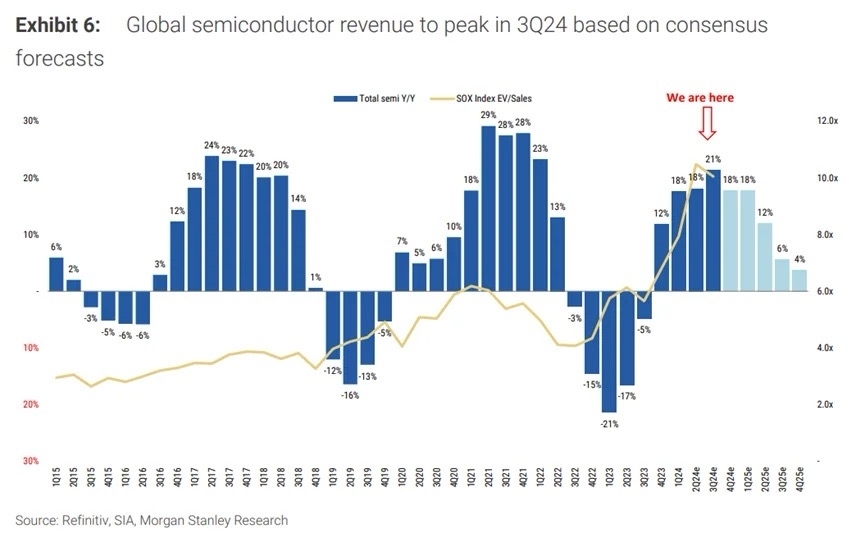

AI tech stocks, particularly semiconductor companies, are facing the challenge of "overly high expectations," which create short-term performance pressures. Since semiconductors are widely used in household appliances, smartphones, computers, and cars, they are also vulnerable to demand slowdowns in these industries, adding to the uncertainty. Morgan Stanley Research predicts that global semiconductor revenue will peak in Q3 2024, though the institution still expects three more quarters of double-digit growth.

104671293 DW : good

103681867 : good