Super Micro Put Options Volume Rise Amid Continued Stock Sell-Off

$Super Micro Computer (SMCI.US)$ is seeing increasing demand for put options that could protect the holders against continued slump in the stock price.

Shares of the maker of high-powered servers tumbled more than 7% Monday morning, after the announcement late Friday that SMCI will be removed from the $NASDAQ 100 Index (.NDX.US)$ before the market opens on Dec. 23. Deletions from the index typically result from money outflows because exchange traded funds (ETFs) that track the benchmark are likely sell their holdings as they adjust the portfolio accordingly.

That decline takes SMCI's slump over the past six months to more than 60%. The company has failed to file its annual report for the fiscal year that ended June 30 and had to find a new auditor after Ernst & Young resigned in October over disagreement on the financial statements prepared by management.

Ernst & Young also refused to be associated with those financial statements and raised concerns "whether the company demonstrates a commitment to integrity and ethical values." While SMCI appointed BDO USA as its new independent auditor last month, and was granted an extension to file its financial report until Feb. 25, these weren't enough to assuage investor concerns and stem the share slump.

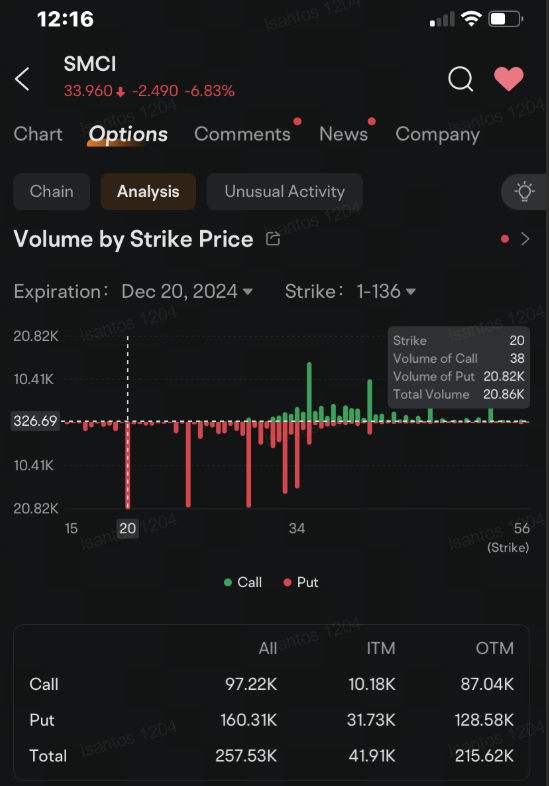

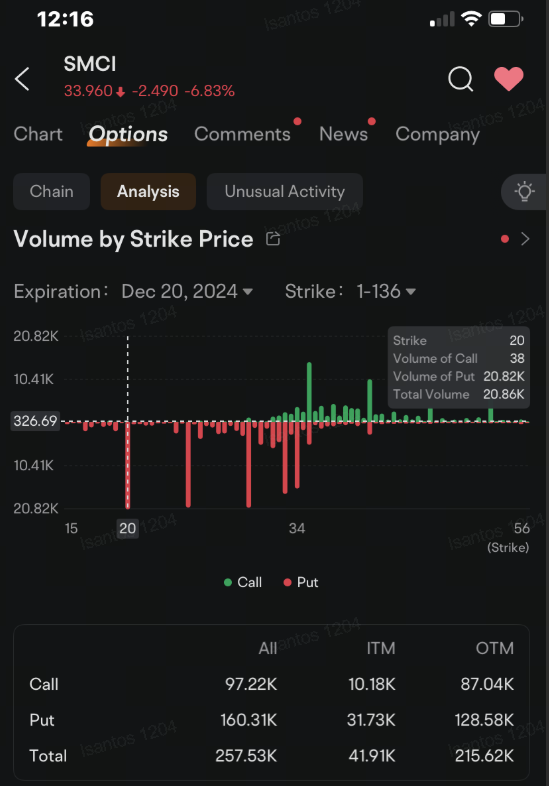

Put optionsthat give the holders the right to sell SMCI shares at 20 each by the end of this week attracted the heaviest trading so far, with 20,820 contracts changing hands as of 12:16 p.m. in New York. The price of those put options surged more than 66% as the stock sell-off increased the odds that the contract could be in-the-money before they expire in four days. Volume jumped 87-fold from just 238 contracts in the previous session.

More than 447,750 options tied to the server maker were traded so far, making SMCI the sixth most active stock option, behind $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, $Broadcom (AVGO.US)$, $Palantir (PLTR.US)$, and $Alphabet-A (GOOGL.US)$.

The rebalancing of Nasdaq 100 is expected to spur $22 billion of selling by ETFs that track the index, Bloomberg Intelligence analyst Eric Balchunas said in a note last week, before the deletions were announced. SMCI's removal from the index could prompt ETFs to sell $657 million in shares of the server maker, according to Balchunas.

The stock's decline to $33.88 sent the share price below the middle line of the Bollinger band, a sign to some who study charts that the trend is bearish and the price could be headed for the lower line. Still, only two of the remaining 14 technical indicators tracked by moomoo agree, four are bullish and the rest are neutral.

Share your thoughts on SMCI in the comments section. Do you see the stock rebounding or is the worst yet to come? Let your voice be heard and vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment