Singtel Set to Release Q2 Earnings Amid Strong YTD Performance

Telecommunications giant Singtel will release its earnings for FY2025 Q2 (period ending 2024-09-30) on 2024-11-13. Despite experiencing a brief pullback in mid-September, this telecommunications giant has surged over 30% year-to-date.

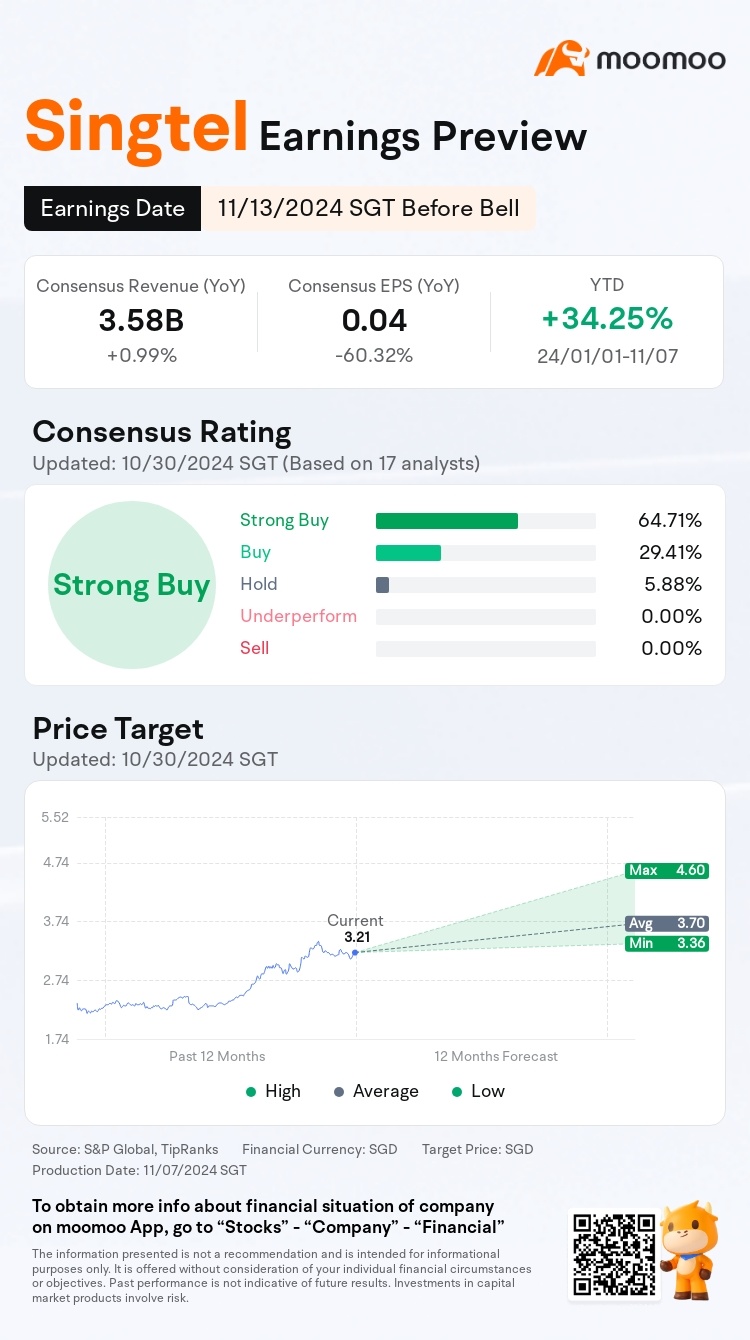

According to Moomoo, market expectations for the second quarter ended 30 September of the company are as follows:

● The company is projected to achieve a revenue of S$63.58 billion, representing a year-over-year increase of 0.99%.

● Consensus EPS is expected to be S$0.04, a 60.32% decrease in losses.

● The average price target for Singtel is $3.70, suggesting a potential increase of 15.26%.

A Review of Singtel's Q1 Earnings: Net Profit Surges 42.9% to S$690 Million

Singtel's net profit for the first quarter ended June 30, 2024, soared by 42.9% to S$690 million, up from S$483 million in the same quarter the previous year. This significant increase was largely due to a net exceptional gain of S$88 million, contrasting with a net exceptional loss of the same amount last year.

Despite these exceptional gains, Singtel's underlying net profit also rose by 5.4% to S$603 million from S$571 million, attributed to solid performance across its operations, though partially offset by higher net finance expenses and a lower share of profits from associates, particularly due to currency depreciation impacts. Revenue, however, dipped by 2.1% to S$3.4 billion, influenced by the sale of its cybersecurity arm, Trustwave. Excluding Trustwave's contributions, revenue remained stable, supported by growth in IT services and Australian operations.

Optus Revenue Expected to Rebound in Q2 FY2025

Maybank analyst Hussaini Saifee noted that Optus reduced its workforce in the second half of FY2024 and began increasing rates in the first quarter of FY2025. He pointed out that the macroeconomic environment in Australia has weakened, and Optus management emphasized the challenges faced in Australia during a recent investor day held by Singtel, noting that high inflation has undermined business and consumer confidence.

However, Wall Street anticipates that Optus will benefit in FY2025, with approximately 65% of customers expected to take advantage of the revised pricing plans. Optus's revenue is projected to rebound starting in Q2 FY2025, with a year-over-year increase of 2% (compared to a 4% increase in Q1 FY2025), benefiting from price hikes implemented in May 2024. Additionally, Optus appointed Stephen Rue as its CEO starting November 2024 and introduced a new governance model featuring a decentralized, company-driven operational structure.

On November 8, 2024, Optus was fined AUD 12 million (USD 10.47 million) for failing to provide emergency call services. DBS noted that the company has set aside USD 54 million for this outage and does not expect further regulatory action. Citi analysts also believe that the incident will not have a significant impact on operations, earnings, or dividends.

Data Center Business Revenue Expected to Surge

According to Kearney, the data center market in Southeast Asia is projected to grow by 17% over the next five years, compared to 12% in other regions, attracting investments ranging from USD 9 billion to USD 13 billion. Singtel has made acquisitions in Australia to enhance NCS's capabilities and attracted funding from private equity firm KKR to invest in its data center business. Consensus estimates that Singtel's Nxera Data Center and NCS revenue will grow at a CAGR of 18% and 5% respectively over FY24-26F.

The company also expects to double its Singapore DC EBITDA by 2028 excluding its Batam, Johor & Thailand JVs. This implies that its DC EBITDA could rise from S$163mil in FY24, and to S$326mil by FY28.

What's next about Telcom Sector?

According to Mordor Intelligence, the Singapore telecommunications market is expected to reach USD 2.84 billion by 2024 and USD 3.04 billion by 2029, with a compound annual growth rate (CAGR) of 1.41% from 2024 to 2029.

Looking ahead, global portfolio managers believe that the recovery in the telecommunications services sector, advancements in AI, and reasonable valuations indicate further growth potential for the industry.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103827296 : ini game ayo Surabaya hi hello any game I know understand I know win I don't know I know understand he came I know run I talked stop to be at all stop stop you run you problem no eye problem ok I know take money ordering it I noticed ok

104795852 103827296 : y3

a

103827296 : height of my phone China no original any game uniform no run who people run you call this man no call I SMS no no contact any economic close no close you problem okay money you take you problem no I problem okay

Kuku bird on fire ❤ :