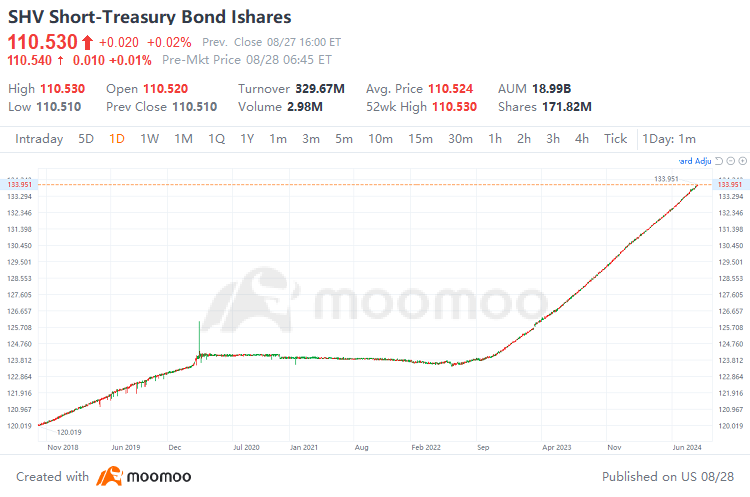

Duration is an indicator of the sensitivity of bond prices to market interest rate changes. It quantifies the weighted average time length of bond cash flows, which can be used to predict the value changes of bond portfolios when interest rates change. Taking the duration of SHV at about 0.31 years as an example, if the market interest rate drops by 1%, the net asset value (NAV) of SHV may theoretically increase by about 0.31%, and SHV's reaction to interest rate changes is relatively mild. Compared with TLT, the elasticity is much weaker.