Set sail with bonds and related funds before rate cuts hit

Hi, mooers.![]()

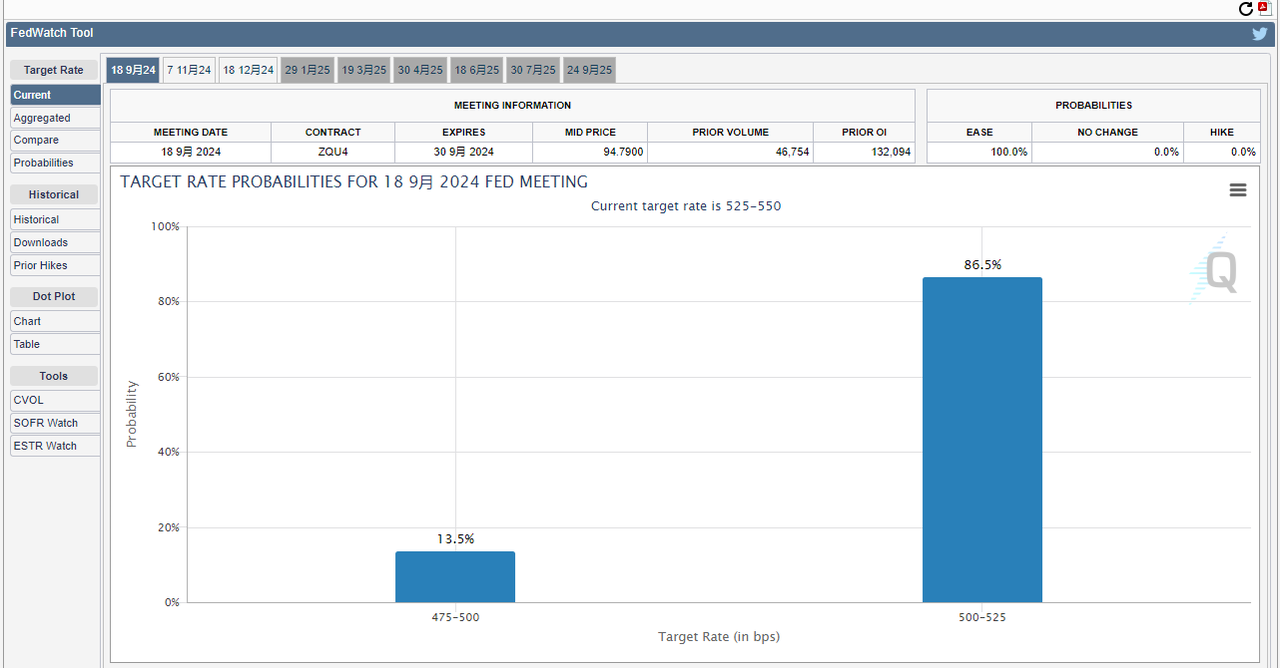

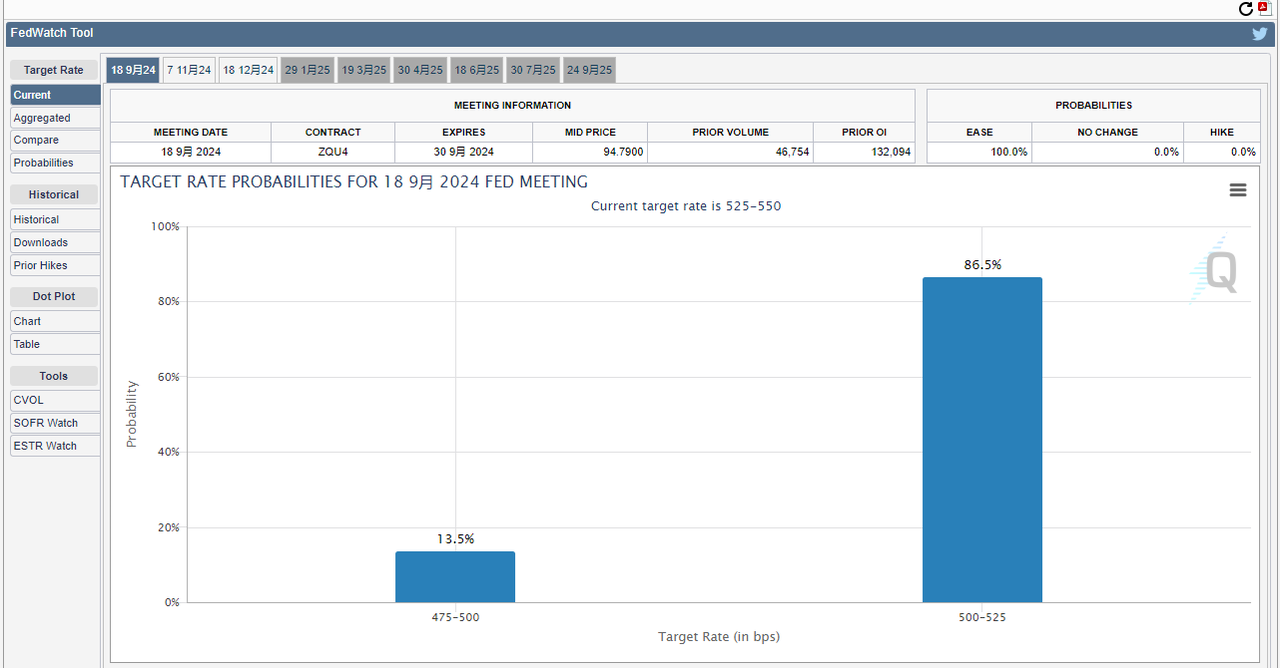

The FOMC wrapped up its July session on 31 July. Powell hinted that if inflation and economic indicators stay strong, rates could drop in September. The market, as indicated by CME's FedWatch, is fully pricing in a 100% probability of such a cut.

When interest rates fall, it's typically good news for bond investors. Bond prices tend to go up, which means you could see higher returns while still enjoying a steady income.

Thinking about US Treasuries or bond funds? If you're scratching your head over the choice, we've got you covered with a mini-class to break it down.

1. What are they?

US Treasuries are financial instruments through which the government borrows funds, which are crucial for supporting its fiscal responsibilities. They are synonymous with security, anchored by the US government's solid reputation.

2. Why consider investing?

Exceptional safety: Backed by the US government, they are among the safest investments you can make.

Predictable income: Fixed interest payouts are ideal for those desiring consistent earnings.

Investment variety: With short to long-term options, they align with a variety of investment objectives.

Got an eye on US Treasury Bonds? Check out our special offer, "Lock in 5%+ stable yields with US Treasury", and pay no commission if you get in by 30 June. Don't let this opportunity slip away!

1. What are they?

Bond funds are collective investments in bonds from sovereign, financial, and corporate entities, offering a spectrum of risk profiles. They are seen as less risky than stocks yet provide more security compared to individual corporate bonds, which offer higher yield prospects.

2. What benefits do they offer?

Balanced risk: Less risky than stocks but offers better potential returns than some other options.

Entry-level friendly: Managed by experts, they take the pressure off you to track the market.

Flexible access: You can access your capital promptly in case of financial emergencies.

Here are three funds with substantial US Treasury holdings:

Check out the following images showing how these funds have performed. Which one do you back?

Cash Plus has always been our mooers' popular investment choice. It provides us with liquidity and relatively stable yet considerable returns. To celebrate National Day, we're offering new clients a guaranteed return of between 5.8% and 6.8% on our Cash Plus fund for the first 30 days. Don't miss out on this limited-time offer!

We hope this mini-class has been informative. Now that you know more about US Treasuries and bond funds, we'd love to hear your thoughts!

1. How are you preparing for a potential rate cut?

