Shrinking Pool of Growth Investments Challenges Buffett's Buy-and-hold Strategy for ASX Investors

Many legendary investors such as Warren Buffett and Jack Bogle praise the buy-and-hold strategy as ideal for individuals seeking healthy long-term returns.

The money is made in investing by owning good companies for long periods of time. That's what people should do with stocks,” Buffett said in 2016.

The key is buying and holding the right companies over the right time frames. However, this is not as easy as it seems, especially with the shrinking pool of available growth investments in Australia.

Investors face a structural problem where many Australian companies have been taken over or are under takeover consideration, resulting in limited opportunities for exponential growth. The $S&P/ASX 200 (.XJO.AU)$ has slipped back to the same level it was at 16 years ago, indicating that investing in great companies and waiting for rewards to flow may not be the best strategy for ASX investors.

S&P/ASX 200 Index since January 2007, weekly (points)

Some of the companies taken over in the past few years include: Afterpay, Newcrest, ALE Property Group, Automotive Holdings, Aveo, Blackmores, Bellamy's, Bingo, Coca-Cola Amatil, Crown Resorts, Dulux, Galaxy Resources, Healthscope, MYOB, Nearmap, OZ Minerals, Pendal, Sydney Airport, Tassal, Uniti Group, Village Roadshow, and Western Areas.

Some currently under takeover consideration include: $Origin Energy Ltd (ORG.AU)$, $InvoCare Ltd (IVC.AU)$, $Costa Group Holdings Ltd (CGC.AU)$, $United Malt Group Ltd (UMG.AU)$, and $Liontown Resources Ltd (LTR.AU)$.

There have been 161 takeovers of $A1 billion-plus companies since 2000. These are companies that would have been mainstays of the Australian market.

The concentration of the ASX also raises questions about the viability of Buffett's buy-and-hold advice.

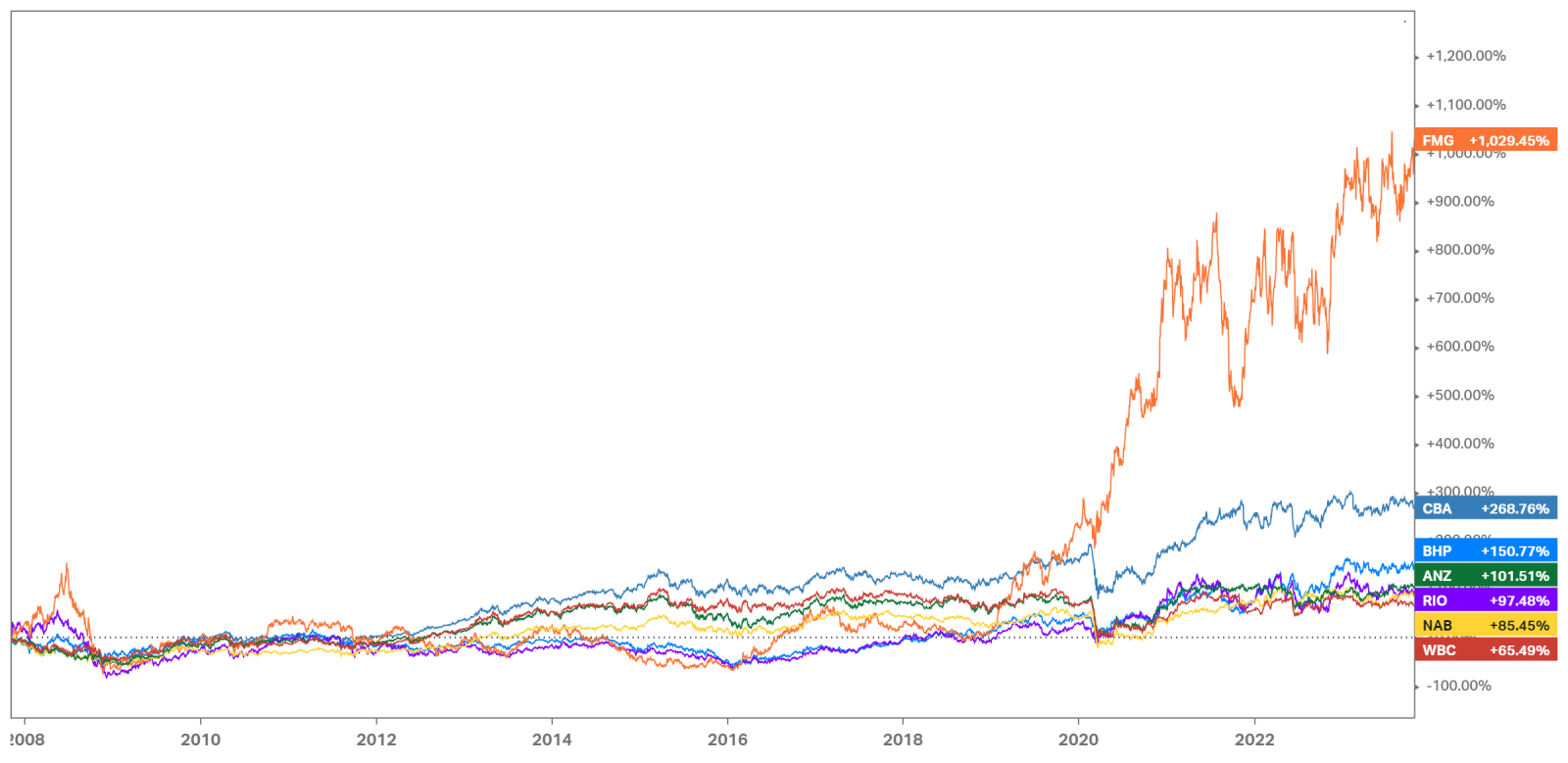

The big banks and giant iron ore miners dominate the ASX as the performance of $CommBank (CBA.AU)$, $BHP Group Ltd (BHP.AU)$, $Rio Tinto Ltd (RIO.AU)$, $Fortescue Ltd (FMG.AU)$, $National Australia Bank Ltd (NAB.AU)$, $ANZ Group Holdings Ltd (ANZ.AU)$, and $Westpac Banking Corp (WBC.AU)$ have flourished, at least for now. But the market capitalization of household names like $AMP Ltd (AMP.AU)$, $Lendlease Group (LLC.AU)$, $Qantas Airways Ltd (QAN.AU)$, and $QBE Insurance Group Ltd (QBE.AU)$ is either lower or the same as it was in 2007.

Can we assume that the golden run of these banks and iron ore miners will go on forever?

Dion Hershan, head of Australian equities at Yarra Capital Management, challenges the notion of permanent blue chips in the Australian market, citing the changing industry structures, regulations, and business or consumer preferences.

The concentration of the ASX 200, anchored by companies that could well be past their peak, is a real issue for investors to deal with, looking forward.”

Therefore, Australian investors who have done well out of buying and holding the big banks and big miners should at least be prepared to consider the idea that continuing to do so is not without some risk.

The biggest question is where do investors find the next set of growth companies that can provide a robust capital appreciation over the medium term. It is uncertain whether these companies are even on the ASX as the weight of super fund money would suggest the best opportunities will be found offshore.

Source: AFR

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment