SG Morning Highlights | DBS Partners with Japan Finance Corporation to Support Japanese SMEs in Asia

Good morning mooers! Here are things you need to know about today's Singapore markets:

● Singapore shares opened higher on Thursday; STI up 0.21%

● Singapore Retains Position as a Top Real Estate Investment Destination in Asia Pacific for 2025

● Singapore's Private Home Prices Forecasted to Rise Up to 7% in 2025

● Stocks to watch: Mapletree Logistics Trust, DBS, etc.

● Latest share buy back transactions

- Moomoo News SG

Market Snapshot

Singapore shares opened lower on Thursday. The $FTSE Singapore Straits Time Index (.STI.SG)$ rose 0.21 percent to 3715.98 as at 9:15 am.

Advancers / Decliners is 94 / 55, with 77.55M securities worth S$100.80M changing hands.

Breaking News

Singapore Retains Position as a Top Real Estate Investment Destination in Asia Pacific for 2025

Singapore is poised to remain a key real estate investment hub in the Asia Pacific region in 2025, as highlighted in the "Emerging Trends in Real Estate® Asia Pacific 2025" report by PwC and the Urban Land Institute. Despite its strong ranking, the city faces challenges due to tight capitalization rates, which at about 3.4%, are lower than current borrowing costs of 3.94%, dampening significant buying interest. Transaction volumes have stayed low, except for some major deals in Q3 2024, keeping annual transactions near 2023 levels. Concerns about increasing office space supply and weak rental growth prospects are noted, although the market's fundamental strength remains robust. Investors seeking higher returns are increasingly looking at value-add strategies, albeit these are complicated by the need for sustainability upgrades and the focus on lower-priced assets.

Singapore's Private Home Prices Forecasted to Rise Up to 7% in 2025

In 2025, Singapore's private residential market is expected to see a price growth of 4% to 7%, fueled by robust economic expansion, according to Huttons. The real estate agency forecasts that developers will sell between 7,000 and 8,000 new units and the resale market will witness 10,000 to 12,000 transactions. Additionally, 22 new projects launching in 2025 will contribute 11,787 units to the market, including notable developments like Aurelle of Tampines and an Executive Condominium at Plantation Close. With continued strong demand, the government might increase its first half 2025 Government Land Sales (GLS) supply by 10% to 5,500 units. Key launches in various regions include Aurea, Holland Drive, and Marina View Residences in the Core Central Region; Arina East Residences and Bloomsbury Residences in the Rest of Central Region; and Bagnall Haus and Lentor Central Residences in the Outside Central Region, reflecting a vibrant and expanding residential market landscape for the year.

Stocks to Watch

$Mapletree Log Tr (M44U.SG)$ has successfully divested two of its warehouse properties in Japan for a total of 4.25 billion Japanese yen (approximately S$37.5 million). The properties, Toki Centre and Aichi Miyoshi Centre, were sold under sale and purchase agreements facilitated by MLT’s trustee, HSBC Institutional Trust Services (Singapore), with a third-party buyer. The announcement about these transactions was made recently, while units of MLT closed unchanged at S$1.28 on Wednesday, prior to this announcement.

$DBS (D05.SG)$ has signed a memorandum of understanding with Japan Finance Corporation (JFC), a public corporation wholly owned by the Japanese government, to facilitate the expansion of Japanese small and medium-sized enterprises (SMEs) into six key Asian markets. These markets include Singapore, China, Hong Kong, India, Indonesia, and Taiwan, where DBS will act as the single banking partner. As part of the agreement, JFC will provide standby letters of credit to Japanese SMEs, aiding their local subsidiaries in securing smoother access to long-term local currency-denominated funding. Prior to this announcement, shares of DBS saw an increase, closing up 0.3 percent or S$0.14 at S$41.85 on Wednesday.

$First Sponsor (ADN.SG)$ is set to increase its ownership in Dutch property developer NSI from 17.5% to about 22% through the acquisition of 920,839 NSI shares. The deal, valued at 18.9 million euros (approximately S$26.6 million), was announced on Thursday. First Sponsor plans to finance this transaction using the net proceeds from its rights issue scheduled for September 2024. Despite this strategic move, shares of First Sponsor closed at S$1.03 on Wednesday, down S$0.01 or 1%.

$IREIT Global SGD (UD1U.SG)$ has entered into a 20-year lease agreement with the UK hotel chain Premier Inn, securing about 12% of the net lettable space at its Berlin Campus asset. This lease marks the first major commitment in IReit's ambitious 42 million-euro (S$59.5 million) refurbishment project, which is set to begin in the second quarter of 2025. The announcement was made by the company's manager on Thursday. Despite this significant development, units of IReit Global closed flat at S$0.28 on Wednesday.

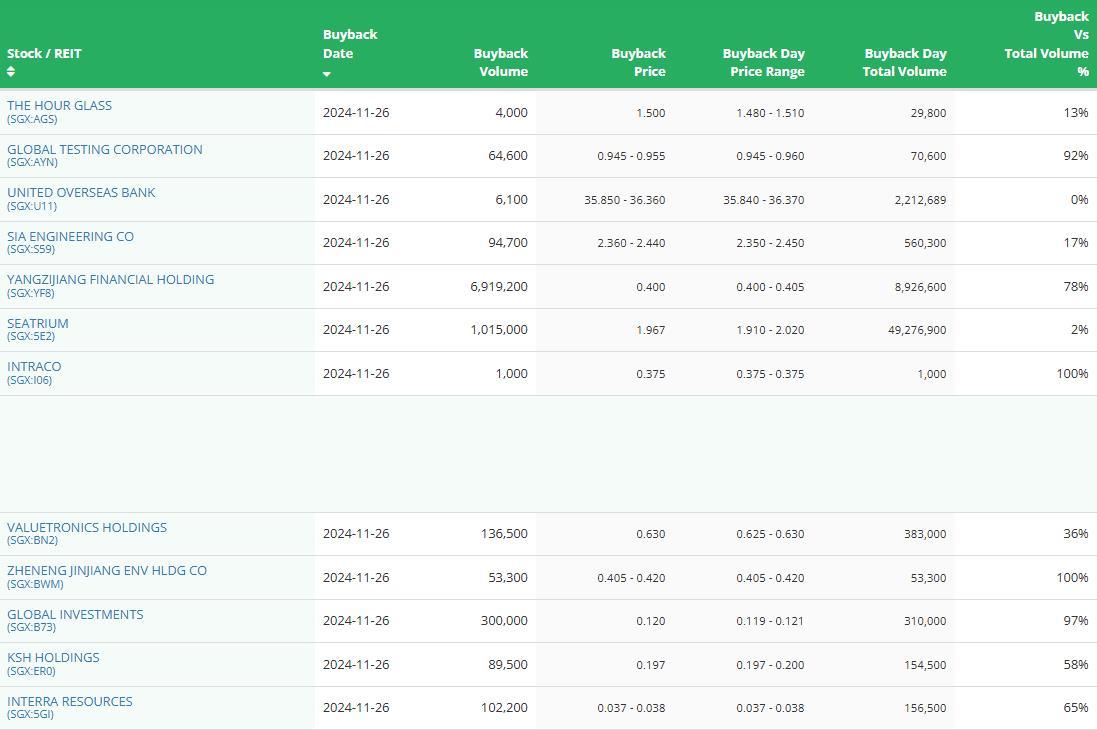

Share Buy Back Transactions

Source: Business Times, SGinvestors.io, Business Review

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101550592 :

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Kuku bird on fire ❤ :