Shopify Earnings Preview: Shopify Plus Momentum May Boost Q1, With a Close Eye on Operating Expenses

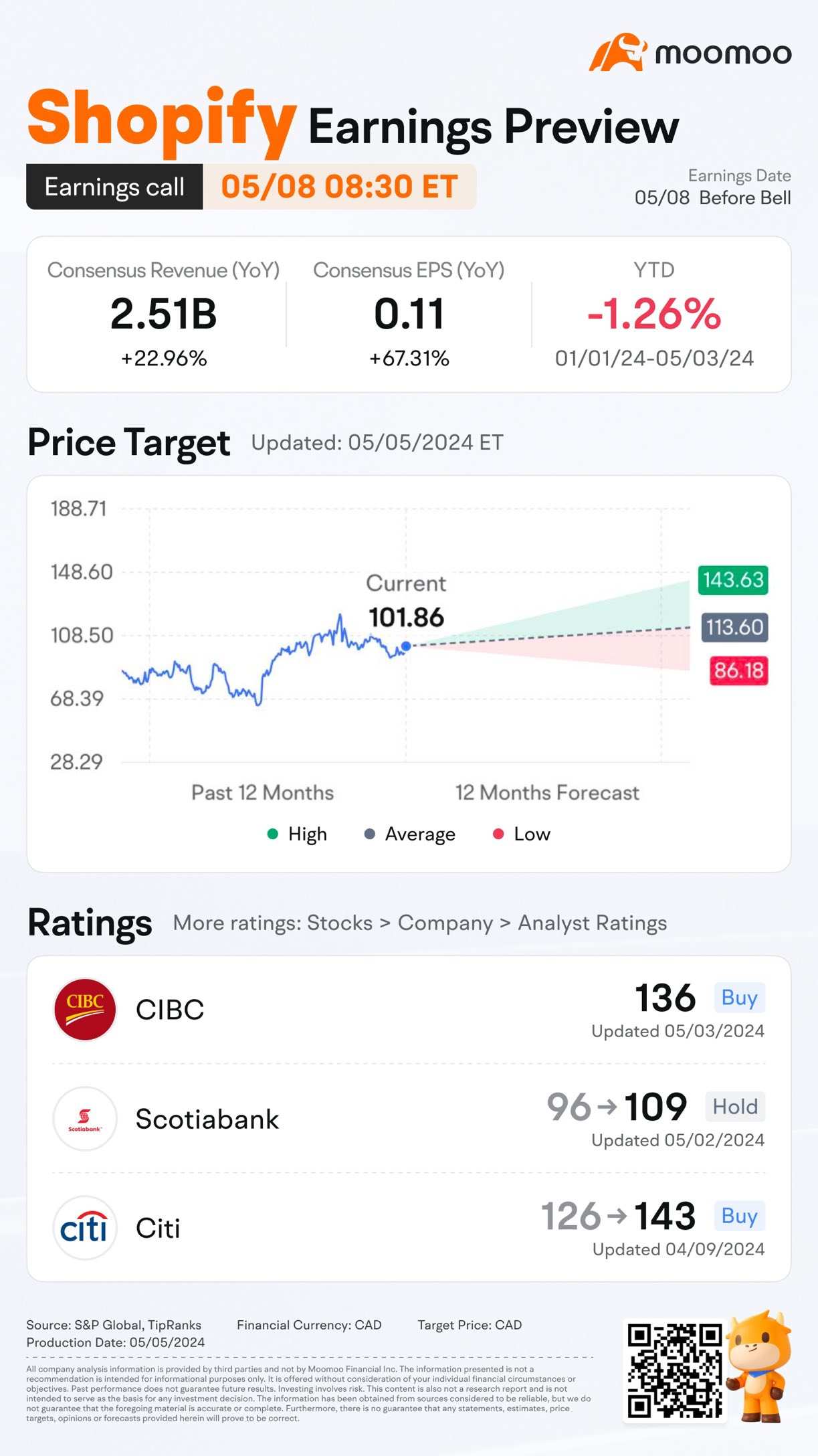

$Shopify Inc(SHOP.CA$ is scheduled to report its first-quarter earnings for 2024 on May 8, with an expected pre-market release of the financial figures. According to consensus analyst estimates, Shopify is set to deliver an EPS of C$0.11, with a growth of 67% compared to the same period last year, according to Bloomberg.

