Singapore Banking Earnings Highlights: DBS and OCBC Strong, UOB Slightly Behind

The three banking giants in Singapore have all released their earnings reports for Q1FY24. DBS Bank's revenue has grown again by 13%, followed closely by OCBC with an 8% increase, while UOB's growth was almost flat compared to the same quarter last year. Although the three banks showed varying performance in net interest income, they all saw growth in wealth income and assets under management.

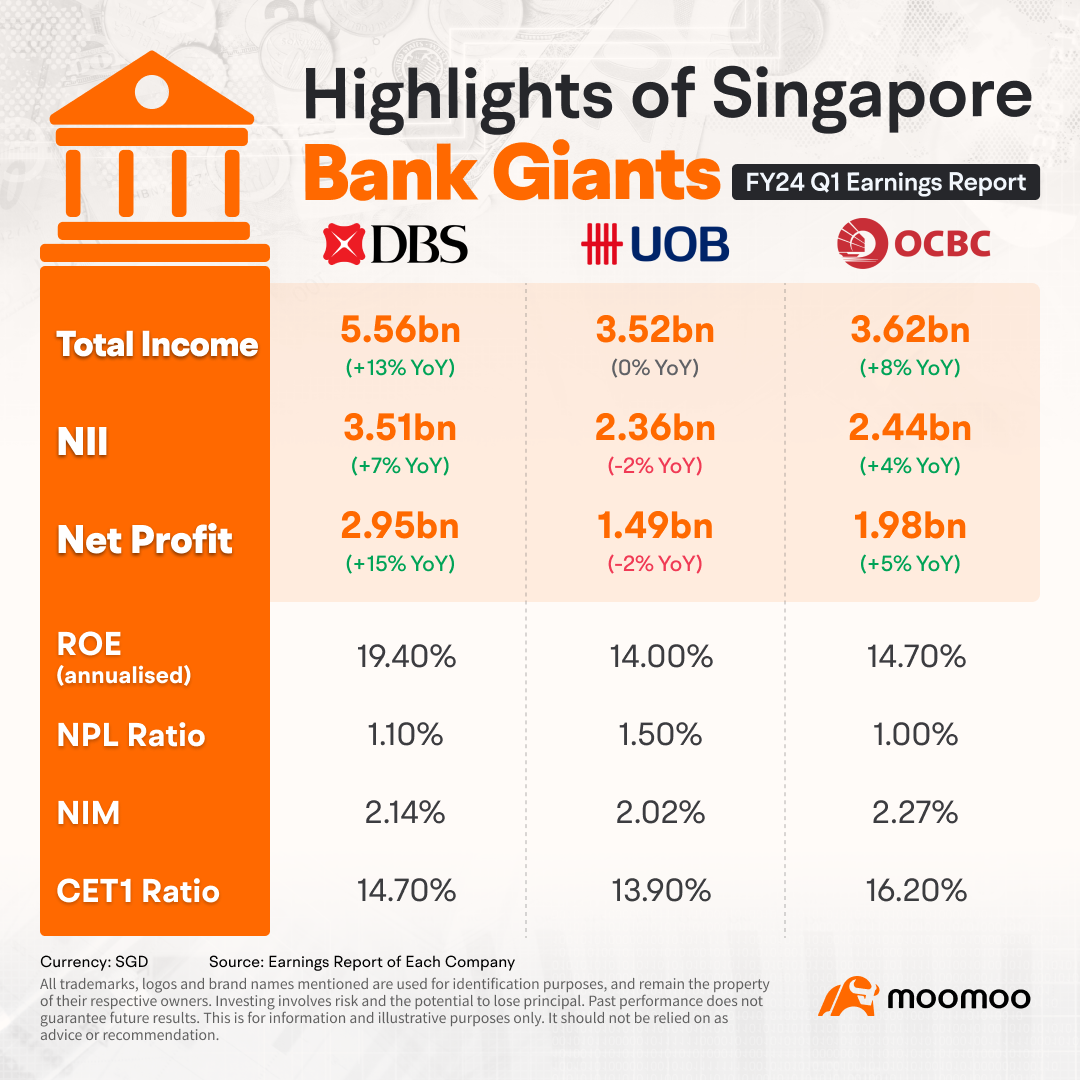

Here are the key indicators from the financial reports of the three banking giants.

DBS NIM Outperforms and OCBC and UOB Narrow

Three banking giants show variations in NIM performance. DBS's net interest margin (NIM) expanded to 2.14%, while OCBC and UOB saw slight contractions in NIM to 2.27% and 2.02%, respectively.

$DBS Group Holdings (D05.SG)$'s NIM saw a slight year-on-year improvement, rising from 2.12% in the same period last year to 2.14%. The growth was attributed to a repricing of fixed-rate loans upward, while the outflow from current and savings accounts was slower than the previous year. Additionally, the NIM for the first quarter of 2024 was marginally better than the 2.13% in the fourth quarter of 2023. Due to increased non-trade corporate loans and the consolidation of Citigroup's Taiwan operations, DBS Bank's loan book grew by 2% year-on-year to S$424.8 billion. Despite Singapore's economy growing less than expected in the first three months, DBS Bank revised its forecasts upward for 2024. The outlook suggests that the tailwinds boosting global banking revenues in recent years could persist as expectations shift towards a long-term environment of higher global interest rates.

$OCBC Bank (O39.SG)$'s NIM for the first quarter of 2024 was 2.27%, slightly lower than the 2.3% in the same period last year. The bank attributed this to rising financing costs (higher interest rates for savings accounts and fixed deposits), which offset the impact of rising loan rates. Meanwhile, OCBC Bank's total loan saw a modest increase of 2% yearly, reaching S$296.9 billion.

$UOB (U11.SG)$'s modest loan growth was offset by a softer NIM. The bank's NIM weakened, falling below the 2.14% in the first quarter of 2023. However, there was an increase in the total loan volume, which grew by 3% year-on-year on a constant currency basis and by 1% from the fourth quarter, primarily due to selective quality credit and short-term trade financing. Group CFO Lee Wai Fai noted that increased regional trade has eased the effects of tighter margins from competition for quality loans. As clients adjust to interest rates, loan growth is anticipated to improve in the latter half of the year.

Big Three Banks Benefit from Rise in Non-Interest Income

DBS Bank's net fee and commission income grew by 23% year-on-year to S$1.04 billion, surpassing the S$1 billion mark for the first time. This was due to increased wealth management fees from improved market sentiment, an expanded asset under management (AUM) base, and higher card fees driven by increased spending.

OCBC's non-interest income reached a record S$1.19 billion. Benefiting from improved investment performance and claims experience, insurance income was at S$289 million, significantly higher than the S$88 million in the fourth quarter of FY2023. Supported by record customer flow fund income and enhanced non-customer flow fund income, net trading income surged 67% quarter-on-quarter.

UOB's fee income from loan-related, credit card, and wealth activities grew by 5% year-on-year, reaching S$580 million. Transaction and investment income significantly increased, with customer-related fund income setting a new record at S$219 million. This was due to increased retail bond sales and hedging activities prompted by investor expectations of interest rate cuts.

DBS and OCBC Net Profits Benefit from Well-Managed CIR

DBS and OCBC net profits increased by 15% and 5% year-on-year, reaching S$2.95 billion and S$1.98 billion, respectively, while UOB saw a 2% decline to S$1.49 billion. The cost-income ratio (CIR) is a key indicator affecting net profits. DBS's CIR saw a slight improvement from 38.1% in the same period last year to 37% in the first quarter of 2024. OCBC managed to maintain its operating expenses growth in line with total income at 37.1%, consistent with the same period last year. UOB, however, exhibited higher expense levels with a CIR of 41.9% in the first quarter of 2024. The increase in core operating expenses was primarily driven by staff costs.

Optimistic Outlook for the Future Shared by All Three Banks

All three banking giants have forecasted a bright performance outlook for 2024. In addition to maintaining the NIM at current levels, DBS believes that non-interest income will continue to make a significant contribution. "Our record earnings have given us a strong start to the year. We had broad-based business momentum as loans grew and both fee income and treasury customer sales reached new highs," says DBS CEO Piyush Gupta.

OCBC attributes its corporate performance to the deep synergies driven by the bank, wealth management, and insurance sectors. The bank also believes that OCBC's key markets in Asia are expected to be resilient, benefiting from increased capital flows and diversified supply chains. OCBC Group CEO Helen Wong has stated: "Our healthy balance sheet position provides us the flexibility to manage uncertainties, and capacity for growth as we continue to support our customers across our network."

CEO Wee Ee Cheong still expects a positive outlook for UOB in 2024, with a lower loan growth rate and a double-digit increase in expenses. UOB is confident in achieving total revenue growth in 2024, with the CIR hovering around 41% to 42%.

Source: Blomberg, The Smart Investor, The Edge, The Straits Times, Earnings Report of Each Company

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102356143 : Buy uob sell ocbc???

104260287 : No I bought DBS n sold UOB

CY90 : DBS is the best. 2nd is OCBC. UOB avoid.

Anva : Always go with market leader , may be less reward but lesser risk also.