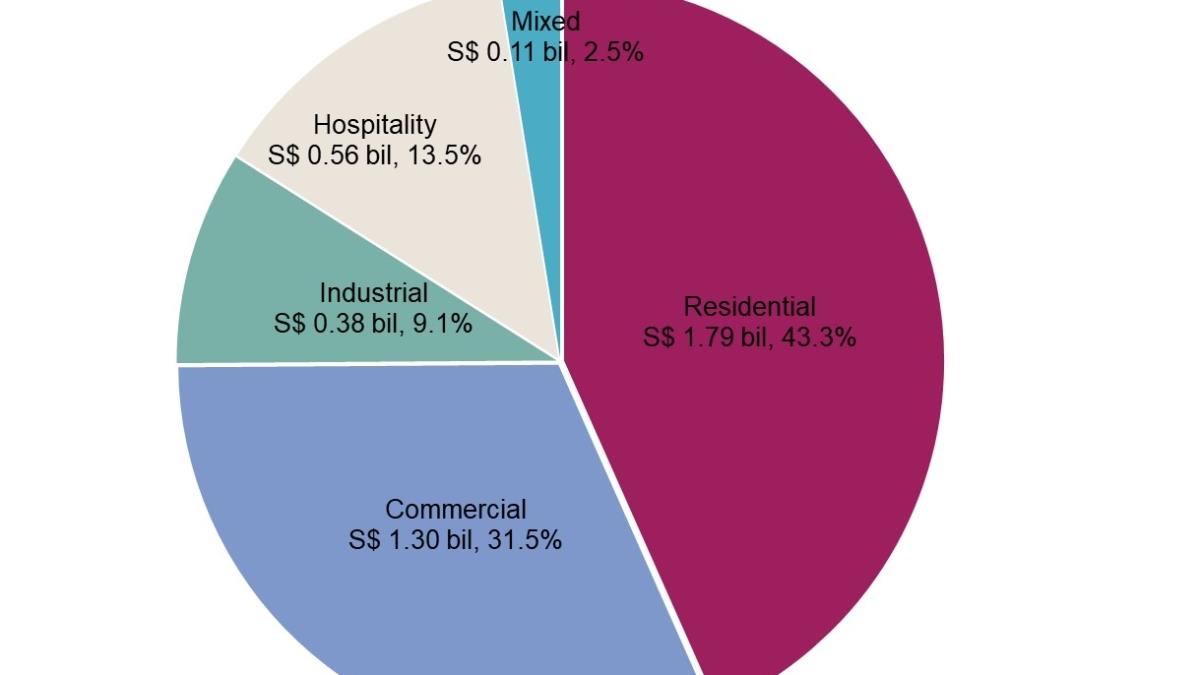

The residential sector has dominated investment sales in 1Q24 with $1.79 billion, accounting for 43.3% of the total transactions for the period. However, residential investment sales dropped 48.5% quarter-on-quarter. The commercial property sector followed closely behind with $1.3 billion worth of investment sales in 1Q24. Like residential, the commercial property sector also saw a drop in total transactions, recording a 20.9% QoQ dip. Meanwhile, the industrial sector recorded $375.4 million in investment sales in 1Q24, a 25% growth from 4Q23. The largest private sector transaction in 1Q24, the $140 million sale of OneTen Paya Lebar, belonged to the industrial sector. Savills noted that this attests to the attraction of high-quality data centre assets in Singapore by investors and operators.