Snowflake's Q2 2025 Earnings Report

👉 Business Highlights:

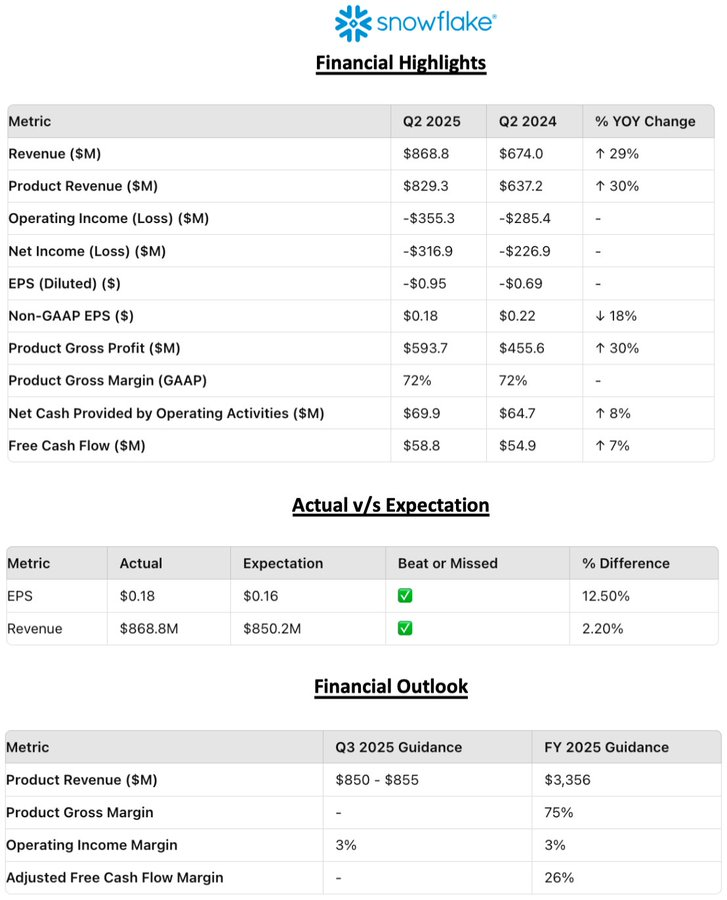

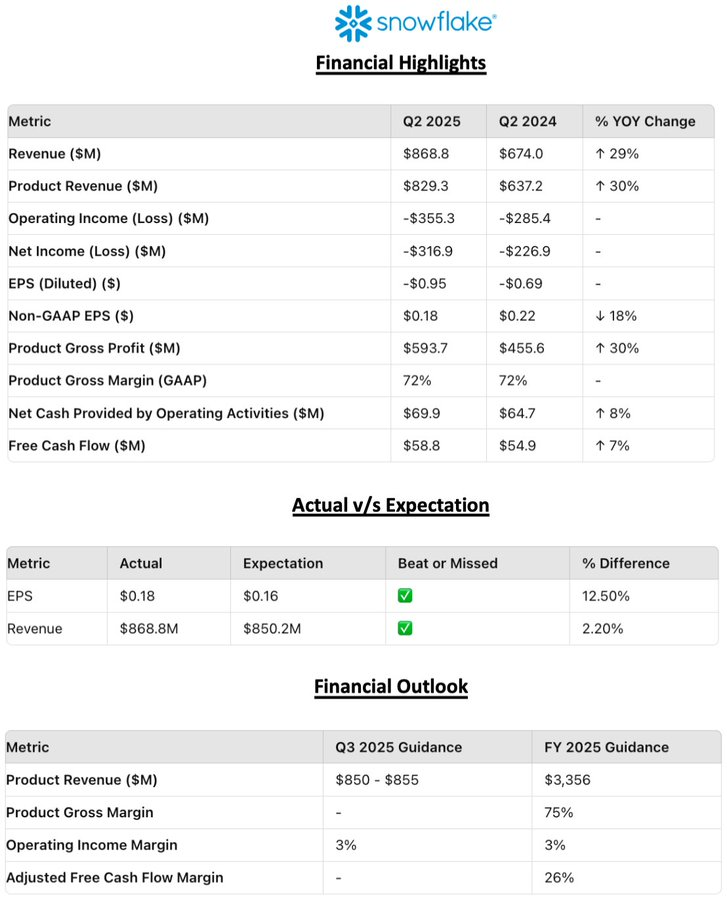

➡️ Revenue reached $868.8M, a 29% YoY increase.

➡️ Product revenue was $829.3M, up 30% YoY.

➡️ Net revenue retention rate stood at 127%.

➡️ 510 customers now generate over $1M in trailing 12-month product revenue.

➡️ 736 Forbes Global 2000 customers, a 5% YoY increase.

➡️ Remaining performance obligations reached $5.2B, a 48% YoY growth.

➡️ Raised product revenue guidance for the year, citing strong traction in new AI products.

➡️ Authorized an additional $2.5B for stock repurchase through March 2027.

👉 Business Segments:

➡️ Product Gross Profit: $593.7M, with a 72% margin (GAAP).

➡️ Operating Income (Loss): -$355.3M, with a -41% margin (GAAP).

➡️ Net Cash Provided by Operating Activities: $69.9M, an 8% increase.

➡️ Free Cash Flow: $58.8M, representing a 7% margin.

👉 Share Repurchase:

➡️ Authorized an additional $2.5B under the stock repurchase program, extending it through March 2027.

👉 CEO Statement:

"Snowflake delivered another strong quarter, surpassing the high end of our Q2 product revenue guidance and, as a result, we're raising our product revenue guidance for the year," said Sridhar Ramaswamy, CEO of Snowflake. "The quarter was hallmarked by innovation and product delivery, and great traction in the early stages of our new AI products. With the combination of our platform, the network effect of collaboration and our AI innovations, we have a huge opportunity ahead to deliver even greater value to our customers."

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment