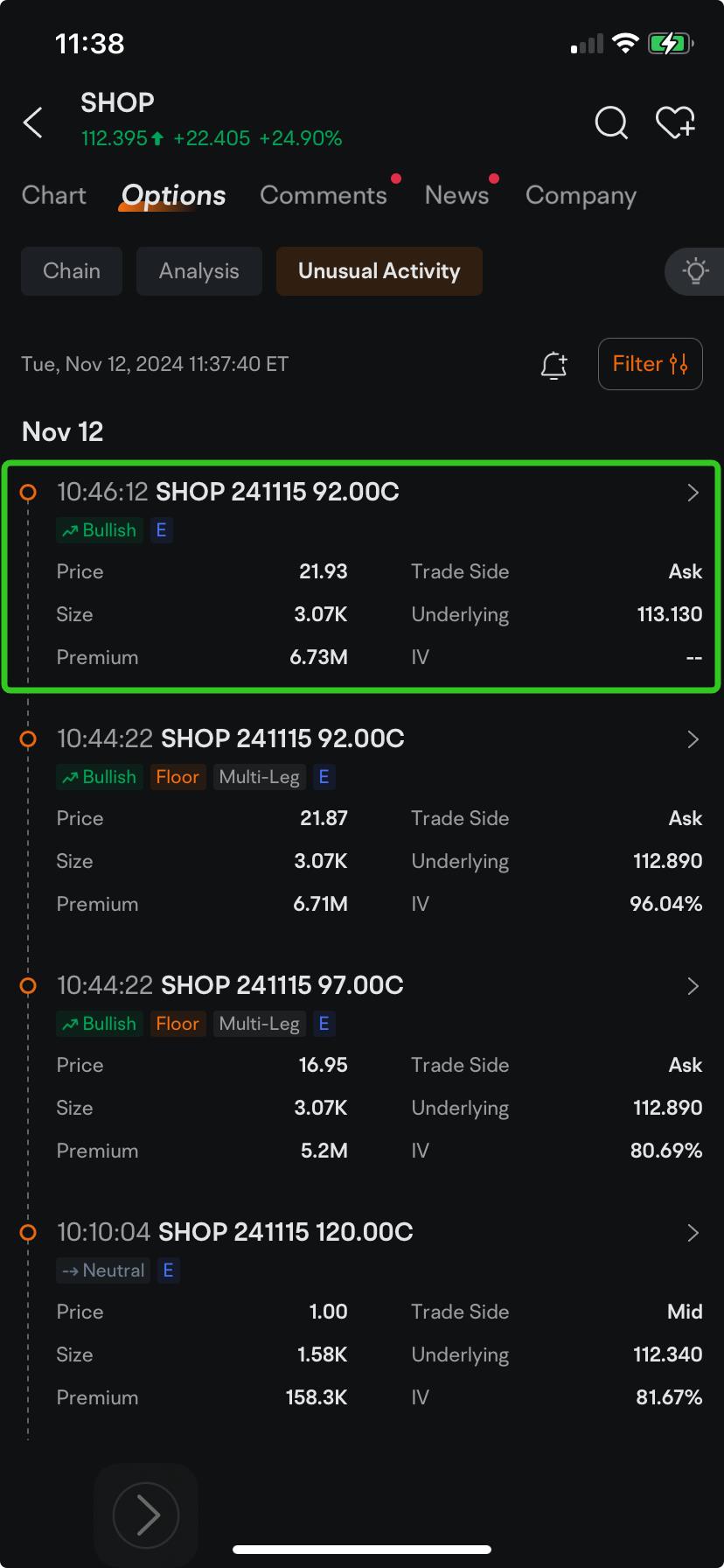

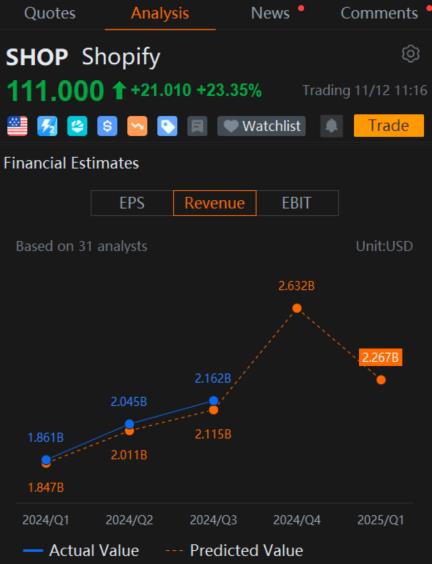

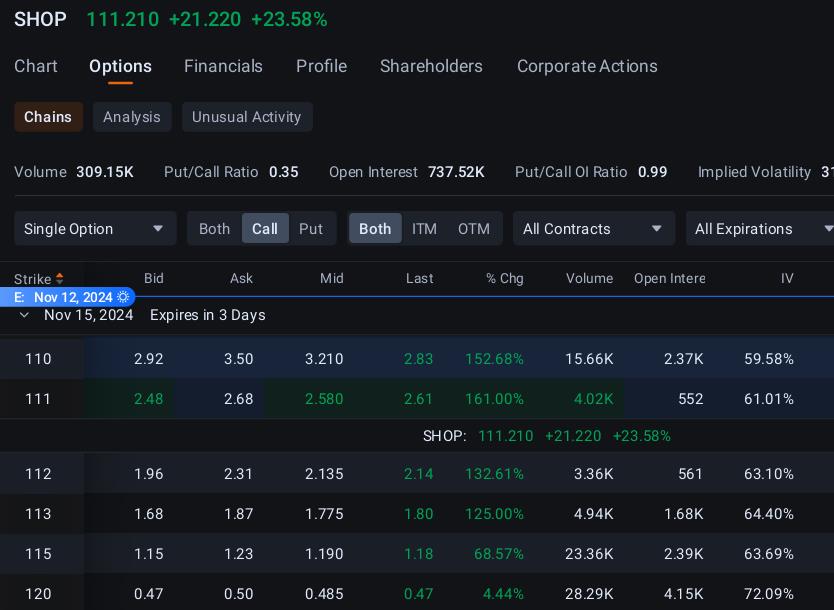

Shopify shares rose as much as 27% to $114.51 before paring gains to $112.47 at 11:32 a.m. in New York. The rally pushed many of its call options in-the-money, boosting their investment appeal. So far, more than 325,000 options changed hands across 15 expiration dates stretching through Jan. 15, 2027, exchange data tracked by moomoo showed.

White_Shadow : depends on how good of a holiday season they have![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Luzi Ann Santos OP : Thanks to everyone who read this story and cast their votes. I erroneously published this only in the Canadian channel, so I had to redo it. If those who voted could recast their vote in the new version, that would be really helpful so we could get the full picture. I'd also love reading your comments so keep them coming. Here's the new version with the updated numbers. Shopify Joins Nvidia, Tesla in Top Options List as Bulls Pour Millions Into Calls