2. Is now the right time to invest in bonds? What's your strategy?

3. Have US Treasuries or bond funds been part of your portfolio? Give us your take and show us your gains or losses!

Feel free to share your investment strategies and insights in your posts to join our discussion and win rewards. ![]()

⏰ Event time:

8 August – 22 August, 2024

1. 18% (3d) fund coupon: for writers of the top 5 influential posts of over 50 words

2. 80 points: for all writers of on-topic posts over 50 words

*Notes:

The influential posts will be selected based on post quality, originality, creativity, and influence.

Posts that are not original or relevant shall be excluded.

All rewards are mutually exclusive.

All rewards will be distributed to your universal account within 15–30 working days after the winner's announcement.

This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : Given the likelihood of a rate cut, I’ll be focusing on high-yield bonds and dividend-paying stocks to capture better returns. I’m also considering bond ETFs, which tend to perform well in a declining rate environment. My strategy is to balance risk and reward by diversifying across these assets while keeping an eye on market trends to prepare for potential rate adjustments.

mr_cashcow : Time to shift from cashplus to bond fund?

Moo_Rich OP : Welcome to join our discussion to win rewards!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Set sail with bonds and related funds before rate cuts hit

Set sail with bonds and related funds before rate cuts hit

Khin8858 : I have used up all my us investment fund hence even if there is a rate cut there is not much alternatives I will go for in the US market. rather I will stick to the sg market going for the blue chips stock catching them at current low price and wait for the rebound. from past years seems it will benefit the Asian market more with the rate cut. and sg blue chip definitely will still give good dividend hence this will be how I will approach this.

Hd hengheng : I will try to diversify my portfolios for a potential rate cut. I am having a bullish synthetic option trade on TLT now. while not 100% sure, I think it is the right time to invest in high quality bonds now. I am investing other platform to trade TLT option trade. Attached is my current performance so far.

Steve77 : Definitely going in on the Sept 2025 US Treasury note. I had been purchasing more of these notes as I value the fixed dividends that I will be getting and then reinvesting them in other blue chip stocks or bonds on the SGX. Not really an ideal place to invest but there are not many other alternatives available to retail investors

ZnWC : Thanks for the event![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

My sharing:

Invest in Cash Plus Fund, T-Note & Bond Fund amid US Fed Rate Cut?