Here are the key financials to focus on:

1. Gross merchandise volume growth

$Shopify(SHOP.US$'s gross merchandise volume (GMV) is anticipated to showcase robust growth, with consensus estimates pegging it at C$59 billion, marking a 19.95% increase from the prior year. This expected sustainable growth is attributed to the diversification of Shopify's merchant base and the continued acquisition of high-value clients, especially within the Shopify Plus ecosystem. Additionally, the point-of-sale (POS) system is expected to contribute to this upward trajectory, potentially compensating for any slowdown in same-store sales.

2. Operating expenses growth

Operating expenses (OpEx) have been a focal point since the last quarter's guidance indicated a low-teens GAAP OpEx increase. This management split the increase into marketing efforts (split again between performance marketing and POS investments) and employee-related expenses (predominantly payroll tax, seasonal costs, and compensation increments). While investors are concerned about the growing expenditures, analysts suggest that the nature of these costs is transitory and unlikely to have a long-term detriment to Shopify's financial health.

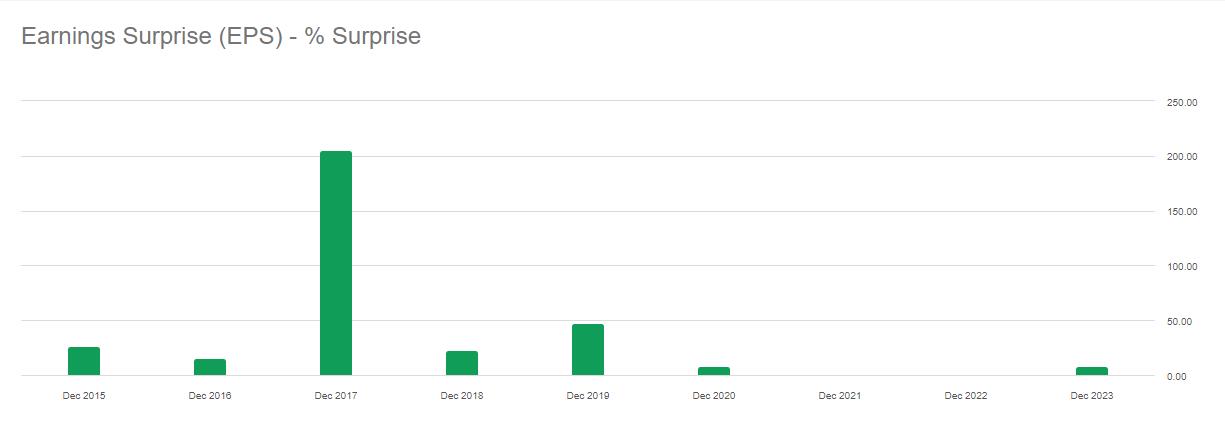

Is Shopify expected to beat earnings?

Shopify has a reputation for conservative guidance, a trend that could very well continue in this upcoming earnings report. Notably, Shopify has received 24 upward revisions for Q1 2024 revenue as analysts adjust for stronger-than-expected consumer spending and e-commerce data throughout the quarter. As of today, the consensus analyst estimate for Shopify's Q1 revenue sits at C$2.5B, in line with management's guidance of +22.5% yoy.

A vote of confidence comes from Citi, which recently upgraded Shopify to Buy from Neutral, while raising the price target from C$126 to C$143. This upgrade follows a series of conference visits and channel checks that have reaffirmed a resilient e-commerce landscape and Shopify's ability to capture a larger share of the market. Citi's deep-dive into Shopify's Merchant Solutions segment has reinforced its conviction in the company's long-term growth trajectory, especially as the company gears up for a product and feature take-rate expansion expected to hit its stride in 2025.

Wall Street previews the secular trends powering Shopify's growth will remain strong for years to come. While its financial performance is set to come under pressure in the near term, Shopify is still growing profitably at scale. However, investors should also be cautious that the slightest hint of moderation in growth rates may be punished in this environment, given Shopify's present elevated trading multiples.

Source: Bloomberg, Seeking Alpha

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment