Singapore Airlines Ltd: Fundamentals and Market Position Expected to Generate Long-Term Returns

Brief Introduction of Company

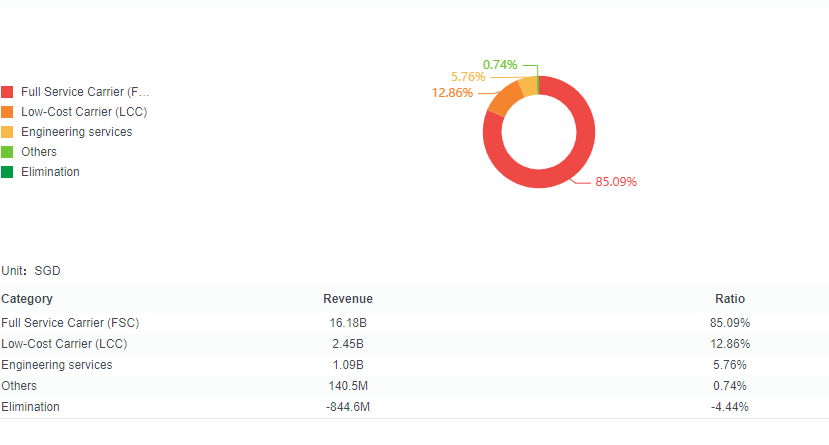

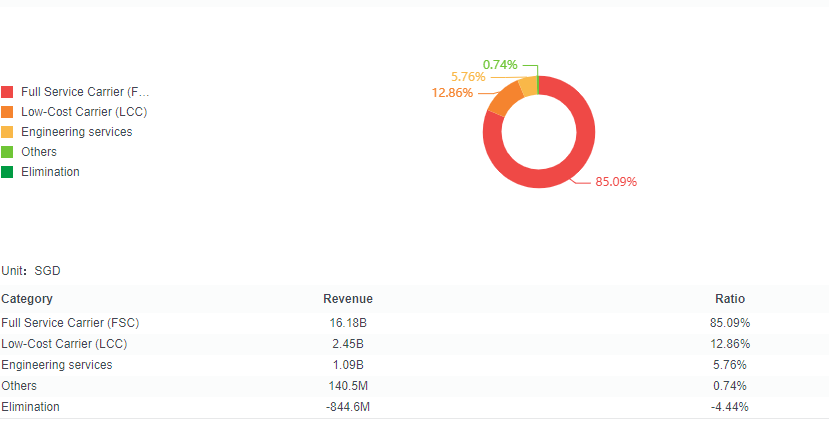

Singapore Airlines Ltd is a company listed on the Singapore Exchange, primarily engaged in passenger and cargo air transportation services. Through its subsidiaries, the company offers a comprehensive range of services including cargo air transportation, engineering services, pilot training, air charters, tour activities, merchandise sales, and related activities. Singapore Airlines operates through its Full-Service Carrier (FSC) segment, focusing on the full-service passenger segment for both short and long-haul markets, and its Low-Cost Carrier (LCC) segment, targeting the low-cost passenger segment.

The company's business is mainly concentrated in East Asia, but it also involves various parts of the world such as the Southwest Pacific and Europe and America.

The company has received high ratings for its business, management, and financials, boasting a robust revenue stream, good asset conversion, and low leverage. Although there was a decline in management efficiency in the last quarter, the overall management of Singapore Airlines is deemed efficient. Additionally, the company has been rated positively in corporate governance, demonstrating a high level of accountability and protection against tunnelling issues.

Analysts Expect Steady EPS Growth for Singapore Airlines in the Next Two Years

According to the latest financial report, in the 24 fiscal year ended March 31, the company's total revenue was about 19.013 billion SGD, an increase of 6.69% year-on-year; Earnings Before Interest And Taxes was about 3.037 billion SGD, an increase of 15.18% year-on-year; adjusted earnings per share were 0.633 SGD, an increase of 77.81% year-on-year.

For the company's EPS situation in the next two years, CFRA gives a conservative estimate of 0.65/0.70 SGD. The forecast logic includes the following points:

Business Model Restructuring: Singapore Airlines is undergoing a restructuring of its business model. The budget segment (Scoot) has shown good success in the low-cost flying business, but the legacy full-service carrier still faces pressure due to weak demand for premium services.

Revenue and Earnings Data: The company financial report indicates that Singapore Airlines' revenue and earnings per share increased in 2024, with expectations for continued growth in 2025 and 2026.

Cost Management: Singapore Airlines' cost management has helped the company maintain necessary liquidity during the earlier downturn, ending the hiring freeze and encouraging former staff (including those on unpaid leave) to rejoin the airline.

Capital Injection: With the support of its shareholder Temasek Holdings, Singapore Airlines raised new capital through a rights issue of shares, which is expected to enhance the airline's robustness and prepare it for regional expansion.

Market Demand Recovery: It is anticipated that the global air travel demand will experience a sustainable upswing following the reopening of international borders in 2024, particularly driven by the recovery in East Asia as travel restrictions ease across China, Hong Kong, Japan, and Taiwan.

Uncontrollable Issues Exist, Such as Geopolitical Conflicts

In addition, analysts have identified several risks that may affect Singapore Airlines' future performance:

Geopolitical uncertainty: Increased geopolitical risk may lead to instability in the global aviation industry, affecting Singapore Airlines' operations and profitability.

Rising fuel prices: If supply-side pressures lead to higher fuel prices, airlines' costs will increase, potentially squeezing profit margins.

Slowdown in demand: With limited visibility on the reopening of borders, demand may continue to slow, affecting airlines' passenger traffic and revenue.

Underperformance of low-cost subsidiaries: Poor performance of Singapore Airlines' low-cost subsidiaries may impact the entire group's financial performance.

Market competition: The growth of low-cost airlines and the increase in seat capacity of Middle Eastern airlines on Singapore-Middle East and Singapore-Europe routes may pose a threat to Singapore Airlines' market position.

Ineffective company transformation: Although the company has undergone transformation to improve efficiency and competitiveness, if the transformation is not as effective as expected, it may affect the company's long-term development.

Focus on Shareholder Returns. The dividend yield exceeds 5%.

Singapore Airlines, as a company with a solid business foundation and financial position, is still recognized by the market for its long-term investment value despite facing some short-term profit challenges. The company's current stock price trades at 11x P/E, which is attractive compared to the industry average. In addition, the company has a low market risk, low information risk, and average operational risk, making it an overall very safe investment.

In addition to its significant potential for performance improvement, Singapore Airlines' dividend level is also attractive. As of June 18th, the company's dividend yield was approximately 5.62%. In its latest announcement on May 15th, the company stated that it will pay a one-time dividend of SGD 0.38 per share this year, which is equivalent to the sum of its two dividend payments from last year.

Considering the company's business quality, financial position, governance structure, and market sentiment, Singapore Airlines is considered an excellent choice for long-term investment. Although short-term EPS forecasts show some signs of weakness, the company's fundamentals and market position are expected to generate long-term returns in the future.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment