Berkshire -99%, Flat Market, and Gamestop Memes | Herd on Wall Street

Morning mooers! Happy Monday, and happy June! The market is open, memeing and mixed, and T+1 settlement might still cause issues. Shortly after 10 AM the New York Stock Exchange showed pricing errors, displaying $Berkshire Hathaway-B (BRK.B.US)$down 99%.

UPDATE 11:40: the stock resumed trade just past 11:30 AM, up about 1%.

It wasn't the only equity haulted on the way down from pricing errors, as $Chipotle Mexican Grill (CMG.US)$ an about a dozen other stocks also fell; check in for more updates.

My name is Kevin Travers, here are stories heard on a Wall Street today.

The largest climber on the S&P was $Autodesk (ADSK.US)$, up 7% after an audit committee said there would be no changes to their previously announced GAAP and non-GAAP earnings results.

$Paramount Global-B (PARA.US)$ was right behind, climbing 7% after confirmation of the firm's merger with Skydance based on terms to be announced in the coming days, according to CNBC's David Farber.

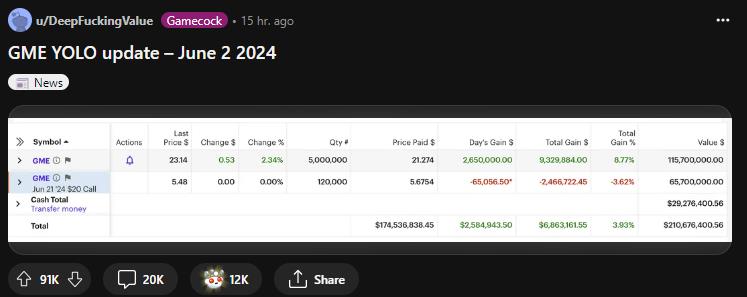

$GameStop (GME.US)$ was surging 25% Monday after Roaring Kitty posted a screenshot of an alleged position and call options in Gamestop valued over $180M to a Reddit community. Other meme stocks saw volatility, with $AMC Entertainment (AMC.US)$+13%.

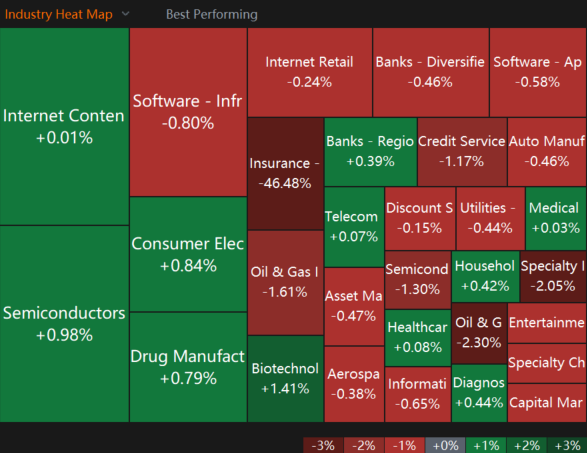

In industries, 'Insurance' stocks were down a whopping 46% due to Berkshire's pricing errors.

$Crude Oil Futures(JUL4) (CLmain.US)$ fell by a dramatic 3.3% after an OPEC+ meeting Sunday where the cartel agreed to extend production cuts to the end of 2025.

Gold climbed 0.40%, while Silver prices traded -0.13%. Bitcoin climbed about 1.59%.

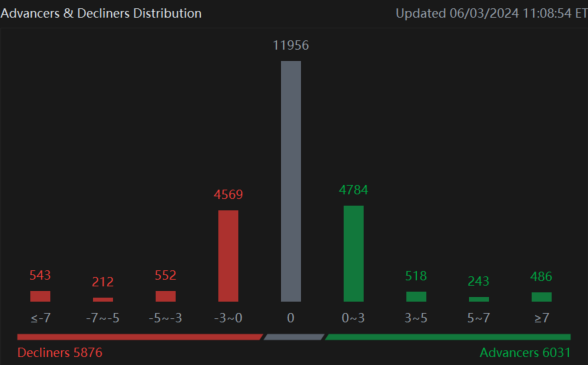

As a general recap, indexes were mixed and the market was flatter. Just after 11 AM EST, the $S&P 500 Index traded -0.17%, the $Dow Jones Industrial Average fell 0.53%, and the $Nasdaq Composite Index climbed 0.21%.

By direction, 6000 equities climbed, while 5800 fell.

In macro this week, investors will watch for Initial jobless claims, non-farm payrolls, and unemployment data.

Last week, the Personal Consumption Expenditure Index inflation gauge showed a slight month-to-month slowdown. Core prices climbed just 0.2% from March to April, while year-over-year changes came in at expectations, maintaining last month's 2.7% regular and 2.8% core price growth.

Thursday, revised GDP numbers for Q1 showed the U.S. economy grew at a slower 1.3% annual pace in the first three months of the year, largely due to softer consumer spending. The numbers were revised down from a previous 1.6%.

The $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ fell to 4.82, and the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ 4.42.

Mooers on Friday were worried about inflation, saying that it was still to high and that aa 0.1% drop was not enough.

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Father-Flash : RK doesn't make the squeeze. he merely informs the people it is a collective effort of retail in order toRK doesn't make the squeeze. he merely informs the people it is a collective effort of retail in order to squeeze institutions he is merely the catalyst

EZ_money : we never had RK before why would it matter

NewBB : Definitely squeezed, bullish in the short term

Radio09 EthiCapitalist : Wise!

Scapey T Goat :

Victorious : He does not "cause" anything to happen; he educates people, nothing more.

ohTHATguy EthiCapitalist : It’s funny how they believe they are smart and that nobody can see what game plan is being played out. Just like politicians we get the dumbest fucks in positions of power. So nice to see the day the world grows a back bone n says enough of this shit and take these systems down. My dogs can make better decisions then any of these greedy fucks

titanium mp : cool!

Kevin Travers OP EthiCapitalist : What makes you feel that way?

103798743 : $GameStop (GME.US)$

View more comments...