SG Morning Highlights | S-REITs Record Negative Total Returns in January

Good morning mooers! Here are things you need to know about today's Singapore markets:

●Singapore shares opened higher on Tuesday; STI up 0.20%

●Maybank: Financial, Tech, and Consumer Sectors to Benefit from Singapore Budget 2024

●S-REITs Record Negative Total Returns in January

●Stocks to watch: Straits Trading

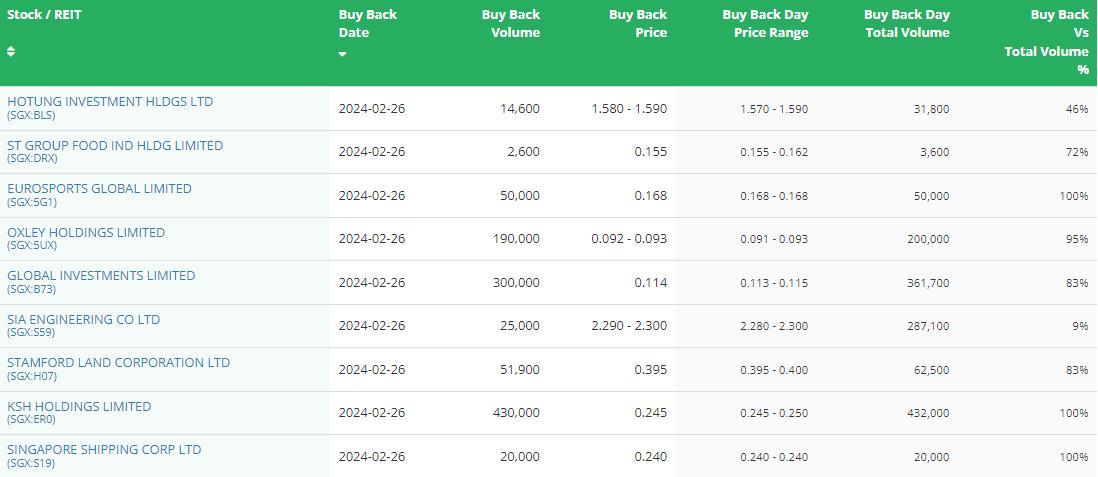

●Latest share buy back transactions

-moomoo News SG

Market Snapshot

Singapore shares opened higher on Tuesday. The $FTSE Singapore Straits Time Index (.STI.SG)$ rose 0.20 percent to 3,177.55 as at 9.05 am.

Advancers / Decliners is 74 to 52, with 92.30 million securities worth S$51.33 million changing hands.

Breaking News

Maybank: Financial, Tech, and Consumer Sectors to Benefit from Singapore Budget 2024

Maybank analysts have identified financial, technology, and consumer staples sectors as the top beneficiaries of the support measures and tax reliefs unveiled in Singapore's Budget 2024. In addition, companies in the renewables sector are expected to benefit from the new $5 billion Future Energy Fund aimed at spurring green investments. The budget also includes an investment tax credit with refundable cash features, which could support the high-value initiatives of companies from research and development to the expansion of manufacturing capacity. The analysts predict that the relief measures will have a marginal positive impact on sales volumes of real estate developers like UOL and CDL. The longer-term schemes are expected to improve productivity and raise social inclusivity, boosting long-term growth.

S-REITs Record Negative Total Returns in January

Singapore's Real Estate Investment Trusts (REITs) ended January with a negative total return of -4.6%, despite retail investors buying $195.6m of S-REITs while institutional investors sold $192.6m. This represents a drop from 2023's iEdge S-REIT Index return of 6.6%. However, the index had rebounded close to 20% in total returns from its lows at the end of October 2023.

Stocks to Watch

$Straits Trading (S20.SG)$: Straits Trading Company reported a net loss of S$43.5 million for H2 FY2023, down from S$121.8 million in the previous year. The real estate segment remained the main contributor to the group's performance, posting a lower fair value loss from certain investment properties in Australia, China, South Korea, and the UK. The resources segment also saw a year-on-year growth in profit due to cost-control initiatives and production process optimization. However, total revenue for the half-year was down 0.6% to S$255.9 million due to lower tin mining and smelting revenue, despite a rise in property revenue. The hospitality segment returned to profitability in H2, but higher operating expenses partially offset the positive demand from international travel.

$Gallant Venture (5IG.SG)$: Gallant Venture, a developer and utilities provider for industrial parks and resorts in Batam and Bintan, recorded a net loss of S$16 million for H2 2023, despite a 4% increase in revenue to S$94.7 million. The loss was mainly due to higher finance costs and lower profit contributions from associated companies, according to Gallant Venture's profit guidance. The group attributed the revenue growth to higher income from industrial leases and utilities, driven by increased occupancy from the industrial parks segment and a housing project in Batam. However, administrative expenses also increased to S$10.2 million in H2 2023.

Share Buy Back Transactions

Source: Business Times, SGinvestors.io

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment